Week 18/2022

BOJ summary, ECB Economic Bulletin, central bank speakers, economic data, a ton of charts and figures

Welcome to the sixth edition of FX & Macro Weekly.

Thanks to everyone who subscribed, I really appreciate it and I hope you benefit from the content. If you do, please consider sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (BOJ Rate Statement, Speakers)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

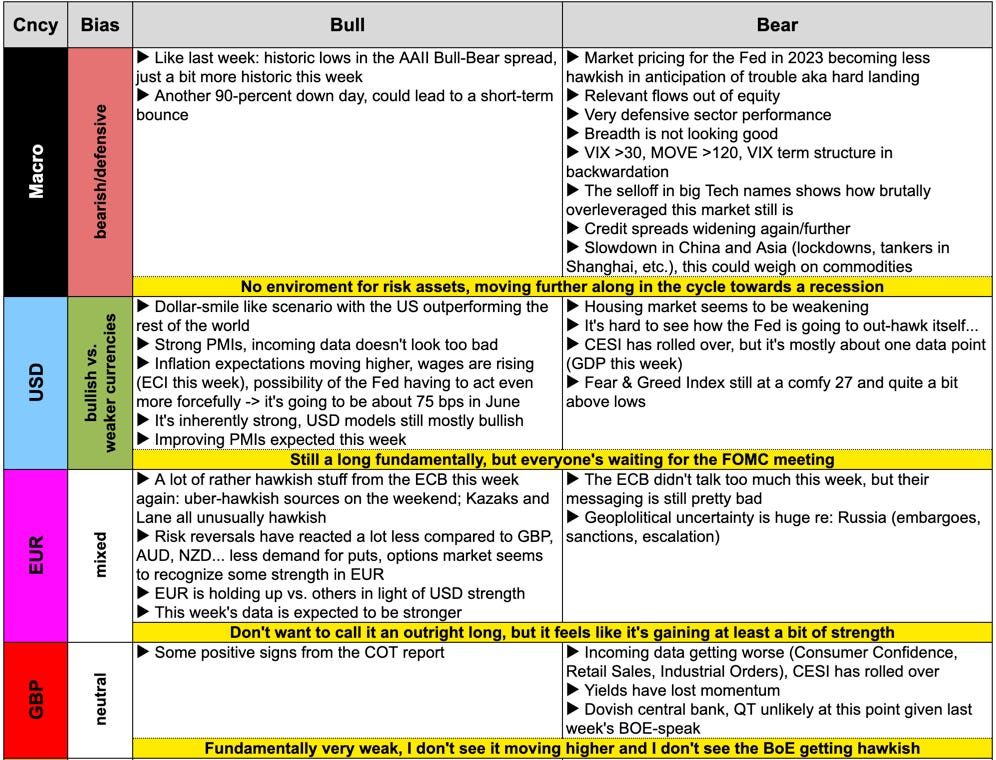

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

I usually wouldn't put this here, but I think it's important to do some self-reflection from time to time:

I'm pretty bearish on risk overall at this point. “Pretty bearish” means I can't even put together a small bull case for risk (!!!).

Almost everyone I follow is bearish, and most of what I'm reading is bearish as well. So far the market seems to confirm my view, though. But it starts to feel like a herd.

Taken together, I need to actively seek out opposing views before I continue blindly following what seems to be an overwhelming consensus for now.

As for market risks:

Geopolitics with the Ukraine war escalating in terms of bombs or sanctions/embargos.

Spillover of liquidity issues from commodity markets. Here's a great piece of what's been going on with commodity trading houses lately and what they can expect: Commodity Traders Can’t Go 'Unregulated' Anymore

The Covid situation in China is still dire and unpredictable, but it's hard to imagine it blowing up even more.

In the UK the risk of a government crisis with regards to investigations of Covid lockdown breaches seems to have diminished a bit for now.

That's not a complete list, but rather things I have on the radar. If you think I missed something important, please let me know in the comments.

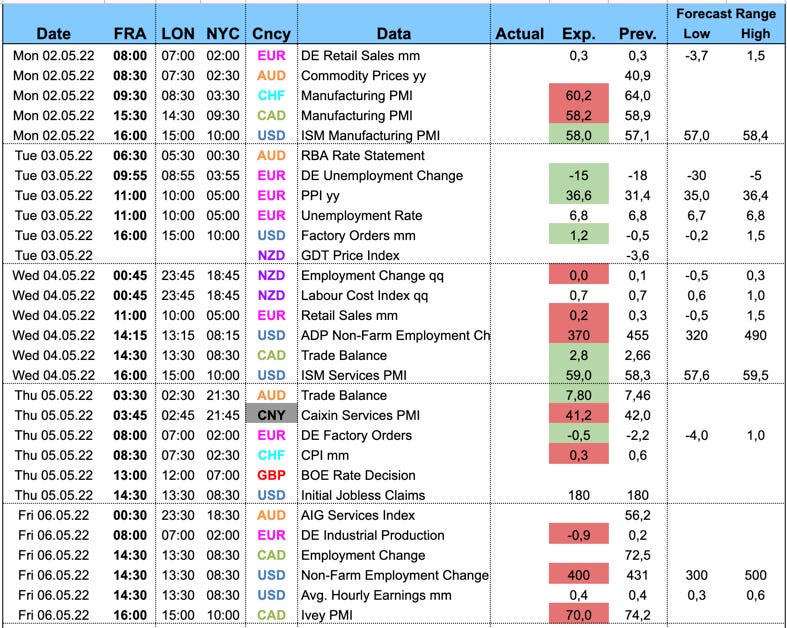

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

BOJ Rate Decision (28.04.22)

The statement from the BOJ is as dovish as expected:

No change to policy rate

Offers to buy unlimited 10y JGBs every business day fixed-rate “unless it's highly likely that no bids will be submitted”

Forward guidance unchanged

I've included Kuroda's remarks from the press conference in the next section.

