Week 17/2022

Lots of central bank speak with beef at the ECB, sector deep dive, PMIs, far more than 60 charts and tables...

Welcome to the fifth edition of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (Speakers, Sources)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

I've touched on the murky risk of a liquidity crisis in the commodity sector spilling over into the rest of the markets a couple of times now. The BOE has mentioned it, the Dallas Fed has mentioned it, and now it shows up in the IMF Global Financial Stability Report (emphasis mine):

The number of dealer banks globally active in commodity markets has declined in recent years. These banks provide credit and liquidity to, among others, a small group of large energy trading firms that operate globally across a number of commodity markets. These firms are largely unregulated, mostly privately owned, and highly reliant on financing by dealer banks to operate. Market participants have also expressed concerns about dealer banks’ concentrated positions with respect to assessment of aggregate exposures and risk management practices.

In addition, available data suggest that investors may be growing concerned about credit availability and liquidity positions of commodity trading firms amid large commodity price moves.

Amid supply chain disruptions and large price swings, banks may become less willing to finance commodity shipments, and the cost of hedging through futures and options may become prohibitively expensive for some producers. In addition, in the event of default on a derivatives contract by a counterparty, smaller clearing members of exchanges may themselves face risk of default, adding strains to the system.

And here's a look at the bonds of those commodity traders:

H/T Javier Blas, whose book “The World for Sale” I can highly recommend.

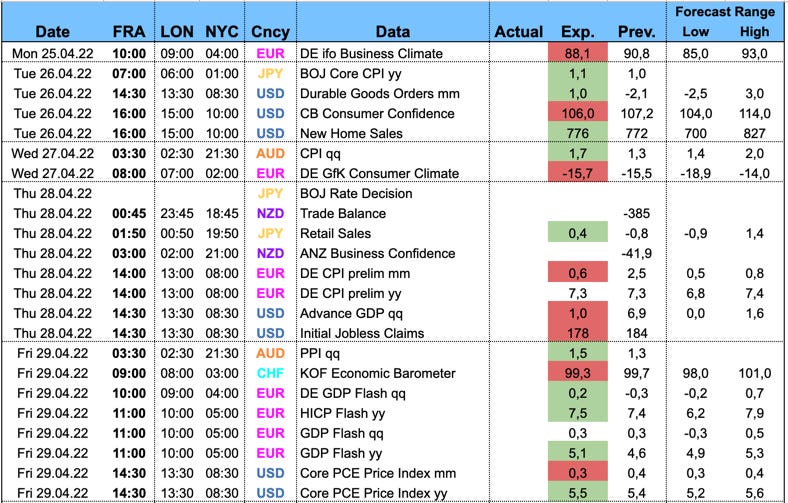

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

Confab, Speakers, News

Federal Reserve

Bullard (Hawk) didn't rule out a 75 bps hike at the next meeting (!), sees target FFR at 3.5% minimum by the end of the year, wants to get above neutral in Q3, said it's reasonable for housing to cool down; Thursday: Fed is behind the curve, but doesn't see a hard landing, 75 bps hikes have been done before and the world has not come to an end

Bostic (Hawk) does not see a 75 bps hike, estimates neutral at around 2.5% (up from 2.25% on 21.03.), recent IMF cut to growth forecasts a reason not to go beyond neutral (unchanged from 21.03)

Evans (Dove) on Tuesday: sees two 50 bps hikes this year, neutral rate at 2.25-2.50%, Fed could get there by the end of the year, expects to go above neutral, FFR will be main policy tool, does not see balance sheet reduction on autopilot, economy will do well as rates rise; Wednesday: reiterated that the Fed will be at neutral by the end of the year

Kashkari (Dove): if supply chains don't improve the Fed will need to do more to bring down inflation

Daly (Neutral) said the case for a 50 bps hike is “now complete”, hiking to 2.5% is not surprising, announcement regarding balance sheet possible in May, expects the economy to slow but avoid a recession, US labour market is “frothy”; Thursday: Fed will “likely” be raising rates by 50 bps at a couple of meetings, but will deliberate with colleagues whether rate hikes of "25 bps, 50 bps or 75 bps" are required

Powell (Neutral): appropriate to front-load hikes and to move quickly, 50 bps in May on the table, market pricing was “appropriate”, labour market is unsustainably hot

Mester (Hawk): not in favour of a 75 bps hike but wants to be rather "deliberate and intentional”, wants to get to 2.50% by the end of the year, Fed needs to be “resolute” in bringing policy to neutral

Nomura now see a 50 bps hike in May followed by two 75 bps hikes in June and July

European Central Bank

Kazaks (Hawk): rate hike possible in July, ending APP in Q3 is appropriate, 0% is not a cap for policy rate

Nagel (Hawk) said a return to the inflation target of 2% looks ever less likely, possible rate hike early Q3, possible stop of the APP at the end of Q2

Lagarde (Dove): next moves will be data-dependent, growth risks are skewed to the downside, core inflation is only at 2.9% and “manageable”, the ECB can't act at the same pace as the Fed; Friday: strong chance rates will be increased this year, and APP is likely to end early in Q3, no mention of a gap between the end of the APP and a rate hike

Wunsch (Neutral): ECB policy rate could turn positive this year, ready to consider first hike in July

De Guindos (Dove) said a rate hike was possible in July, does not see a reason why the APP could not end in July, expects inflation to slow in H2

Sources:

Lagarde has told policymakers to stick to the majority view after policy decisions (which are on Thursday) when talking to the press until the following Monday

An internal guideline asks policymakers not to leak details of internal discussions to the press; these guidelines are not binding, though

Bank of England

Mann (Hawk) said the UK is facing a significant cost-of-living squeeze, tighter monetary policy is required because of asymmetric risks, key question for the meeting in May is when the expected consumption drag materializes

Bailey (Dove) talked about the importance of keeping inflation expectations anchored, short-term expectations are unsurprisingly increasing; inflation in the UK has more in common with the Eurozone than the US; Friday: said the BOE will only do QT in stable markets and cease if conditions change (!)

