Welcome to the seventh edition of FX & Macro Weekly.

Thanks to everyone who subscribed, I really appreciate it and I hope you benefit from the content. If you do, please consider sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (RBA, FOMC, BOE Rate Statement)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

As for market risks (almost unchanged from last week):

Geopolitics with the Ukraine war escalating in terms of bombs or sanctions/embargos.

Spillover of liquidity issues from commodity markets.

The Covid situation in China is still dire and unpredictable, but it's hard to imagine it blowing up even more.

In the UK the risk of a government crisis with regards to investigations of Covid lockdown breaches seems to have diminished a bit for now, and the bad election results for the Tories this week haven't caused much of a stir, yet.

That's not a complete list, but rather things I have on the radar. If you think I missed something important, please let me know in the comments.

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Rate Decision (03.05.)

The RBA turned hawkish with a 25 bps hike and a change in guidance. Full text: link. Summary and diff-text:

Further lifts of the interest rate over the period ahead

Does not plan to reinvest proceeds of maturing government bond holdings, expects the balance sheet to decline significantly over coming years; no plans to sell bonds at the moment

Inflation has picked up more quickly and to a higher level than expected, evidence of wage growth picking up

Inflation still lower than in other countries, mostly caused by global factors, but domestic capacity constraints increasing, further increases in CPI expected in the short term before easing of supply constraints

Economy has proven resilient, very strong labour market, economic outlook remains positive despite uncertainties (Covid-19 especially in China, Ukraine War, demand destruction through inflation)

Central forecast: GDP 4.25% in 2022, 2% in 2023. CPI 6% in 2022 (Core CPI 4.75%) moderating to around 3% in mid-2024 (both headline and core)

RBNZ Financial Stability Report (04.05.)

Link to full text here. Their assessment of the housing market is quite interesting (emphasis mine):

New Zealand house prices have grown rapidly since 2019, reflecting low interest rates, relatively favourable domestic economic conditions, and supply constraints, but these conditions are being unwound. Seasonally-adjusted house prices have declined 4.3 percent since November 2021 (figure 2.3), reflecting broad falls across regions. Despite a decline, the level of house prices remains unsustainable when assessed against a range of fundamentals. A steady adjustment of prices towards more sustainable levels based on fundamental demand and supply factors remains desirable for the stability of the financial system.

While a gradual decline in house prices to more sustainable levels is desirable from

a financial stability perspective, a sharp correction remains a plausible outcome that would have broad economic implications. Recent buyers with limited equity are particularly vulnerable to house price declines. Furthermore, a large fall in house prices would significantly reduce housing wealth and could lead to a contraction in consumer spending, especially when combined with borrowers cutting back discretionary spending due to rising interest rates and higher living costs.

FOMC Rate Statement (04.05.)

My summary, difftext below:

50 bps hike as expected, overall guidance unchanged, unanimous vote

Economic activity has slowed down, but household spending and business investment remained strong

Acknowledges risks due to Ukraine war and Covid-19 in China

"The Committee is highly attentive to inflation risks."

Balance sheet reduction to begin on June 1st, details provided in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet:

Treasuries initial cap at $30 bln/month, increase to $60 bln/month after three months.

MBS initial cap at $17.5 bln/month, increase to $35 bln/month after three months.

Bank of England Rate Statement (05.04.)

The BOE delivered a 25 bps hike as expected. My summary and the difftext below:

25 bps hike to 1%, vote split 6-3 with the minority in favour of a 50 bps hike

“some degree of further tightening may still be appropriate in the coming months” (previously: “some further modest tightening may be appropriate")

Will consider beginning process of selling government bonds, but depend on economic circumstances and market conditions, tasks bank staff to work out a framework for potential sales, will provide an update in August

War in Ukraine and Covid-19 in China have led to deteriorating growth outlook and exacerbated supply shocks

UK GDP estimated at 0.9% in Q1, tight labour market, margin of excess demand; squeeze of real disposable incomes is starting to weigh on demand, GDP growth to slow sharply over the first half of the forecast period

CPI expected to rise to just over 9% in Q2 and average slightly over 10% at its peak in Q4; Ofgem price cap mechanics will lead inflation to peak in the UK later than in other countries; CPI expected to fall to 2% in 2 years and 1.3% in 3 years

Relevant points from the Monetary Policy Report:

GDP Growth and Unemployment projections:

CPI inflation and projection:

RBA Statement on Monetary Policy (06.05.)