Here's the summary of the summary of their economic outlook (emphasis mine):

The year-on-year rate of change in the consumer price index (CPI, all items less fresh food) is likely to increase temporarily to around 2 percent -- due to the impact of a significant rise in energy prices -- in fiscal 2022, when the effects of a reduction in mobile phone charges dissipate.

[The] projected growth rates for fiscal 2021 and 2022 are lower due to the effects of such factors as a resurgence of COVID-19, the rise in commodity prices, and a slowdown in overseas economies. However, the projected growth rate for fiscal 2023 is higher, partly owing to a rebound from the lower projection in the previous year.

With regard to the risk balance, risks to economic activity are skewed to the downside for the time being, mainly due to the impact of COVID-19 and the situation surrounding Ukraine, but are generally balanced thereafter. Risks to prices are skewed to the upside for the time being, mainly reflecting uncertainties over energy prices, but are generally balanced thereafter.

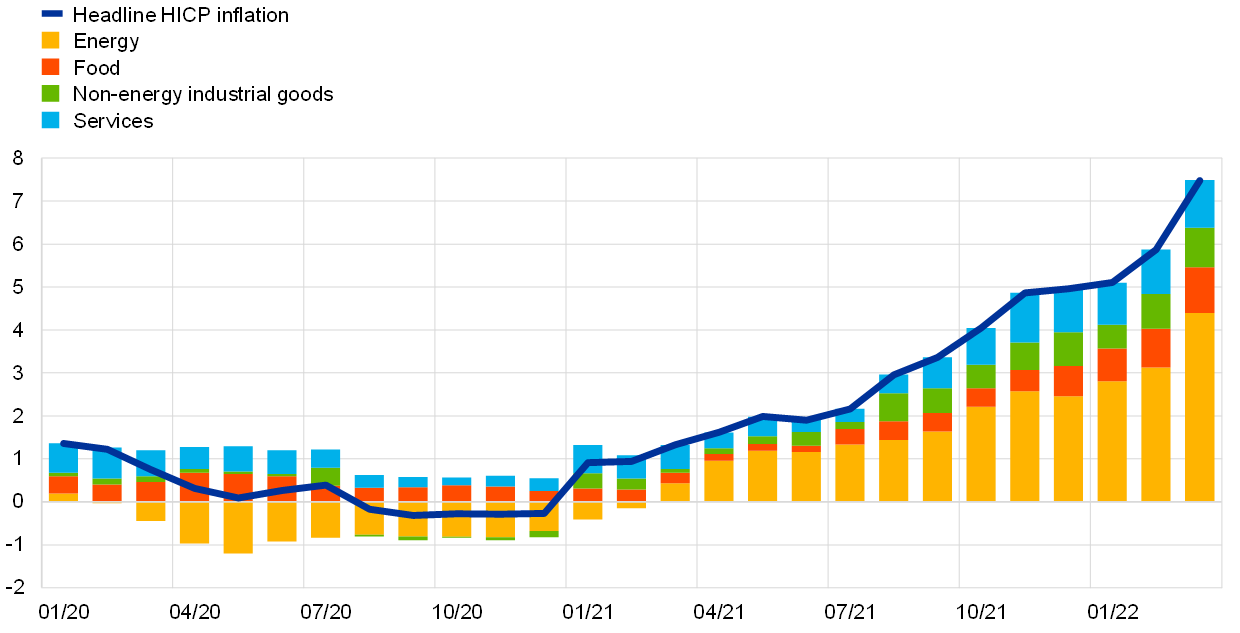

ECB Economic Bulletin (28.04.22)

It's a comprehensive macroeconomic overview and it's a pretty long read. Here are some quotes and charts I found interesting (emphasis is mostly mine):

The most recent euro area bank lending survey reports that credit standards for loans to firms and for housing loans tightened overall in the first quarter of the year, as lenders are becoming more concerned about the risks facing their customers in an uncertain environment. Credit standards are expected to tighten further in the coming months, as banks factor in the adverse economic impact of Russia’s aggression towards Ukraine and higher energy prices.

The recent surge in commodity prices is expected to weigh on the growth prospects of commodity-importing EMEs. The deterioration in the terms of trade in commodity-importing EMEs, especially in key Asian manufacturing countries, is generating a negative income effect that weighs on economic activity. Moreover, commodity importers with current account deficits, such as India and Turkey, could be hit harder if foreign investors are unwilling to finance the higher deficits necessary to fund these countries’ commodity imports. By contrast, in key commodity-exporting EMEs, such as Iran, Nigeria and Saudi Arabia, the increases in commodity prices are expected to cushion the negative impact of falling foreign demand and the rising prices of other commodities.

Composition of HICP:

And the composition of the energy component:

A condensed view of different HICP expectations:

Confab, Speakers, News

Federal Reserve

No comments from the Fed due to their blackout period before next week's FOMC meeting.