Reserve Bank of Australia

Nothing new from the RBA Minutes, but here's the relevant paragraph (emphasis mine):

Inflation had picked up and a further increase was expected, with measures of underlying inflation in the March quarter expected to be above 3 per cent. Wages growth had also picked up but, in aggregate terms, had been below rates likely to be consistent with inflation being sustainably at the target. These developments have brought forward the likely timing of the first increase in interest rates. Over coming months, important additional evidence will be available on both inflation and the evolution of labour costs.

Westpac now sees a 40 bps hike at the June meeting

Reserve Bank of New Zealand

Orr expects more rate increases, last hike for 50 bps was about acting sooner and not about getting higher

Bank of Canada

Macklem: supply disruptions aren't easing, won't rule out anything regarding interest rate hikes when asked about interest rate hikes >50 bps

Swiss National Bank

Jordan: no intermediate target for CHF exchange rate, interventions when exchange rate has a negative impact on inflation, average inflation targeting not practical for Switzerland, substantial amount of current inflation may be temporary

Bank of Japan

Kuroda: extreme short-term volatility affects economic activity, wants the Yen to reflect fundamentals, BOJ is watching carefully how FX move impact the economy and prices; reiterated the need for aggressive easing (the headline saying “even as the yen drops” was later retracted)

Another round of unlimited bond buying from the BOJ and lots of comments from the government regarding the moves in JPY; noteworthy: discussions between US and Japanese finance ministers regarding joint currency interventions

People's Bank of China

Yi Gang: will provide more support for the economy, ready to implement more policy steps, will keep monetary policy accommodative

Economic Data

Tuesday, 19.04.22

Chinese Q1 GDP on Monday came in above expectations while Industrial Production was below consensus

New Zealand Services PMI was better than last month and above 50 again, NZD was stronger. Here is the summary (link to the full report) and a breakdown by industry just because the PMI of 15 in the Cultural, Recreational & Personal sector is as bad as you can get… after more than two years of Covid (emphasis mine):

March’s Performance of Services Index (PSI) held out hope of better times, in many ways. Overall, it was good to see the first expansion in 8 months, with a seasonally adjusted index reading of 51.6. There was also a positive vibe for what lies next, in that new orders/business jumped to 60.1 in March, from 55.3 in February, and 40.9 back in January. This points to an underlying resilience in demand showing through, after the initial shock of Omicron’s spread – albeit with accompanying signs that the ability to meet this demand remains hamstrung. The PSI index on supplier deliveries remained weak, at 40.1 – the 20th month in a row it has been below the breakeven mark of 50.

The RBA Meeting Minutes (see above) were perceived as hawkish and the AUD gained momentum

Canadian Housing Starts came in weaker, CAD was not affected much

US Housing Starts hit above the forecast range, USD saw some strength after the release

Global Dairy Prices were lower than the previous number, NZD was weaker

Wednesday, 20.04.22

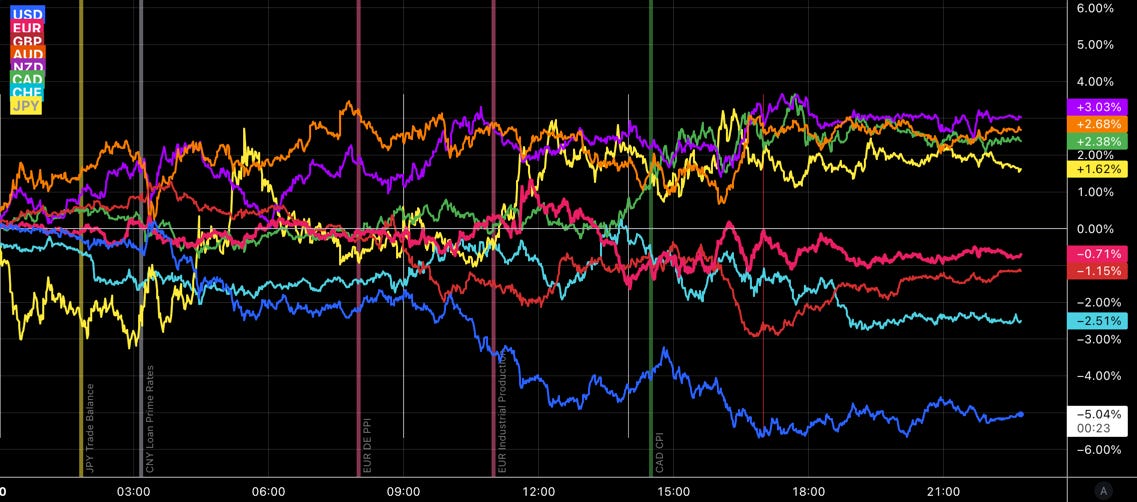

Japanese Trade Balance was below the forecast, the Yen did not move in any clear direction.