Link to the full statement: here. A few relevant charts and snippets (emphasis mine):

The outlook for economic activity in Australia is underpinned by growth in private consumption and investment. Household consumption is forecast to grow strongly over 2022 as spending on services picks up; this outlook is supported by rising labour income, fiscal measures and the large increase in wealth over recent years.

Employment is forecast to grow strongly during 2022, consistent with the ongoing strength in leading indicators of labour demand, before moderating thereafter in line with activity. Participation in the labour force is expected to be sustained at historically high levels over the forecast period, supported by the cyclical strength in labour market conditions and the longer-term trend toward increased participation among females and older Australians.

The outlook for inflation is much stronger than anticipated a few months ago. In the near term, underlying inflation is forecast to be significantly boosted by the pass-through of upstream cost pressures to consumers, continuing the pattern observed in recent quarters. The war in Ukraine (and associated sanctions on Russia and Belarus) and renewed lockdowns in parts of China are expected to delay the easing of these cost pressures until later this year.

Inflationary pressures have broadened in recent months beyond energy, consumer durables and the prices of newly constructed homes.

Confab, Speakers, News

Federal Reserve

Powell. Wednesday post-FOMC:

Inflation is much too high, wages rising at fastest pace in years, labour market extremely tight

Broad consensus that 50 bps hikes on the table for next two meetings

75 bps hikes are not actively being considered

Long way from neutral, moving there expeditiously, prepared to move policy rate above neutral

Good chance of a “softish landing”

Clarida (ex-Fed, Neutral). Thursday: rates need to go to at least 3.5% to bring inflation under control, need to be over neutral at least one percentage point

Kashkari (Dove). Friday: need to get rates at least to neutral and moderately above by the end of the year or early next year, Fed is “going to walk the walk on forward guidance”, expects home prices to cool off, labour market is very strong and if it softens a bit it's not a bad tradeoff

Barkin (Neutral). Friday: wants to raise rates “as fast as feasible”

European Central Bank

Schnabel (Neutral). Tuesday:

Rate hike possible in July after probable end of APP in June

Going below zero required caution, less so when moving in the opposite direction

Still sees positive growth

Inflation becoming more broad-based, not just energy; no evidence of a wage-price spiral so far, but need to look ahead and can't afford to wait

Possible decline in globalization and green transition could mean higher inflation over the medium term

Rehn (Neutral). Thursday: ECB should start to raise rates in July and continue to gradually raise rates

Holzmann (Hawk). Thursday: ECB will probably discuss raising rates in June, rates will rise this year, US business cycle ahead of Eurozone by about half a year, US economy overheating a bit more than Europe

Panetta (Dove). Thursday: wants to see Q2 data before raising rates, NIRP could end after deciding when to end QE in Q3

Lane (Dove). Thursday: timeline to policy normalization is uncertain, inflation unlikely to return to pre-pandemic trend, ECB will move on rates but timing is not the most important issue

Villeroy (Neutral). Friday: reasonable to get to positive rates by year-end, inflation expectations are becoming less and less anchored at 2%

Nagel (Hawk). Friday: window for monetary policy action is closing, does not believe monetary policy should hold back because of the economy, does not see a recession but much weaker growth

Vasle. Friday: inflation is becoming more broad-based, right time to start raising rates is before the summer

Elderson. Friday: does not see a recession so far despite weaker incoming data

Bank of England

Bailey. Thursday post-statement press conference:

No decision on active Gilt sales, yet

Inflation risks skewed to the upside, but inflation expected to fall rapidly; need to watch wage pressures closely

BOE forecasts consistent with a very sharp slowdown, do not meet technical definition of a recession; not using the word stagflation because it's not well defined

Pill. Friday: BOE doesn't have an exchange rate target, not focussed on short-term reactions in the markets, not going in the direction of stagflation, tricky balance between slowing growth and getting inflation under control

Reserve Bank of Australia

Lowe. Tuesday post-statement press conference:

Expects more rate increases ahead, no preset path, open mind about pace of rate hikes, guided by data

Nominal neutral rate likely to be around 2.5%

Possibility of actively selling bond holding is remote

Inflation has picked up faster than expected, expects more inflation ahead, but will moderate; labour costs increasing more quickly

Economy has been very resilient

Institutionals. Goldman Sachs: two 50 bps hikes in June and July, cash rate at 2.6% by the end of the year. Westpac: 40 bps hike in June, expects a front-loading of the tightening cycle.