European Central Bank

Sources. Weekend: Reuters cited nine unnamed sources “familiar with ECB thinking”:

Rates hike possibly in July and no later than September, nearly all sources see two hikes, some even three

Ending the APP “as soon as possible”

Neutral rate seen at 1-1.25%, normalization should mean a return to neutral

Some policymakers said a technical recession possible in 2022

Lagarde (Dove). Weekend: APP will be interrupted in Q3 (likely early Q3), then look at interest rates; raising interest rates won't bring energy prices down

De Cos (Dove). Monday: slowing growth could weigh on inflation

Kazaks (Neutral-Hawk). Tuesday: wants first rate hike in July after APP has ended at the start of the month, reasonable for the market to price in 2-3 hikes, no need to pause at 0%

Lane (Dove). Friday: first rate hike would not be a problem for the ECB, the big question is how fast to hike after that to normalize policy

Reserve Bank of Australia

Institutionals. Wednesday: ANZ expects cash rate to be raised by 15 bps to 0.25% at next week's meeting. Thursday: Westpac expects 15 bps hike next week and 25 bps in June; other banks expecting a May hike as well; Friday: CBA sees a hold next week

Bank of Canada

Macklem

Monday: BOC will consider another 50 bps hike in June, did. not rule out a 75 bps hike, said rates need to be higher, no pre-set path for rates, inflation is close to a peak, labour market is hot, demand is running above the economy's capacity.

Wednesday: extremely unusual to hike more than 50 bps in one go, neutral at 2-3%, may have to go above that, need to raise rates to moderate spending growth

Swiss National Bank

Jordan. Friday: Swiss inflation is moderate, has not justified interest rate hike; higher inflation abroad and higher CHF cancel each other out, the bank does not react mechanically to every case of upward pressure on the CHF

Bank of Japan

Suzuki (finance minister). Tuesday: refuted reports of discussions of Japan/US joint currency intervention, rapid FX moves undesirable, no comment on FX levels. Wednesday: again rapid moves in yen undesirable

Watanabe (ex finance minister). Tuesday: does not believe there will be a yen intervention right now, USDJPY at 130-135 not a disaster for the economy

Kuroda. Thursday post-statement press conference:

Will continue current powerful monetary easing, will not hesitate to ease further if necessary

2% inflation will not be sustained as energy prices will come down, more time needed to reach inflation target

Bond market operations will ensure the 0.25% cap on 10s and stabilize the market

Wants currency to reflect economic fundamentals and to move in a stable way; recent excessive moves will make it harder for businesses to plan ahead

People's Bank of China

Tuesday: the bank will increase monetary support, will emphasize industry, small/medium enterprises, agriculture and energy, will keep financial markets stable

Economic Data

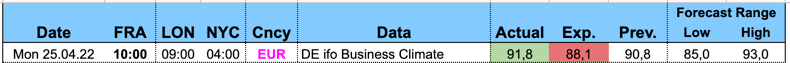

Monday, 25.04.22

German ifo Business Climate came in surprisingly strong, EUR was unimpressed

Tuesday, 26.04.22

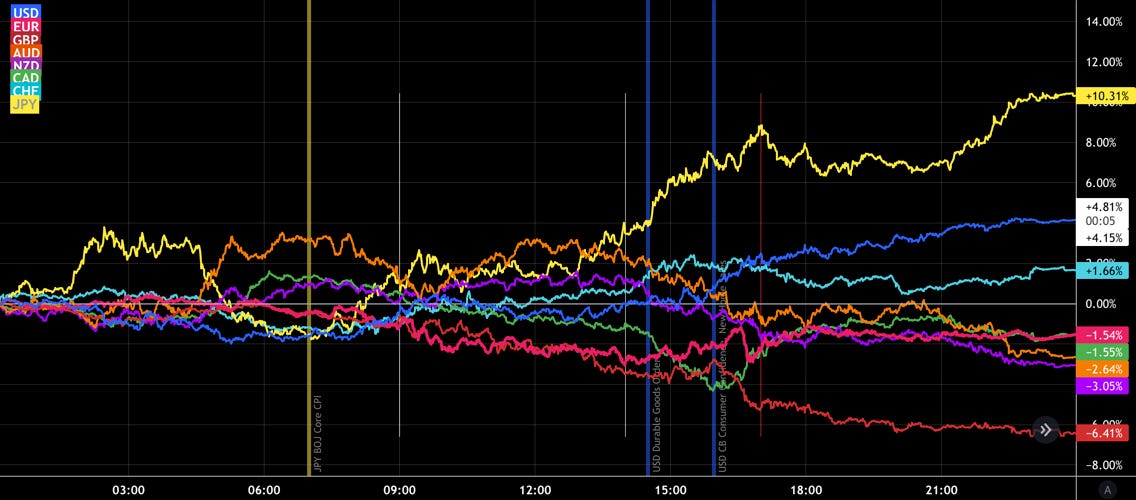

BOJ Core CPI came in line with expectations, JPY was unchanged and later strengthened on risk-off

US Durable Goods Orders and CB Consumer Confidence both beat forecasts, while New Home Sales printed below consensus. USD was stronger

Wednesday, 27.04.22

Aussie CPI was hot with a headline number above the forecast range, AUD was stronger. The Trimmed Mean metric also surprised: 1.4% vs. 1.2% expected. Following the data, ANZ predicted a 15 bps hike by the RBA next week. Here are two charts from the release:

Thursday, 28.04.22

The BOJ Rate Decision was covered above. Japanese Retail sales were stronger, JPY was unchanged.