The Chinese Loan Prime Rates were left unchanged, AUD sold off initially.

German PPI came in above the forecast range (little reaction from the EUR) while Eurozone Industrial Production was slightly below consensus (not much direction, either).

Canadian CPI was higher than expected, the CAD was stronger. Note that there was a change in the methodology of how Statistics Canada calculates the CPI: it incorporates house prices more than before. This added about 15 bps to the headline number this time. Here's the description:

With the release of the March 2022 Consumer Price Index (CPI), a new data source for resale house prices, in addition to the New Housing Price Index, will be used in the calculation of the mortgage interest cost index (MICI). This change will improve the timeliness of resale housing prices in the MICI, as well as the other owned accommodation expenses index, which includes commissions on the sale of real estate.

The Fed Beige Book was also released on Wednesday. It does not carry a headline number, but here are some noteworthy comments from it (emphasis mine):

Many firms reported significant turnover as workers left for higher wages and more flexible job schedules. Persistent labor demand continued to fuel strong wage growth, particularly for footloose workers willing to change jobs. Firms reported that inflationary pressures were also contributing to higher wages, and that higher wages were doing little to alleviate widespread job vacancies. But some contacts reported early signs that the strong pace of wage growth had begun to slow.

Strong demand generally allowed firms to pass through input cost increases to customers, for example, via fuel surcharges for freight and airline fares. However, contacts in a few Districts noted negative sales impacts from rising prices. Firms in most Districts expected inflationary pressures to continue over the coming months.

Thursday, 21.04.22

New Zealand CPI disappointed, NZD sold off immediately

Eurozone Final HICP came in a tad lower, the EUR weakened

US Initial Jobless Claims beat the consensus estimate while the Philly Fed Manufacturing Index missed; the USD was weaker for a while. Here's a snippet from the Philly Fed (emphasis mine):

The diffusion index for future general activity decreased 15 points to 8.2, its lowest reading since December 2008 (see Chart 1). More than 37 percent of the firms expect increases in future activity (down from 41 percent last month) compared with 29 percent that expect decreases (up from 18 percent). The future new orders index fell 18 points to 3.7, while the future shipments index edged down 1 point to 29.9. The future employment index ticked down 2 points but remains elevated. Nearly 55 percent of the firms expect steady employment levels over the next six months, 40 percent of the firms expect to increase employment, and 1 percent expect employment declines.

Eurozone Consumer Confidence came in above the forecast range (but still pretty bad), EUR was weaker

Friday, 22.04.22

Aussie PMIs improved compared to the previous release, but AUD was weaker

UK Retail Sales came in below consensus, GBP sold off heavily

Eurozone PMIs were surprisingly strong with the Services index coming in above the forecast range and the Manufacturing Index well above expectations and above last month's number. The EUR was stronger. Here's the summary (emphasis mine):

April saw a two-speed eurozone economy. Manufacturing came close to stalling due to ongoing supply constraints, rising prices and signs of spending being hit by risk aversion due to the war. However, April also saw manufacturers suffer due to a shift in demand from goods to services amid looser pandemic restrictions, most notably via a record surge in spending on activities such as travel and recreation.

Common across both sectors, however, was a further surge in cost pressures, driven by soaring energy and raw material costs, as well as rising wages. Average prices charged for goods and services rose at an unprecedented rate in April as these higher costs were passed on to customers, sending a worrying signal that inflationary pressures continue to build.

The eurozone has therefore started the second quarter on a stronger than anticipated footing, confounding consensus expectations of a slowdown. However, the weakness of the manufacturing sector is a major concern as it points to an economy that is not firing on all cylinders. Similarly, the ever-rising cost of living suggests that service sector growth could cool sharply once the initial rebound from the opening up of the economy fades.

UK PMIs were mixed with Services below and Manufacturing above consensus. GBP was weaker after the release. Here are some quotes (emphasis mine):

The survey data signal a marked cooling in the pace of UK economic growth during April, caused by an abrupt slowing in demand. Orders received by manufacturers have almost stalled, driven by an increasing loss of exports, and growth of demand for services has slumped to among the weakest since the lockdowns of early 2021.

High prices and the associated rising cost of living were often cited as a principal cause of lower demand, with covid also continuing to affect many businesses. Brexit and transport delays were seen as having further impeded export sales, while the Ukraine war and Russian sanctions also led to lost overseas trade.

Although the current pace of growth remains relatively robust, firms are taking a more cautious approach to hiring and spending as demands cools and the outlook becomes gloomier, to suggest that the slowdown in the economy has further to run.

Canadian Retail Sales surprised to the upside, CAD was a bit stronger

US PMIs also mixed with Services below and Manufacturing above the forecast; the USD showed strength before and after the release. And for these PMIs a summary as well (emphasis mine):

Although still indicative of annualised GDP growth of approximately 3%, the April PMI surveys point to the upturn losing some momentum compared to the strong rebound seen in March, when services activity in particular had been buoyed by loosened pandemic restrictions in the US and abroad.

Many businesses continue to report a tailwind of pent up demand from the pandemic, but companies are also facing mounting challenges from rising inflation and the cost of living squeeze, as well as persistent supply chain delays and labor constraints.

These headwinds, plus increased concerns over the economic outlook and tightening monetary policy, meant business confidence about the outlook slipped sharply lower in April. However, with the overall pace of economic growth and hiring remaining relatively solid, for now the focus from a policy perspective is likely to remain firmly on the need to rein in the record high inflationary pressures signalled by the survey.