Reserve Bank of New Zealand

Orr. Wednesday: can't rule out a global recession in the coming months. Thursday: does not see a risk of stagflation, raising policy rate will take the heat out of the economy

Bank of Canada

Rogers. Tuesday: housing market unsustainably hot, need higher rates to moderate housing demand, would be a good thing for the economy; labour market is a strong indicator of excess demand in the economy right now

Swiss National Bank

Maechler. Wednesday: inflation will come down, strong Franc helps mitigate inflation, financial conditions remain very accommodative overall

Economic Data

Monday, 02.05.22

German Retail Sales disappointed, the EUR was unchanged

Aussie Commodity Prices came in below expectations, AUD was weaker

Swiss Manufacturing PMI beat expectations, no clear direction from CHF

Canadian Manufacturing PMI missed the headline forecast, but was very up-beat under the hood. CAD weakness was limited. Here's the summary, emphasis mine:

The seasonally adjusted S&P Global Canada Manufacturing Purchasing Managers’ Index® (PMI®) registered at 56.2 in April, down from March's survey-record high of 58.9. The latest reading continued to indicate robust operating conditions and extended the current period of growth to 22- months, but dipped to a joint 14-month low.

"The start of the second quarter of 2022 yielded another favourable month of trading for Canadian manufacturers. Demand conditions were supportive and continued to underpin a solid improvement in operating conditions. As has been the case over the last year or so, consumer demand remains strong despite elevated rates of inflation.

"However, capacity constraints have persisted and firms look to be struggling with labour shortages. Recent geopolitical developments have also exacerbated costs, particularly for fuel and raw materials. At the same time, anecdotal evidence often mentioned shortages of trucks which could further impact production in the future.

"Nevertheless, Canada's manufacturing sector has performed strongly despite supply bottlenecks, COVID-19 and increasing uncertainty. Firms remain prepared and continue to foresee output growth over the coming months."

US ISM Manufacturing PMI came in below the forecast range. USD was stronger. Here are the main points, emphasis is mine (link to full text):

“The April Manufacturing PMI® registered 55.4 percent, a decrease of 1.7 percentage points from the March reading of 57.1 percent. This is the lowest reading since July 2020 (53.9 percent).

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment.

April saw a slight easing of prices expansion, but instability in global energy markets continues. Surcharge increase activity across all industry sectors continues. Panel sentiment remained strongly optimistic regarding demand, though the three positive growth comments for every cautious comment was down from March’s ratio of 6-to-1, Panelists continue to note supply chain and pricing issues as their biggest concerns. Demand expanded, with the (1) New Orders Index remaining in growth territory, supported by weaker growth of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index continuing in respectable growth territory. Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate, with a combined minus-6.3-percentage point change to the Manufacturing PMI® calculation.

Inputs — expressed as supplier deliveries, inventories, and imports — continued to constrain production expansion. The Supplier Deliveries Index indicated deliveries slowed at a faster rate in April, while the Inventories and Imports indexes grew at slower rates. The Prices Index increased for the 23rd consecutive month, at a slower rate compared to March.

Tuesday, 03.05.22

The RBA turned hawkish with a 25 bps hike and a change in forward guidance, AUD was higher.

German Employment Change was weaker than expected, EUR was unchanged

Eurozone PPIs came in above consensus while the Unemployment Rate was in line. EUR was stronger.

US Factory Orders hit above the forecast range, USD was stronger.

Kiwi Dairy Prices were weak, NZD unchanged.

UK Final Manufacturing PMI was also released, here are some excerpts just because they sound really bad:

A broad range of inputs were reported to be up in price. This included chemicals, energy, food, freight, fuels, gas, metals, oil, plastics, polymers, timber, and transportation (air, land and sea). Several companies simply noted that "everything" cost more.

“The improved expansion of output at manufacturers, while positive in itself, failed to mask the continued headwinds buffeting the sector at the start of the second quarter. New business growth near-stalled as a slowdown in the domestic market was accompanied by a further deterioration in export orders.”

“Manufacturers and their clients are struggling as lockdowns in China and the Ukraine war exacerbate stretched global supply chains, the inflationary picture worsens and geopolitical tensions rise. Specific to the UK, Brexit represents an additional headwind, notably via lost EU customers, increased paperwork, customs checks and border delays. Business optimism has fallen to a 16-month low as companies become more cautious about the future outlook."