New Zealand Trade Balance was stronger, but the ANZ Business Confidence came in weaker than expected. NZD was weaker. Here's a link to the Business Confidence report and the headline chart and sub-indices breakdown:

German CPI was stronger than forecast, but EUR was broadly unchanged

US Advance GDP came in below the forecast range and Initial Claims were worse than expected. USD sold off briefly but recovered.

Friday, 29.04.22

Aussie PPI hit above consensus, the AUD did not react immediately

Swiss KOF Economic Barometer beat above the forecast range, CHF was weaker

German Flash GDP came in line, Eurozone HICP as well while GDP was weaker than expected. The EUR did not move much on the data.

US Core PCE was in line on a m/m basis and below consensus on a y/y basis. The Employment Cost Index q/q beat consensus (1.4% vs. 1.1% expected, not shown in table). USD was subsequently stronger.

Market Analysis

Growth and Inflation

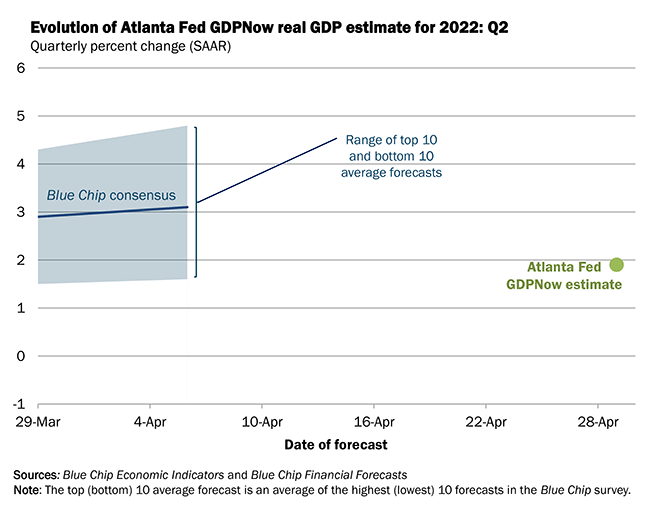

US GDP growth in Q1 was -1.4% (first estimate).

The Atlanta Fed GDPNow estimate for Q2 started off at 1.9%.

The NY Fed Weekly Economic Index stands at 4.31%. The commentary is interesting, because retail and fuel sales seem to have been especially weak (emphasis mine):

The decline in the WEI for the week of April 23 (relative to the final estimate for the week of April 16) is due to decreases in retail sales and fuel sales, which more than offset increases in steel production, tax withholding, consumer confidence, railroad traffic, and electricity output, and a fall in initial unemployment insurance claims (relative to the same time last year).

Citi Economic Surprise Indexes:

USD took quite a hit this week (probably the GDP miss)

GBP has rolled over

CAD still going strong, Aussie bouncing a bit, NZD anemic

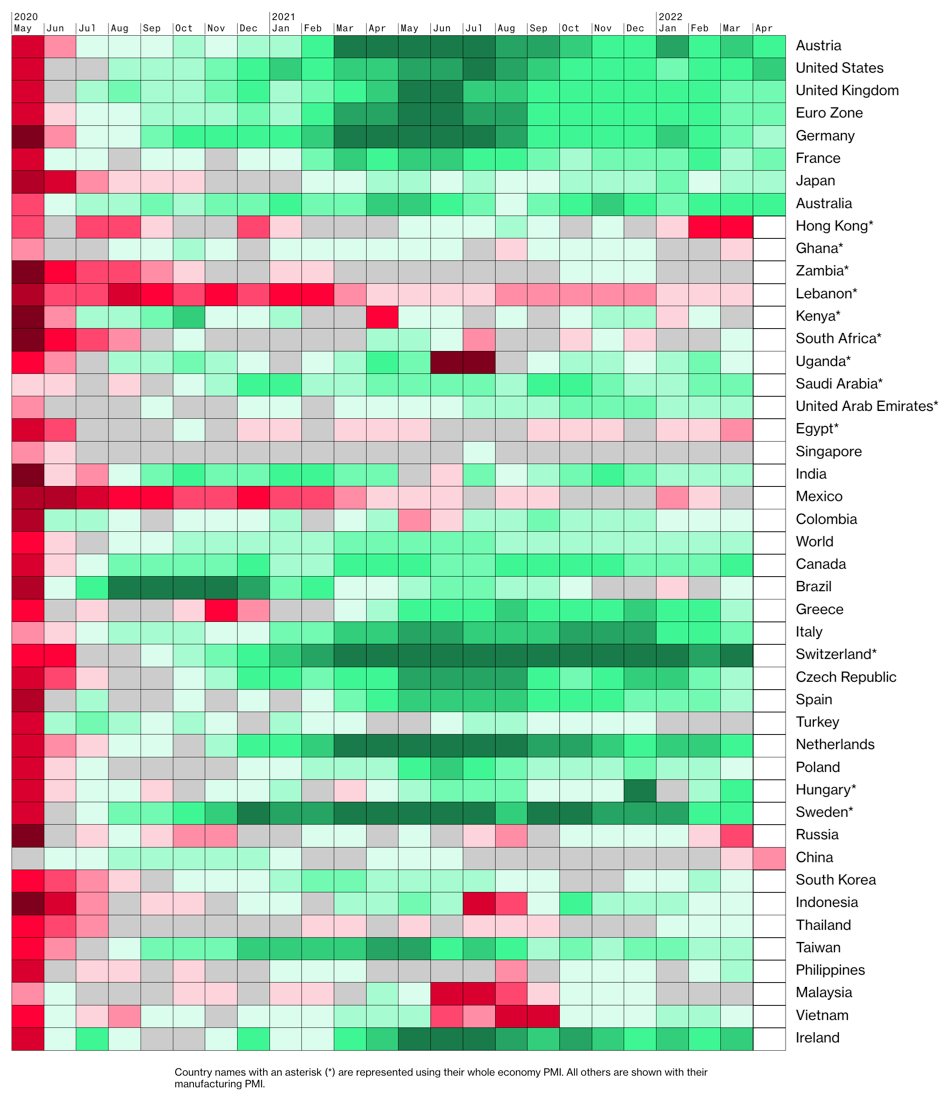

No real change in PMIs from last week:

PMIs have been improving in the US while UK, Australia and the Eurozone remain flat. Note Switzerland and the underperformance in Asian countries (Hong Kong, China, South Korea).

5y5y forward inflation expectations stand at 2.46%, which is a tad below their recent highs at 2.67%.

The inflations expectations ETF is near its high after a breakout:

Citi Inflation Surprise Indexes: not much change from last week:

EUR still at highs, AUD, CAD and CHF as well

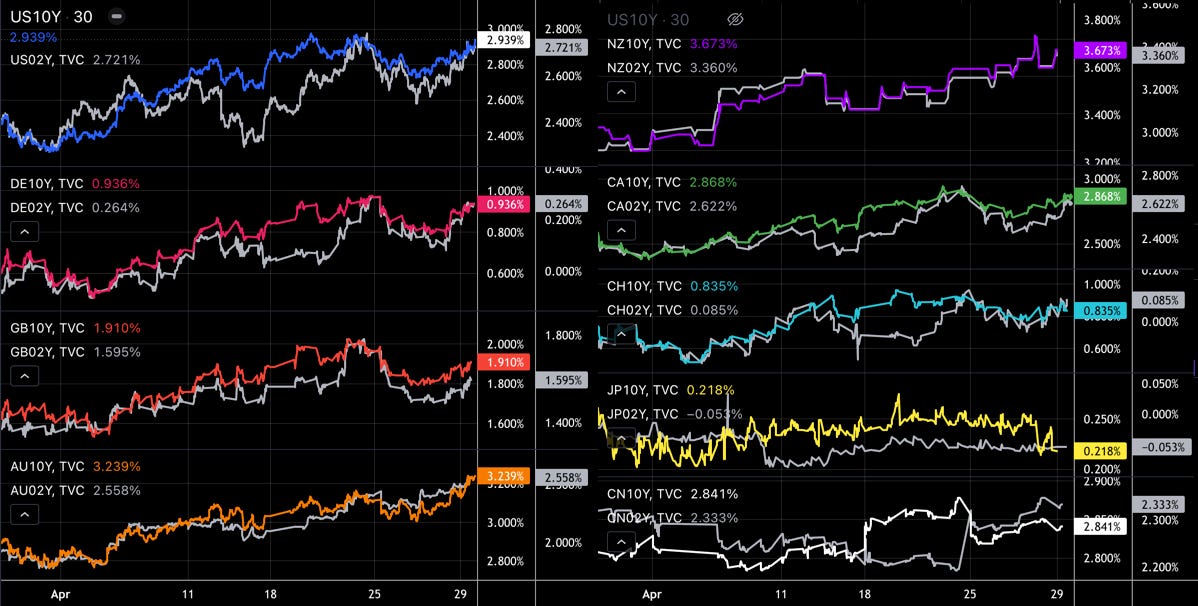

Yields

Looking at the chart and table below:

Aussie and Kiwi show short-term strength

US still going strong, 10s below 3% but have room up to 3.2%

UK relatively weak, especially compared to EUR

Surprisingly strong CN 2s given their central bank path

Not too much change in the 2s10s: Aussie bear flattening further in expectation of hawkish turn from the RBA in the week ahead, similar situation for the EUR and the USD.

Central Banks

A 50 bps hike from the Fed this week is nearly 100% priced in.

The probability of a 75% bps hike in June is currently 89%, followed by a 50 bps hike in July.

The far end remains around 3.25-3.50%.

It looks like the front-loading trade has come to a stop for now, and it's a bit hard to imagine how it could get even more extreme: 100 bps hikes?

STIRs have priced in still a bit more front-loading this week:

Interestingly the expectations for 2023 have cooled somewhat. The ZQZ22-Z23 spread has narrowed further and the corresponding GE spread as well.

It's hard to imagine the K22-Z22 spreads to widen further, so my interpretation is that the market is anticipating the “soft landing” becoming harder with a less hawkish Fed next year.

Sectors and Flows

The USD is by far the strongest currency for the month, followed by the CAD. Aussie and New Zealand dollar are the weakest. The yen has gained some strength.

Significant inflows in CHF and to a lesser extent in USD and AUD (1 month). Equities seeing pretty heavy outflows especially in the US:

It's been a pretty bad week in the stock market.

What's a bit surprising is the relative outperformance of Tech again (but Communication Services are very weak… that's GOOGL, FB, NFLX) and the relative underperformance of Utilities

Other than that sectors still paint a very defensive picture with Cyclicals far behind, Financials towards the bottom, Energy and Staples on top

The 9 largest Communication Services stocks… it's not looking pretty:

Relative sector performance looks like Mining (XME) and Energy (XOP, OIH, XLE) aren't continuing their outperformance for now. Value still stronger than Growth (VTV vs. VUG).

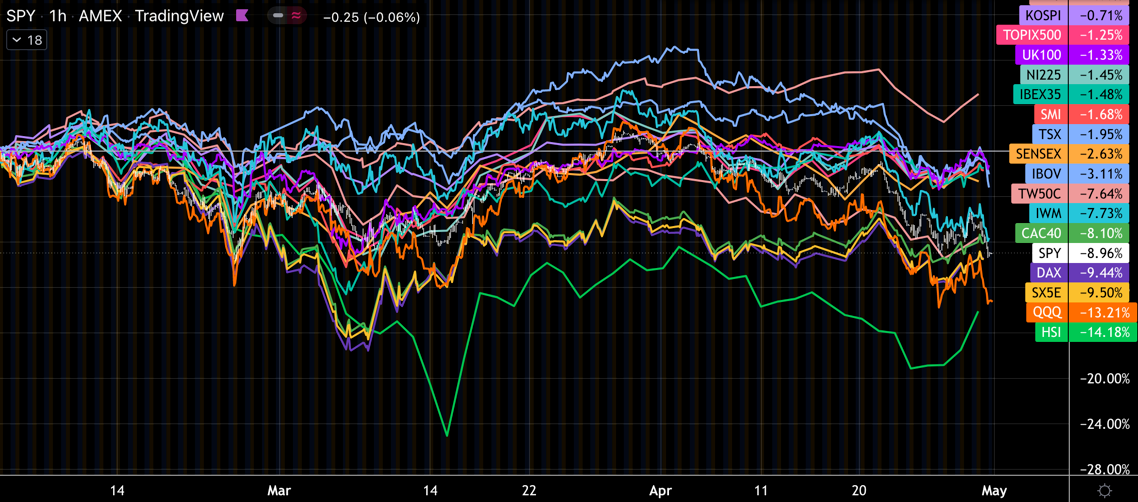

International stock markets are all under water over a 3-month period except for the Aussie All Ordinaries:

Sentiment and Positioning

AAII sentiment has become more extreme this week: the bull-bear spread stands at -43 with just 16% bulls vs. 59% bears. That's worse that during March 2020.

Fintwit isn't as pessimistic, yet (data is as of 25.04., though):

Currency sentiment is:

extremely bearish CAD, CHF, USD

extremely bullish EUR, JPY

Not much change from last week, except for NZD (improved from 40.98 to 45.57).

Similar picture from a different source:

Gold and Silver has become even more extreme compared to last week (!)…

JPY still very short vs. almost everyone else

USD still very short vs. GBP, EUR, AUD, NZD

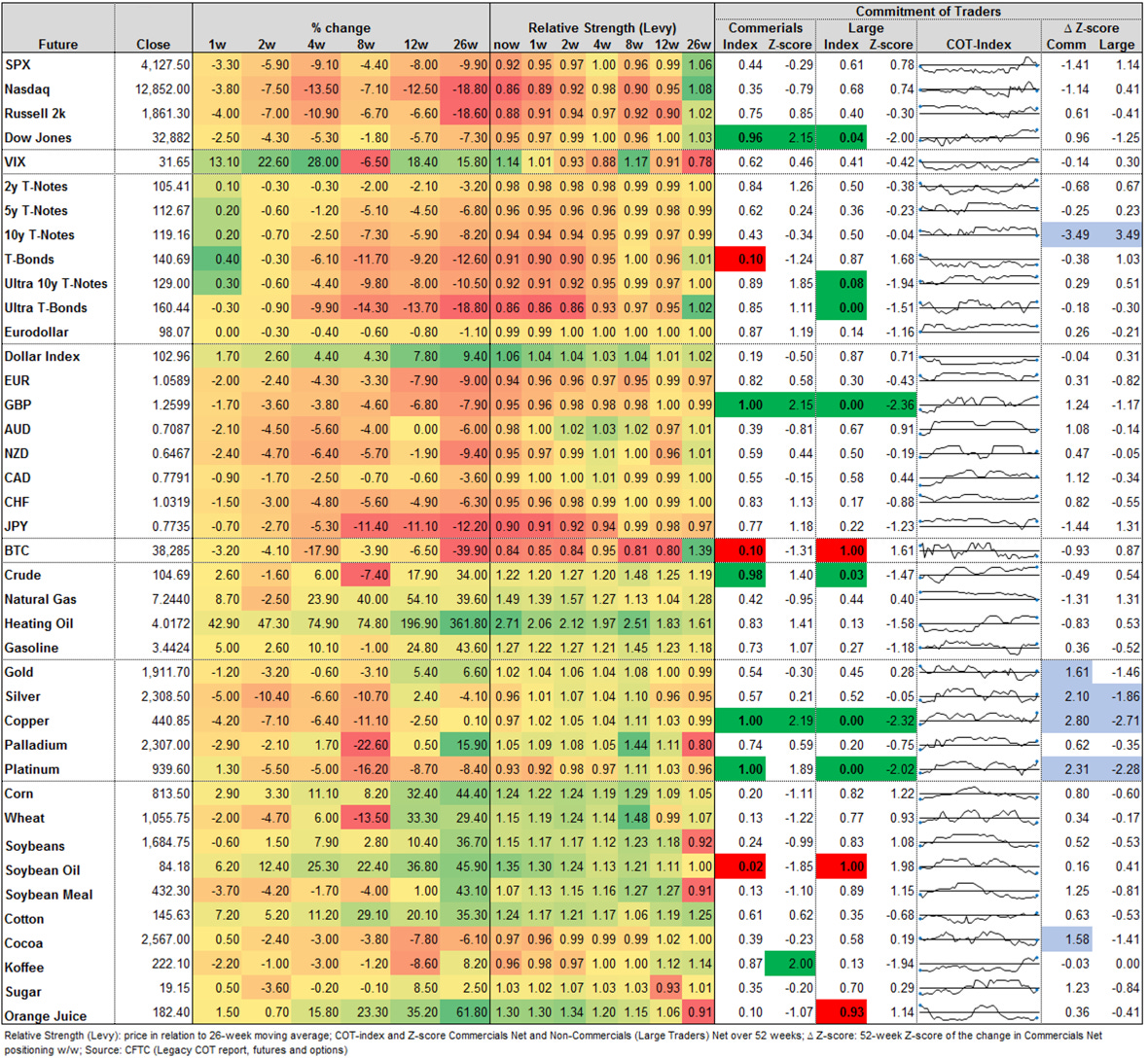

Commitment of Traders shows some interesting developments this week:

Pretty heavy Commercial selling in ZN with a Z-score of -3.5. It's only limited to ZN, none of the other bond futures shows anything similar. I'm not sure what to make of it.

Metals saw heavy Commercial buying with Z-scores above 2 for Silver, Copper, Platinum. The latter two have extreme positions in the COT indexes of Commercials and Large Traders.

As for FX, positioning in the GBP is very bullish.

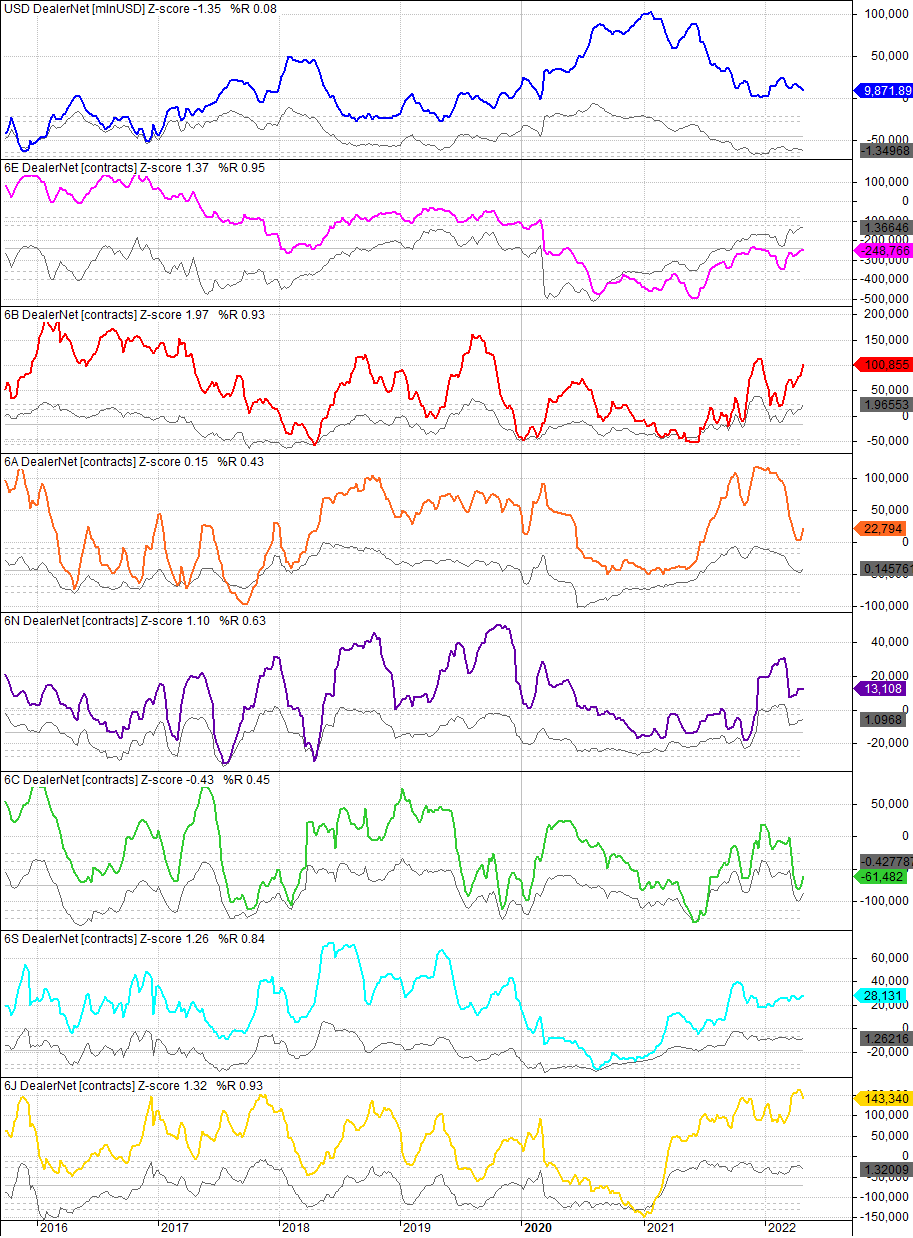

Another look at COT/TIFF data: 6J has come down a bit from the extreme long in Dealer positions while the 6B is getting longer as well (%R is already 0.93 and Z-score close to 2.0).

Market Risks

NYSE down volume is at 90% again. As I wrote last week: this tends to happen around market lows, and it often happens in clusters.

Looks like MOVE was “right” for the time being. VIX >30 and MOVE >120 is definitely not a good sign.

HY OAS are moving up again, but they are still below their 2020 high. Regarding the action in the stock market this does look at least a bit reassuring.

BAA corporate spreads looking less optimistic, though (H/T The Macro Compass):

Similar picture from a composite credit spread index here:

The VIX term structure is back in a clean backwardation with spot VIX well above VX1:

The Fear and Greed Index stands at 27 and is quite a bit off its recent lows:

Various

25-delta risk reversals look bullish for EUR. The moves lower in risk reversals for GBP, AUD, NZD are pretty impressive. Implied volatility has picked up markedly in all USD pairs. In the CME data above every FX future has a skew to the downside (i.e. to a USD upside).

It's not the most timely data, but I like to look at it from time to time anyways: margin debt still has room to decline further.

Seasonality is bearish for AUD, GBP, EUR, NZD and positive for the DXY.

Other Stuff I've been looking at

Voting history at the BOE:

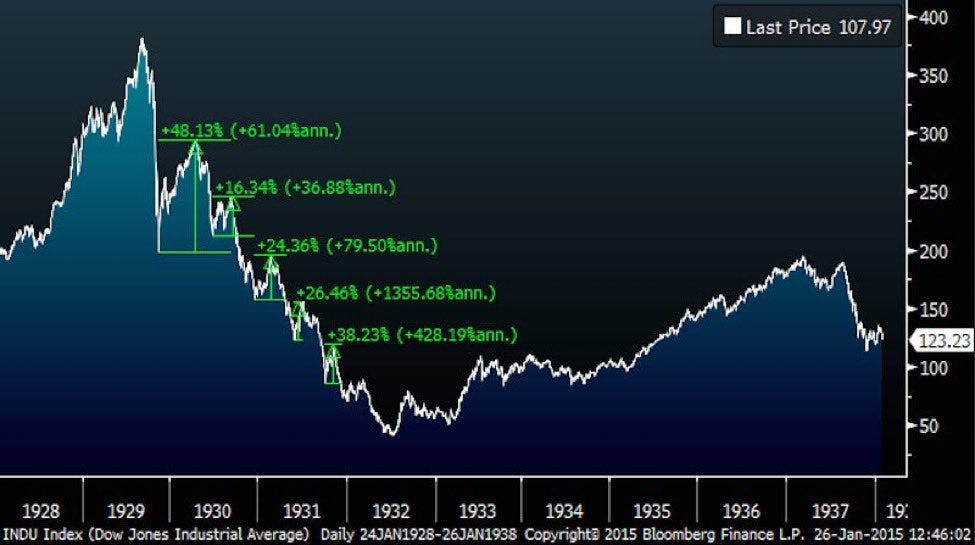

Bear market rallies can be brutal:

Earnings surprises have been lackluster so far:

Retail traders are about to be underwater:

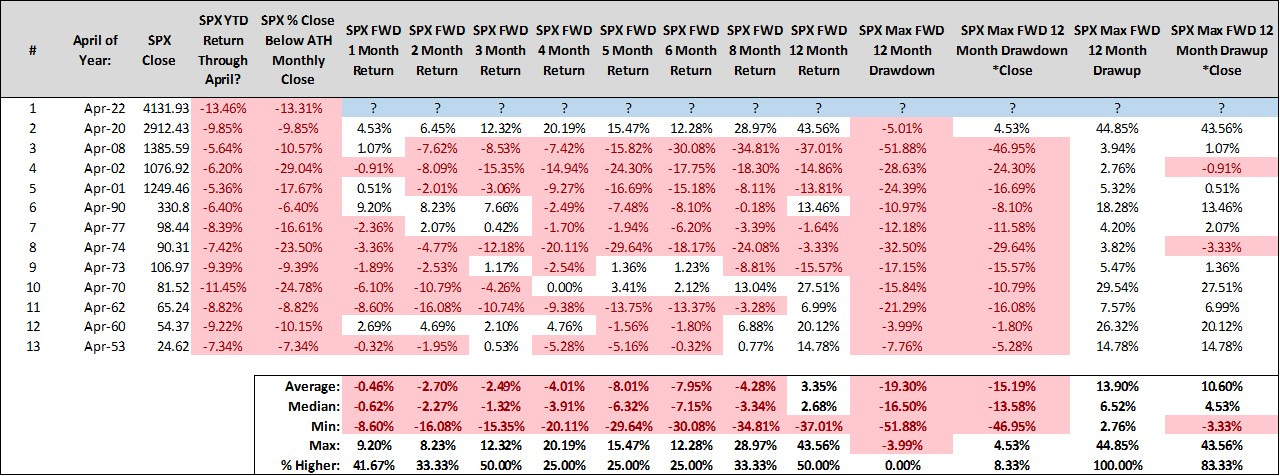

This is what the rest of the year looks like for the SPX when it's down by 5% or more YTD in April:

The economy in Europe is already shrinking if you factor out statistical effects:

It's about 5 o’clock right now…

Global supply chain pressure is at highs…

… global port congestion is wild…

… and trucking in the US is already taking a hit:

Distribution of year-end forecasts for EURUSD, parity is not a crowded trade forecast:

Awesome as usual. Very insighful. Hope i can help you soon :-)