The UK GfK Consumer Sentiment survey overnight was disastrous (not shown in the table). Here's the summary (emphasis mine):

“The cost crunch is really hitting the pockets of UK consumers and the headline confidence score has dropped to a near historic low. The scores looking at the next 12 months for our personal finances at -26 and the general economy at -55 are worse than the 2008 financial crash. The personal finance score for the next year is also worse than the initial Covid shock in 2020. When rising inflation and interest rates meet low growth and declining incomes, consumers will understandably be extremely cautious about any spending. There’s clear evidence that Brits are thinking twice about shopping, as seen in the tumbling Major Purchase Index – now is not considered to be a good time to buy. This is dire news for consumer confidence and with little prospect of any economic relief on the horizon we can only forecast further falls in the Index for the year ahead.”

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow for Q1 stands at 1.3%.

The 4-quarter GDP growth rate according to the NY Fed Weekly Economic Index currently is 4.47%.

The CitiFX Economic Surprise Indexes are a bit surprising this week:

USD still at highs and the EUR moving higher sharply, I suspect because of the headline surprises in the PMIs

CAD jumping up even further

AUD and NZD dropping

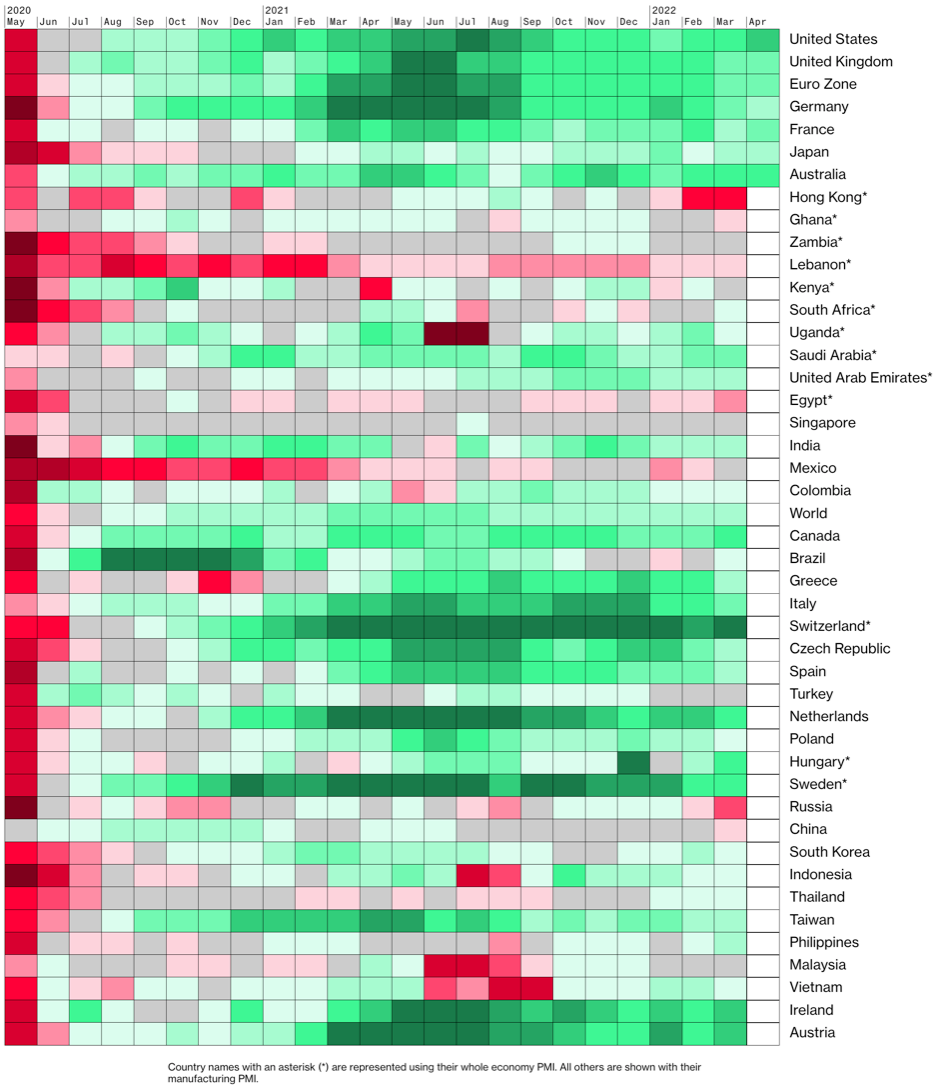

PMIs have been improving in the US while UK, Australia and the Eurozone remain flat. Note Switzerland and the underperformance in Asian countries (Hong Kong, China, South Korea).

5y5y forward inflation expectations moved up sharply higher this week. It now stands at 2.59%, a bit off its high. Note, however, that this has been markedly higher at around 3% in the post-GFC time.