“However, it is difficult to see where ongoing growth will come from in the coming months as new order growth was the most sluggish in over a year. Higher costs and shortages took a bite out of potential opportunities with clients hesitating to place orders and Brexit obstacles weighing down as work from overseas shrank for a third month in a row.”

“Manufacturers are certainly feeling the pressure resulting in less optimism for the year ahead. With the lowest business expectations since December 2020, the global economy will need to pull a rabbit out of the hat to give manufacturers the leg up they need.”

Wednesday, 04.05.22

New Zealand Labour Market Report was mixed with Employment Change a tad above consensus. NZD did not react much.

Eurozone Retail Sales were weaker than expected, EUR unchanged.

US Non-Farm Employment Change and ISM Services both came in below the forecast range, USD was weaker on the former and a bit directionless on the latter. Here's the link to the full text of the PMI and below the sub-indexes:

Canadian Trade Balance was weaker than forecast, CAD was weaker as well.

Thursday, 05.05.22

Aussie Trade Balance was better than expected, AUD was weaker

Chinese Caixin Services PMI was even worse than last month. Here's a bit from the report (emphasis mine):

“In April, the Caixin China Composite PMI came in at 37.2, down sharply by 6.7 points from the previous month. Due to the impact of Covid outbreaks, supply and demand in both the manufacturing and service sectors fell to their lowest levels since February 2020. External demand remained weak, employment declined slightly, and business costs continued to rise.

“Overall, in April, local Covid outbreaks continued and activity in the manufacturing and service sectors continued to contract, with services shrinking more. Demand was under pressure, external demand deteriorated, supply shrank, supply chains were disrupted, delivery times were prolonged, backlogs of work grew, workers found it difficult to return to their jobs, inflationary pressures lingered, and market confidence remained below the long-term average.

German Factory Orders came in below the forecast range, EUR was unchanged

Swiss CPI hit a bit above consensus, CHF only showed short-term strength

The BOE Rate Statement was dovish, GBP sold off heavily

US Initial Jobless Claims were worse than expected, USD was stronger

Friday, 06.05.22

Australian AIG Services PMI improved from last month, AUD was broadly unchanged

German Industrial Production was below the forecast, EUR was weaker.

Canadian Employment Change was lower than previously and the Ivey PMI was also below the forecast. CAD was weaker.

US Employment Change came in above consensus but Average Hourly Earnings were weaker. USD sold off but regained strength quickly.

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow estimate for Q2 currently stands at 2.2%.

The NY Fed Weekly Economic Index is at 4.31.

Citi Economic Surprise Indexes:

USD weakening further

EUR has rolled over, GBP and CHF as well

AUD improving

Purchasing Manager Indexes:

US is improving,

UK, Eurozone, Australia and Japan are flat

Switzerland is weakening but still very strong

Still no growth impulse from Asia (China deteriorating further, South Korea flat, Taiwan weaker, only Hong Kong ticking up).

5y5y forward inflation expectations are trading below their recent high.

The Inflations Expectations ETF is also just a tad below its high.

Citi Inflation Surprise Indexes:

USD and NZD moving lower

EUR might have rolled over

GBP, AUD, CAD at highs

Interesting take on the business cycle of various economies in Q2:

Yields

See chart and table below. GBP is very weak, especially the 2s have lost a lot of ground after the BOE this week. Swiss and Japanese yields are lagging as well. US 10s are above 3% and just below resistance at around 3.2% (next stop would be 3.7%), but the move looks unsustainable… it does in most of the 10s.

Yield curves along the 2s10s spread are interesting this week:

Aussie bear flattening after hawkish RBA decision

UK yields are bull steepening with the front moving lower and the back moving higher, reflecting a less hawkish central bank and a lot more inflation

Central Banks

The current FFR is 0.75-1.00%. Fedwatch is still assigning a 83% chance of a 75 bps hike in July (despite Powell's post-FOMC remarks). The back end of the strip has moved up rate-wise as well with a the highest chance now being a terminal rate of 350-375 bps.

STIRS have been rather unimpressed by the dovish rhetoric from Jay Powell. Fed Funds Futures have priced in a bit lower interest rate this year vs. a comparatively greater step up next year (ZQK22/Z22 spread moving lower vs. Z22/Z23 spread moving higher).