The Inflations Expectations ETF has moved up further as well:

CitiFX Inflation Surprise Indexes:

Up for the EUR, CAD and CHF

Down for USD, NZD, AUD

Yields

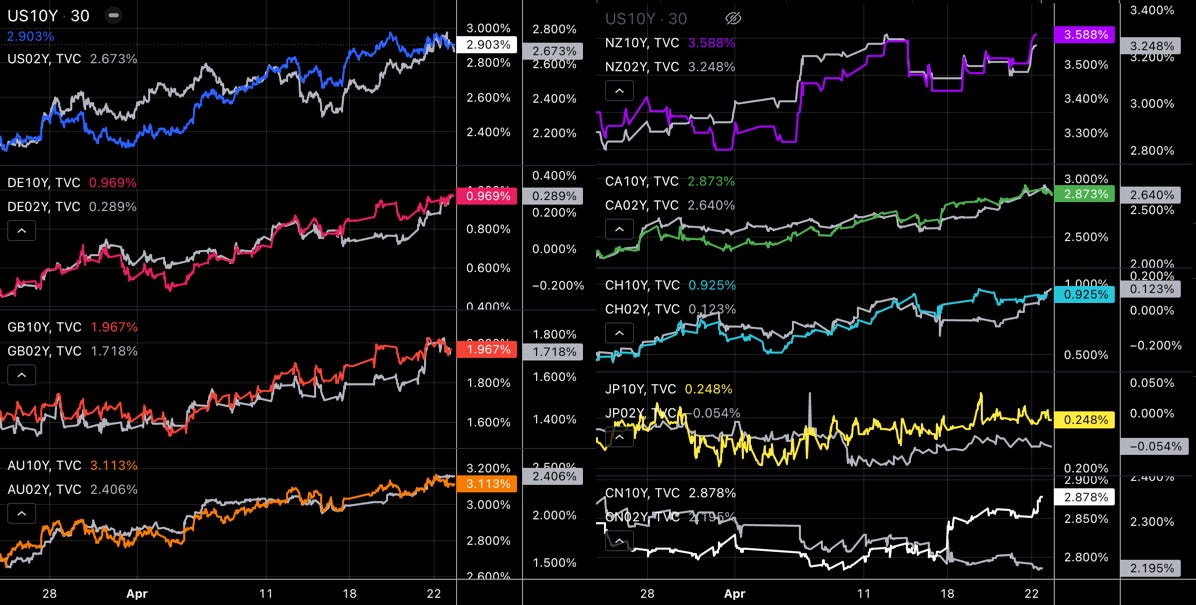

I'm looking at the chart and table below:

US yields still going strong, 10s are just a tad below 3%, longer-term there's room up to 3.2%

German 2s above zero and going

NZ sideways (no new high for the 2s)

Chinese 10s are reversing upwards (can't imagine they're pricing growth) while 2s continue lower

Almost all G8 10s are near decision points (support/resistance).

The yield curve (2s10s spread) has flattened again this week, stands at 23 bps in the US at this point. Noteworthy is the bear flattening in the Aussie curve, reflecting the market pricing of steeper hiking expectations.

Central Banks

The market is pricing in more and more front-loading by the Fed:

There's a near 100% chance of a 50 bps hike at the next meeting (and a 0.4% chance of a 75 bps hike…)

The June meeting is priced with a 75 bps hike followed by another 50 bps and then 25 bps increments. Last week June was priced for a 50 bps hike

At the far-out end there hasn't been much change

Same story, different chart: Fed Fund Futures and Eurodollar Futures are pricing in more and more front-loading while expectations for 2023 drop (still pricing in 1-2 hikes then) and 2024 has priced in one rate cut:

Sectors and Flows

The dollar is the strongest currency for the month, the yen the weakest. AUD and NZD have lost quite a lot of ground recently while the CAD stayed a bit more resilient.

I'm not paying a lot of attention to the CNY on a day-to-day basis, but the recent move is worth taking note of:

Sector performance shows that everything has come down in sync recently. Nothing is really working well in stocks anymore, which is worrying:

Metals/Mining (XME) was hit hardest, followed by Energy (XOP, OIH, XLE)

XLP (Staples) was an outperformer this week, but XLY (Discretionary) wasn't far behind, XLK (Tech) performed better than XLU (Utilities)

Things look a bit clearer here: the market is moving further towards a recessionary environment with Defensives and Utilities outperforming. The outperformance of Energy has come to an end for now.

Another take on sector performance: the 15 largest Tech stocks are all well off highs (note that these are weekly charts).

Meanwhile, the 15 largest Utilities are mostly near their highs:

The BNY Mellon iFlow Monitor shows heavy inflows into CHF, but also positive flows for AUD, CAD and USD. Equity-wise I'm surprised by negative flows in CHF and GBP, because they do not show up in the stock indexes so far.

On the international front the commodity economies are still outperforming: TSX is Canada, XAO is Australia, IBOV is Brazil. Noteworthy is the SMI (Switzerland) with its stellar PMIs.

Sentiment and Positioning

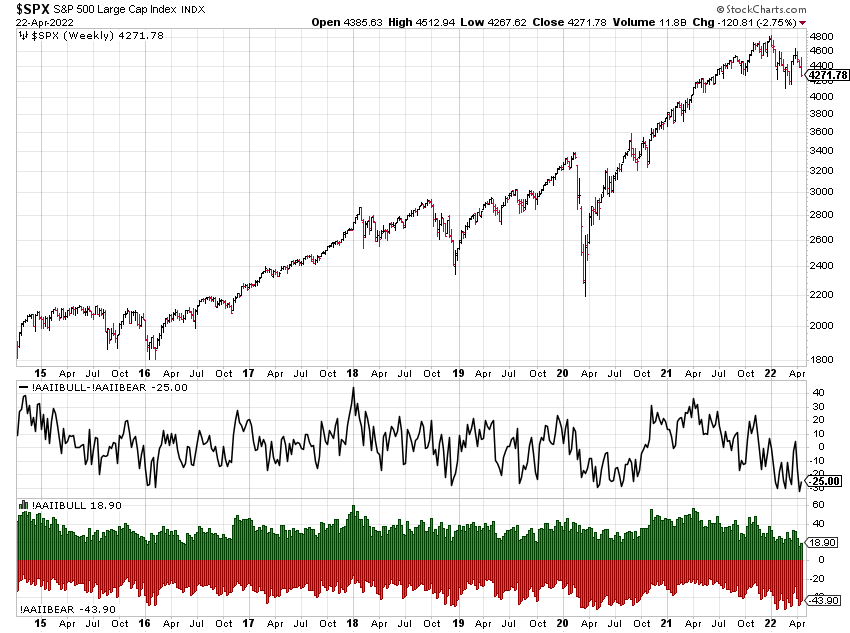

AAII sentiment is still extremely bearish with Bull-Bears at multi-year lows:

The TD Ameritrade Investor Movement Index has cooled somewhat, but we're still far from lows:

The overall FX sentiment is similar to last week:

Long CAD, CHF, USD

Short JPY, EUR, GBP

Similar picture here:

Sentiment is still very bullish for JPY and bearish for USD

Long USD, short JPY, short EUR

Silver and Gold have become even more extreme compared to last week

There have been quite some interesting moves across markets in term of price action and positioning:

Energy has sold off with Natural Gas at about -10% for the week, Metals have sold off as well while Grains and Softs have been mixed

VIX Futures have spiked considerably, the very large bearish changes in equity positioning we had last week have been prescient

Positioning in JPY and GBP is at extremes

A closer look at Dealer positioning in the G8:

JPY still at an extreme

GBP not looking as extremely positioned as in the legacy COT data

USD not at an extreme

Once again: this does not help with timing!

Market Risks

The CNN Fear and Greed Index not at an extreme:

VIX and MOVE had been diverging for a while now but the spread is narrowing again. Looks like the bond market was right once again.

High-yield OAS have moved lower, which is a bit surprising after Friday's action.

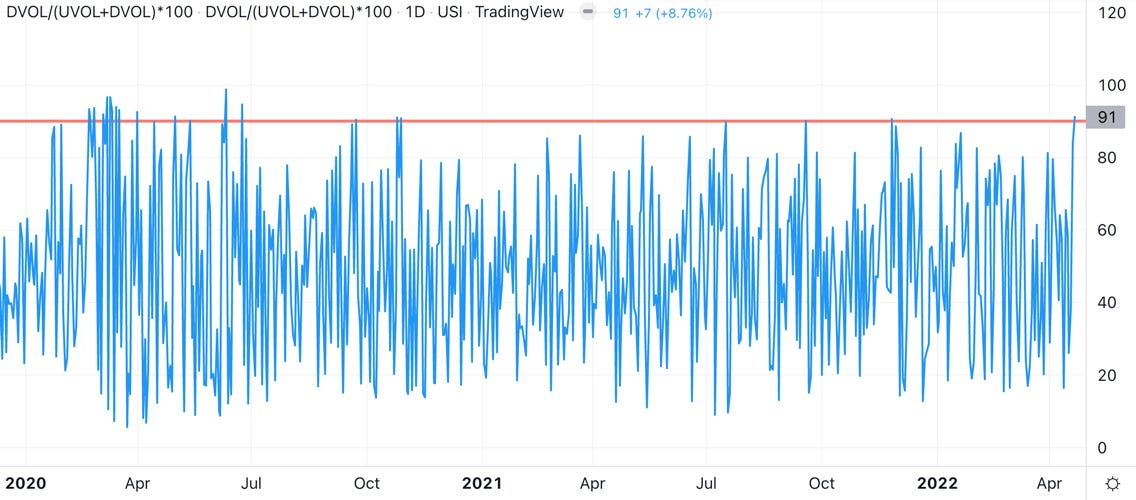

NYSE Down Volume spiked above 90% of total volume, which is a relatively rare occurence and can lead to a bounce.

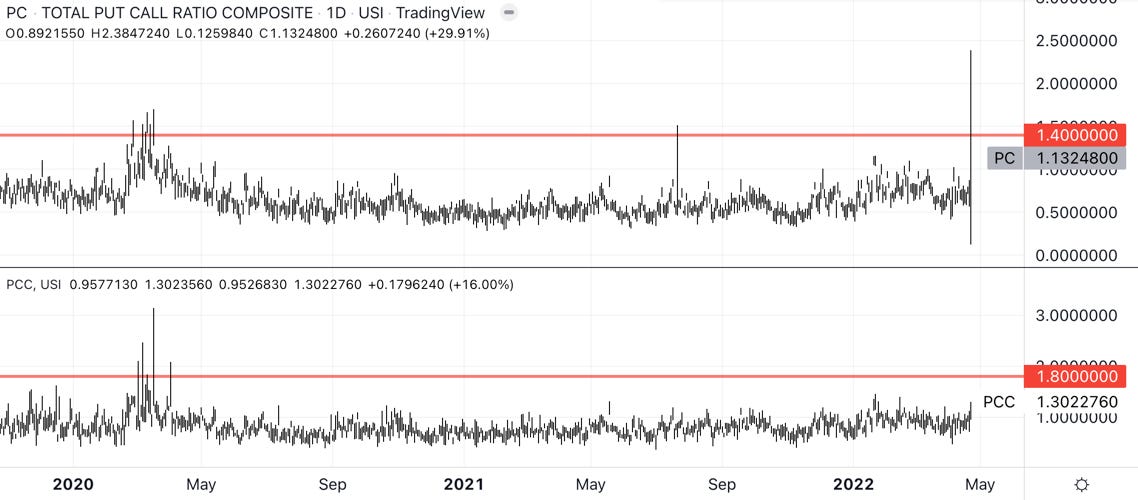

Put/Call Ratios also had a moment on Friday. I use values of 1.40 for the Total P/C ratio and 1.80 for the CBOE metric. This can also happen around lows.

The VIX term structure had been looking pretty innocent until Thursday. After Friday's action it has deformed quite a bit, but:

Spot VIX is still a tad below VX1

The first three months are still in contango

It's tempting to think the VIX predicts turmoil until October before IV calming down, but the year-end flattening of the VIX curve isn't uncommon and the overall curve is virtually flat right now (premium May-October is just -0.60)

Various

25-delta risk reversals are pricing the EUR, GBP and NZD higher.

Other Stuff I've been looking at

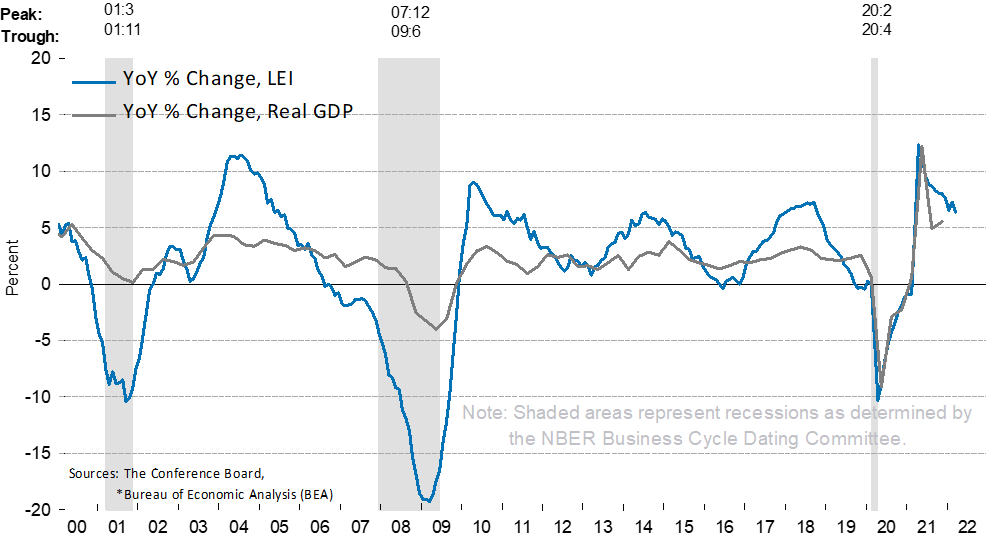

The Gowth Impulse is slowing:

Chinese economic indicators rolling over:

Chinese imports down while commodity prices are up… this does not look too good for commodities:

This won't help find good trades for next week, but Chinese demographics shocked me a bit (emphasis mine):

Demographers warn that if drastic measures are not taken to reverse this trend, the country’s population could halve by the end of this century, from 1.4bn people to 730mn, as forecast by one influential Lancet study. That creates a policy headache for Beijing: how to pay for the rising pension and medical costs of the elderly with the tax contributions of the shrinking working-age population.

UK real earnings are diving:

The US Leading Economic Index has been falling for a while:

And Financial Conditions are getting tighter again:

Outlook isn't too good for stocks:

… and bonds aren't a very good hedge at the moment:

The market usually overestimates the Fed hiking path:

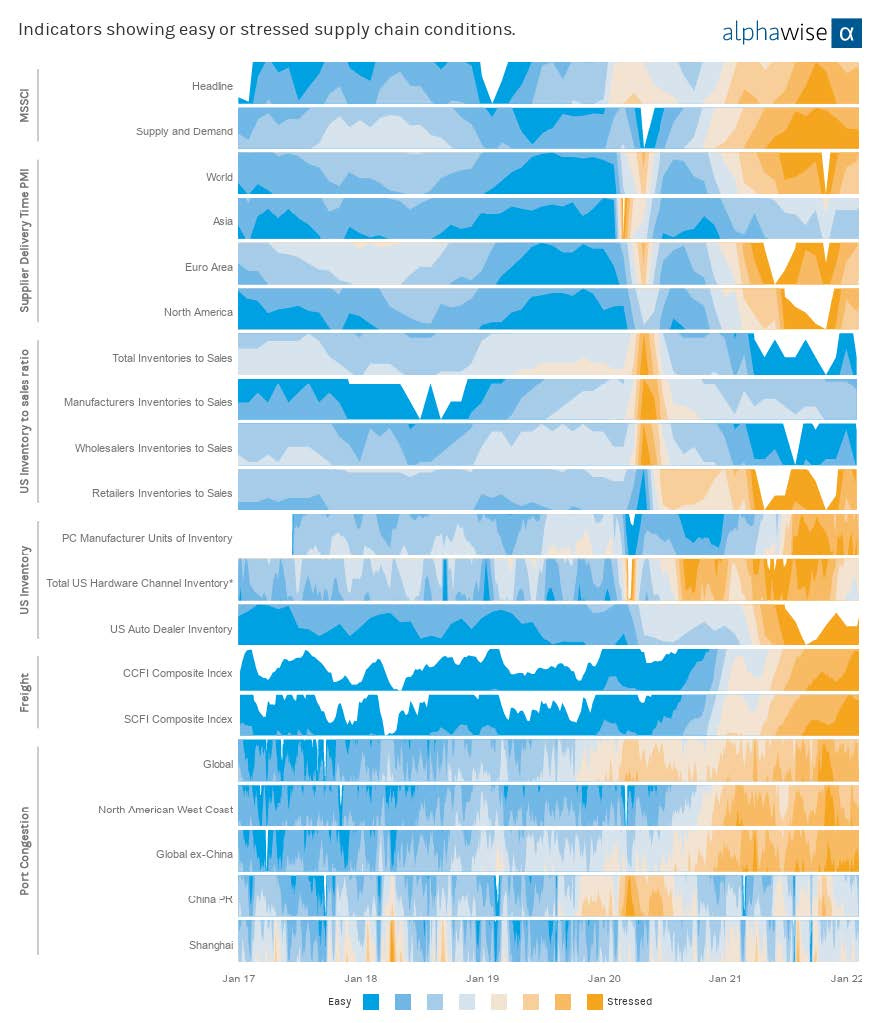

An interesting look at the stress in global supply chains:

BNY Mellon iFlow Mood indicator is already below March 2020:

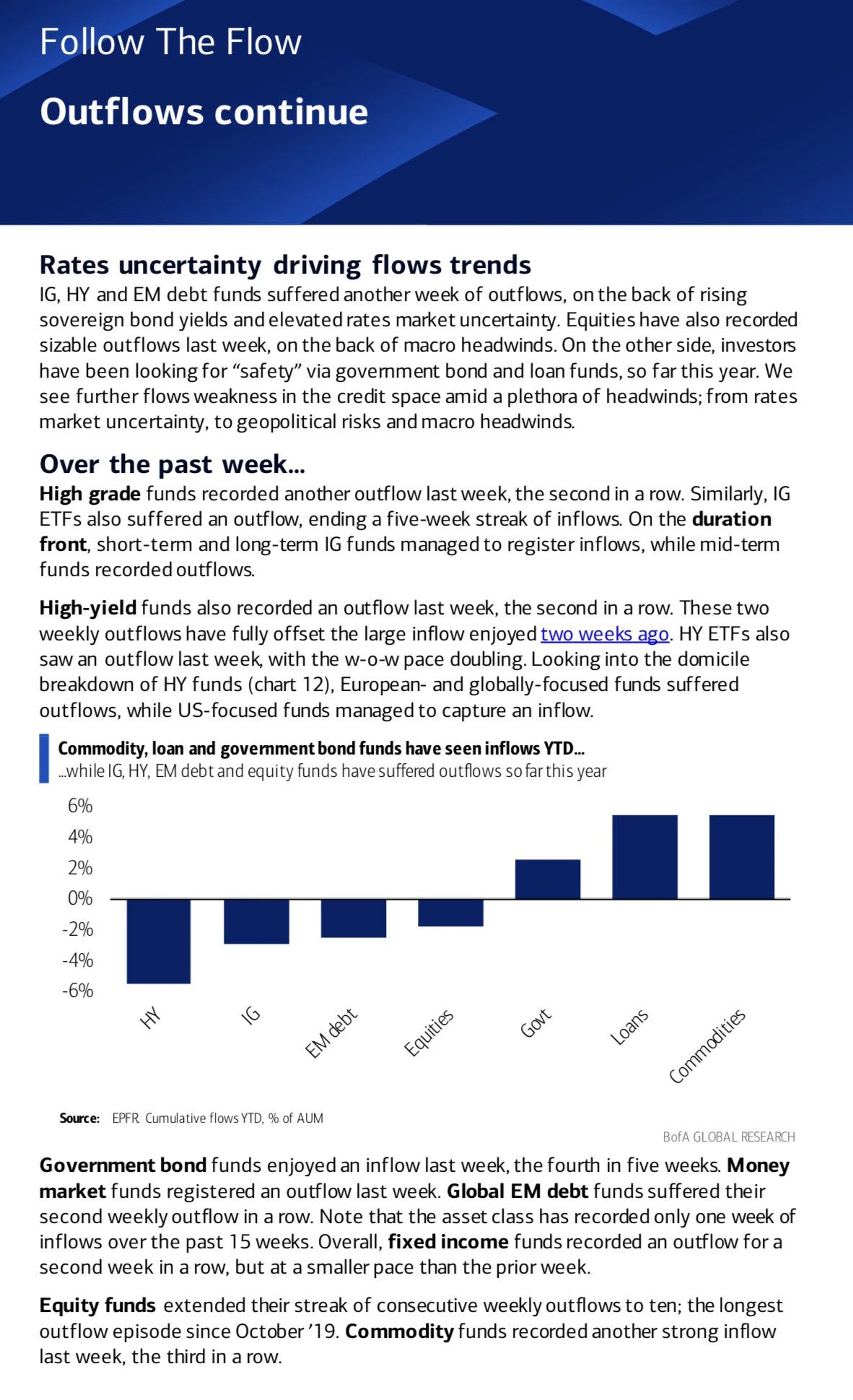

Another take on flows:

congrats, the best summarize of the week. So much alpha here..