Sectors and Flows

The USD is by far the outperformer over one month, EUR and CAD are positive as well. AUD and NZD are the worst performing currencies.

Swissie still seeing significant inflows, recent flows into EUR (and SEK given their surprise hike), but also into AUD. Relevant flows out of most equities:

Outperforming sectors are Energy again (XLE, XOP) and Staples (XLP) while Growth (VUG) and Consumer Discretionary (XLY) are lagging. The relative underperformance of Metals/Mining (XME) is interesting and fits with lower demand ahead.

Same data, different chart: very bearish price action and relative performance.

A different look at sectors: compare the 15 largest Consumer Cyclical stocks (note that these are weekly charts)…

… to the 15 largest Consumer Staples. They're not all looking pretty, because it's a bear market after all, but the overall picture is pretty impressive:

International markets are all underwater by now over three months. The relative outperformance of Japanese markets (Topix, Nikkei) is a bit surprising, but the overall picture remains unchanged.

Sentiment and Positioning

AAII Sentiment bounced back a bit from its historically bearish reading: 53% bears now vs. 27% bulls and a spread of 26%.

FX Sentiment is still bearish for AUD, CAD, CHF and USD. For the Aussie it has even become more bearish even after the hawkish turn by the RBA (35.4% bulls this week vs. 39.7% last week).

Different sentiment data:

Silver longs… it's hard to imagine this getting even more crowded, but longs have added to their position.

Most USD pairs are bearish on USD

All JPY pairs are bullish on JPY

Commitment of Traders:

Decent buying in the S&P500 with a Z-score of 1.52 this week

In FX, there's still an extreme Commercial long position in GBP and a new long position in CHF

Crude still has a large Commercial long position as well as Copper

Performance has been weak among metals and softs, energy is still going strong.

Dealer positioning in the COT/TIFF report is starting to get a bit stretched over all currencies:

USD is near its 2-year low, EUR at its 2-year high

GBP is getting to its high, CHF as well

JPY positioning is still near its extreme long

Not really a lot of information there at this point, but I like the look of the Citi Pain Indexes:

USD positioning is not as long as I would have thought from the relative short positioning of COT Dealers

Market Risks

VIX and MOVE have converged, but both a MOVE >120 and a VIX >30 are bad signs. The last time it happened was March 2020, and the time before that was during the GFC.

High-yield OAS are at 4.03, so just below their 4.21 high.

Baa-spreads are at their highs already:

A composite index of credit spreads hasn't really stopped moving up:

The VIX term structure still in backwardation overall, but spot VIX is below the front month and VX1/VX2 are in a slight contango. That's a bit inconsistent with the very bearish market action we've seen on Thursday.

The CNN Fear and Greed Index is far from panic-mode:

Various

The NYSE Advance/Decline line made a new low.

Another day with >90% down volume this week on Thursday. Days with similar down volume are starting to cluster again, which isn't a good sign.

25-delta risk reversals are looking bullish for EUR and to a lesser extent for GBP:

Other Stuff I've been looking at

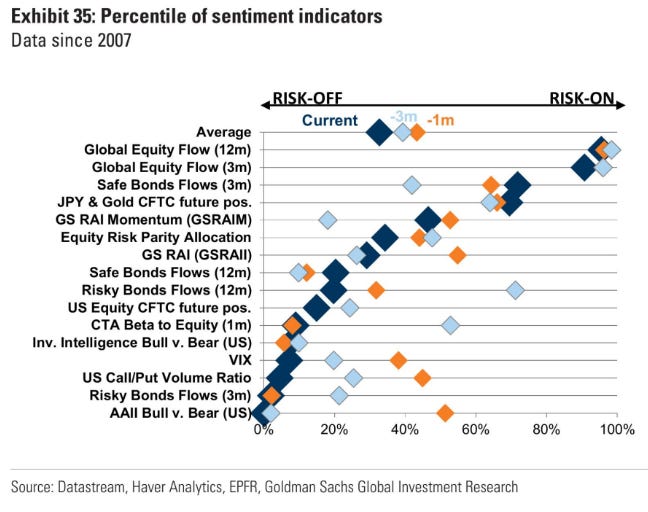

Overview of different sentiment indicators:

The share of central banks that have started tightening:

Money has been flowing out of China at a rapid rate:

Rising real yields aren't particularly good news for gold:

Valuation is not a timing tool:

Treasury ETFs getting a larger share of inflows: