Week 15/2022

Welcome to the third edition of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it. I'm also on Twitter @fxmacroweekly.

Now let's dive in…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (RBA Rate Statement, FOMC and ECB Minutes, Speakers)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

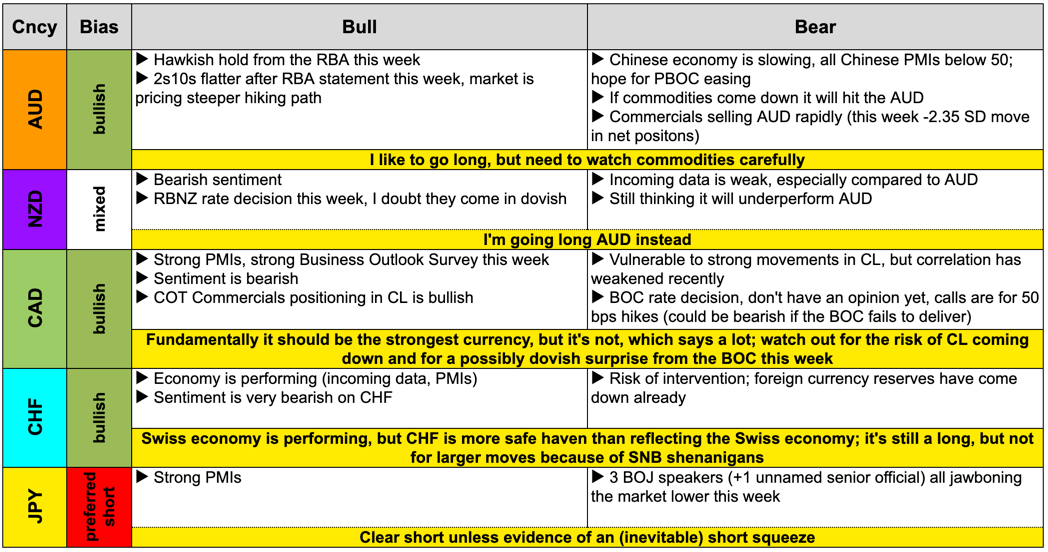

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

As for market risks: the Ukraine war is still hot even though it seems to impact markets less. A major escalation (or de-escalation) could quickly change that. Also, I believe the black-swan risk of a crunch in commodity markets is still not discussed widely enough. But it's popping up here and there, e.g. in statements from the BOE recently or this week in a note from Credit Suisse's Zoltan Poszar commenting on energy traders’ request to the ECB for emergency funding (which was denied by the bank):

Commodity traders asking for central bank liquidity assistance is a symptom – the symptom – of liquidity stress. You don’t ask for liquidity assistance without long-term consequences like regulatory oversight and liquidity rules, and so if you ask for liquidity assistance, you must really-really need it. Why?

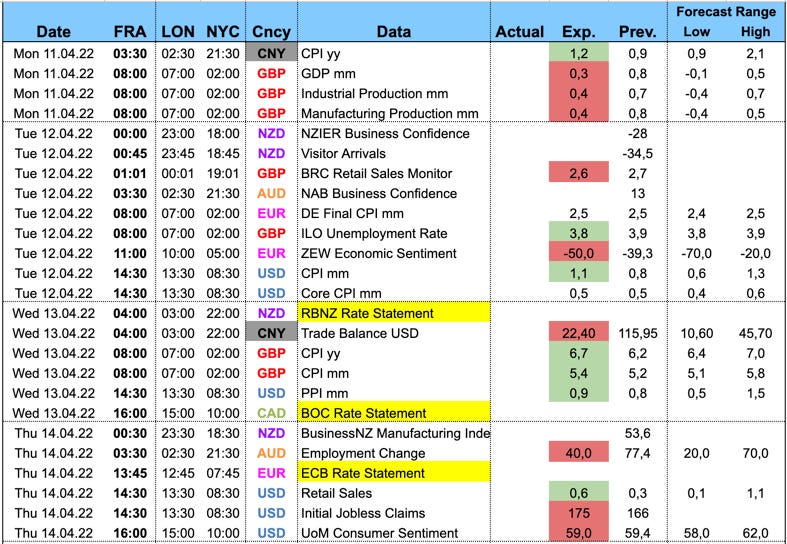

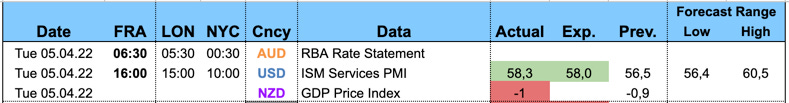

Economic Calendar for next week

Three central banks and a short week due to the Easter holidays.

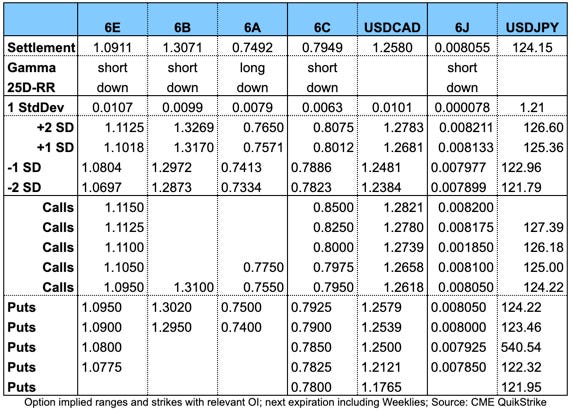

Important levels to watch and look out for in the Majors

Note: the original version of this table was based on Thursday's data and contained an error for 6B (wrong expiration). This version is based on the latest data and the error has been corrected.

Week in Review

Central Banks

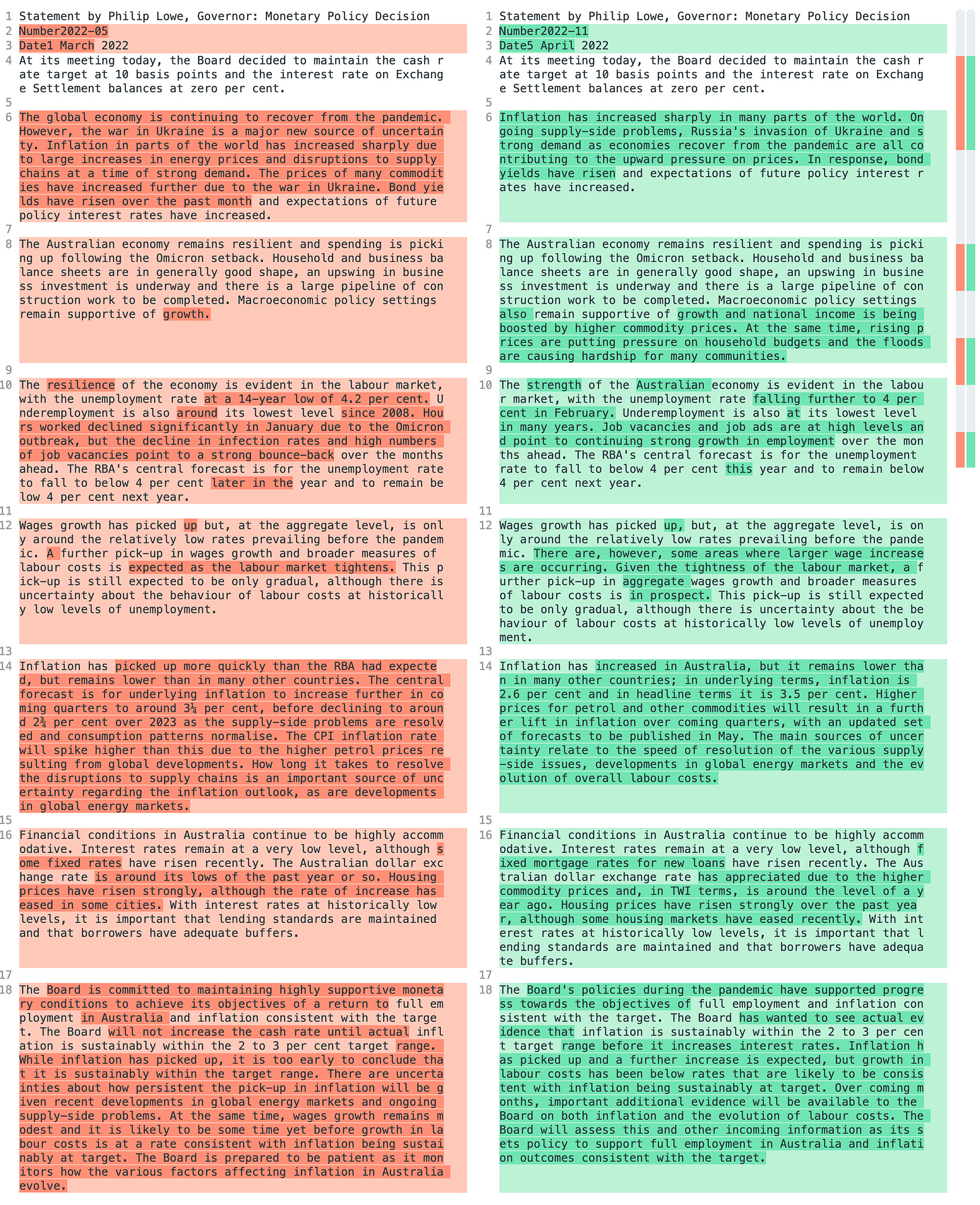

RBA Rate Statement (05.04.22)

This was a hawkish hold as the RBA dropped “The Board is prepared to be patient” and has acknowledged that there are “larger wage increases” in “some areas.” The full statement with differences is shown below. Relevant points:

Acknowledges that expectations of future policy rates have increased

Australian economy resilient and picking up post Omicron, economic outlook is good

Unemployment at multi-year lows, employment to grow further, unemployment rate expected to drop below 4% this year and stay there next year

Wage growth has picked up, larger wage increases in some areas, but overall only gradual and below levels “likely to be consistent” with inflation at target

Inflation has increased but still below other countries, inflation is expected to increase over coming quarters; new forecasts to be published in May; main sources of uncertainty: supply-side issues, energy markets and labour costs

Financial conditions continue to be highly accomodative

FOMC Meeting Minutes (06.04.22)

More hawkish than expected with the speed of the balance sheet runoff discussed ($95 bln/month) near the higher end of the expected range ($60-100 bln/month). USD showed strength after the release. Here are the relevant points and quotes, emphasis mine:

Many participants noted that—with inflation well above the Committee's objective, inflationary risks to the upside, and the federal funds rate well below participants' estimates of its longer-run level—they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting.

“A number” of these chose to go with 25 bps in light of the uncertainty re: Ukraine war, but “many participants” noted 50 bps could be warranted at a future meeting

All participants agreed to start balance sheet runoff at a coming meeting (possibly in May) at a faster pace than last time

$60 bln/month for Treasuries and $35 bln/month for MBS:

Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant.

Active sales of MBS as soon as the balance sheet runoff is “well under way”

Ongoing increases in the FFR are warranted

Participants judged that it would be appropriate to move the stance of monetary policy toward a neutral posture expeditiously. They also noted that, depending on economic and financial developments, a move to a tighter policy stance could be warranted.

Many participants indicated that their business contacts continued to report substantial increases in wages and input prices that were being passed through into higher prices to their customers without any significant decrease in demand.

They are well aware that they've jawboned rates higher:

A number of participants noted that the Committee's previous communications had already contributed to a tightening of financial conditions, as evident in the notable increase in longer-term interest rates over recent months.

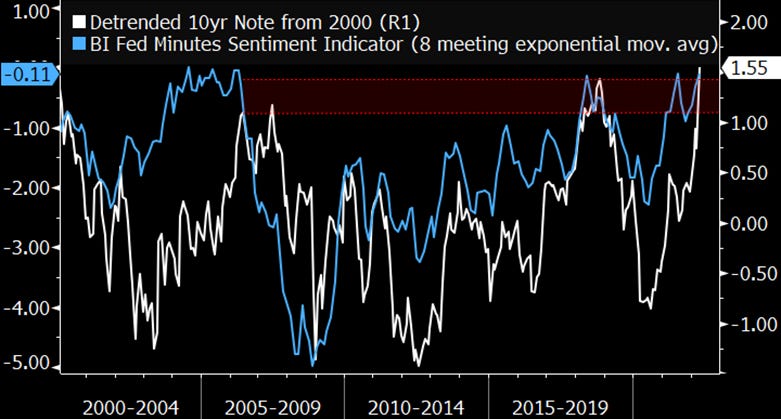

Here's an interesting look at FOMC Minutes sentiment. According to this indicator the Fed is reaching “peak hawkishness”:

ECB Meeting Minutes (07.04.22)

This newsletter is supposed to contain a more or less objective summary of what's going on in the world of macro in order to generate profitable trade ideas. I do not intend to write about things like my personal opinion on how a central bank should operate and what it should do, as I'm utterly unqualified to do so and because it does not provide an edge. But I encourage you to read the meeting minutes in full, because it's really hard to provide a meaningful summary here without giving an opinion. Just take this quote as an example where they clearly say that market-based longer-term inflation expectations are getting out of hand, but in the same paragraph they dismiss it conveniently:

Most indicators [of long-term inflation expectations] were at around 2%, which was seen as good news. It was pointed out that some market-based measures were significantly above 2%. On the one hand, it was suggested that this could be seen as the first sign that long-term inflation expectations were becoming unanchored and needed to be closely monitored, as this could give rise to a wage-price spiral. On the other hand, it was recalled that these measures included risk premia and that correcting for these would still leave genuinely expected inflation at around 2%. In this respect, attention was drawn to the correlation between movements in oil prices and market-based measures of inflation compensation. For instance, a rise in the five-year implied forward inflation-linked swap rate five years ahead might inter alia reflect that investors were looking for hedges in the face of an oil price-driven inflation surge.

Here are some more quotes that should be read in the light of the actual outcome of the meeting, which was initially perceived as hawkish with actually very little to show for:

A large number of members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation. Inflation was projected to be far above target in 2022, with unprecedented upward revisions over the latest two projection rounds. It was projected to remain above target in 2023, with significant upside risks, as also evidenced by the alternative scenarios. (…) In addition, available measures of underlying inflation had moved above 2%, suggesting that the staff projections may be underestimating the persistence of above-target inflation.

While the Russian invasion of Ukraine had increased uncertainty surrounding the macroeconomic outlook, related risks to the inflation outlook were seen as largely one-sided, with experience suggesting that wars tended to be inflationary, often fuelled by increased fiscal spending in conjunction with a loose monetary policy stance. While the war would likely dent economic growth in the short term, annual growth was projected to remain positive even in the severe scenario, pointing to “slowflation” rather than stagflation. The greater persistence of inflation increased the probability of second-round effects via strengthening wage dynamics.

Among those calling for action at the present meeting, some members preferred to set a firm end date for APP net purchases during the summer and not to make that date conditional on unfolding events. This could clear the way for a possible rate rise in the third quarter of this year in the light of the deterioration in the inflation outlook. Preserving optionality on asset purchases was not without cost, especially considering the risk of “falling behind the curve”.

This tells you how dovish they really are: "those calling for action” cannot even agree to set a firm end date on asset purchases.

Other members expressed a preference for adopting a wait-and-see approach at the present meeting in view of the exceptionally high uncertainty created by the Russia-Ukraine war.

So, to sum it up: they see the signs, but they're actively talking themselves out of acting on them. And if they act, the steps they take are tiny. The market perceived the minutes as hawkish, but they aren't.

Confab, Speakers, News

Federal Reserve

Daly (Dove) said on the weekend that the case for a 50 bps hike has grown; on Tuesday: growth will slow but only short-term, does not expect a recession

Brainard (Dove) sent the USD higher:

sees balance sheet reduction as soon as May at a “considerably more rapid” pace than last time

this will tighten financial conditions more than currently priced into the market in terms of policy rates

prepared to take stronger action if warranted by inflation and inflation expectations

watching the yield curve for signs of economic deterioration

Harker (Hawk) reiterated that hikes will be “methodical” and “deliberate”

Barkin (Neutral): FED has “some time” to get to neutral, thinks it takes about 9-10 hikes to get there; housing supply is tight and it will take time until it catches up with demand

Bullard (Hawk): Fed Funds Rate needs to be around 3.5% to combat inflation

Fed is behind the curve even with tightening

will “lean into” 50 bps at next meeting but remains data dependent

getting policy rate to neutral should not impact the economy

Bostic (Hawk) move to neutral policy will be done in a cautious way

Evans (Dove) expects to be at neutral setting by the end of this year or early next year

Bill Dudley (former NY Fed president and a Dove): If Stocks Don’t Fall, the Fed Needs to Force Them (emphasis mine):

Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn’t happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower.

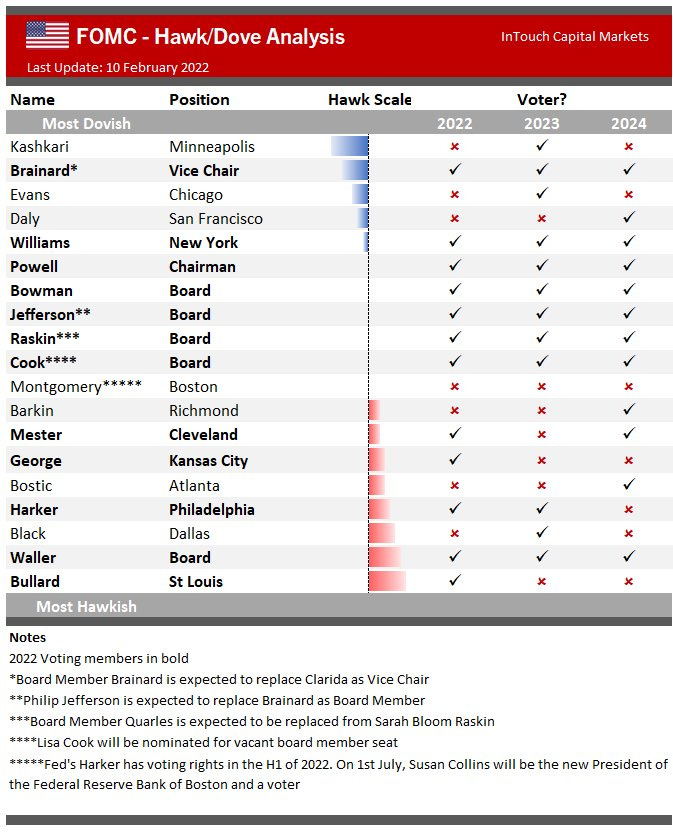

Here's your FOMC Hawks/Doves cheatsheet:

European Central Bank

Schnabel (Neutral-hawkish) said the ECB will hike rates, but did not provide a timeframe

Knot (Hawk) urged rate hikes (“gradual but timely” normalization), inflation not entirely due to supply shock but also due to demand recovering quicker than expected

Vasle (Neutral-hawkish) said NIRP could end by the end of this year, QE could end in July, sees strong growth and considers the ECB inflation outlook realistic

Lane (Dove) expects inflation to come down “a lot” next year, sees a slowdown in the economy but no recession, said it's important not to overreact to current inflation

Panetta (Dove) warned policy action might crash the economy

expects very low growth rates this year, war could bring them into negative territory

fiscal policy should be used to deal with the crisis rather than monetary policy

Wunsch (Neutral-hawkish) said there had been no discussions within the ECB to raise rates; expects policy rate to be at 0% at the end of the year (“no-brainer"), terminal rate around 1.5-2%

Nagel (Hawk) expects interest rates for bank deposits to rise soon, ECB agreed to take a decision in June

Stournas (Dove): low probability of stagflation and recession

Bank of England

Cunliffe (Neutral) said he's not convinced the BOE needs to lean constantly and heavily against an embedding inflationary mindset

does not see psychology of persistently higher inflation emerging

emphasized risks to both sides

does not think monetary policy can do much to offset external price pressures

Reserve Bank of Australia

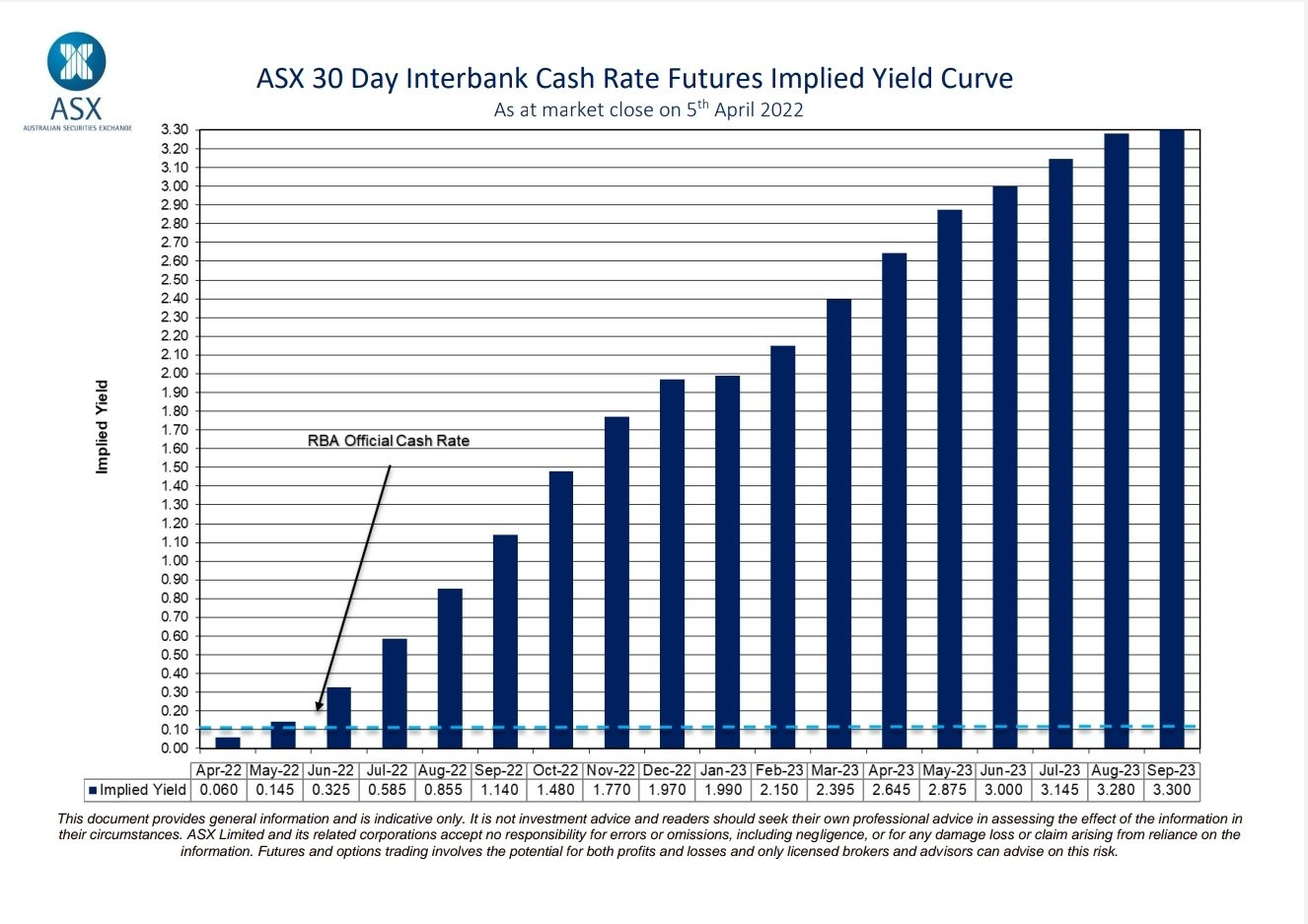

Hawkish hold as the bank dropped “The Board is prepared to be patient” from their statement

Bullock expects the RBA's inflation forecasts to be revised upwards

Kent expects inflation to be pushed higher

CAMA RBA Shadow Board: confidence that cash rate should remain at 10 bps in six months dropped from 51% to 33%

ANZ and Macquarie brought forward their rate hike calls in response to the RBA statement. ANZ: 15 bps in June, 25 bps in July, August and November. Macquarie: first hike in June (from August).

Citi thinks June and July meetings are live, expect a 15 bps hike (reason: RBA rate statement says “over coming months” new evidence will be available re: inflation and wage growth)

Westpac brought forward liftoff estimate from August to June after the rate statement; expect: 15 bps in June and 25 bps at every meeting (1.25% at the end of the year)

RBA Financial Stability Review:

borrowers should prepare for higher interest rates

high household debt to income ratio increases sensitivity to higher rates

many households have built substantial buffers on mortgages

global asset markets are vulnerable to larger-than-expected rate increases

Reserve Bank of New Zealand

BNZ adjusted its May rate-hike call from 25 bps to 50 bps

ANZ expects a 50 bps hike next week and again in May, then 25 bps at each meeting until peak of 3.5% in May 2023

Bank of Canada

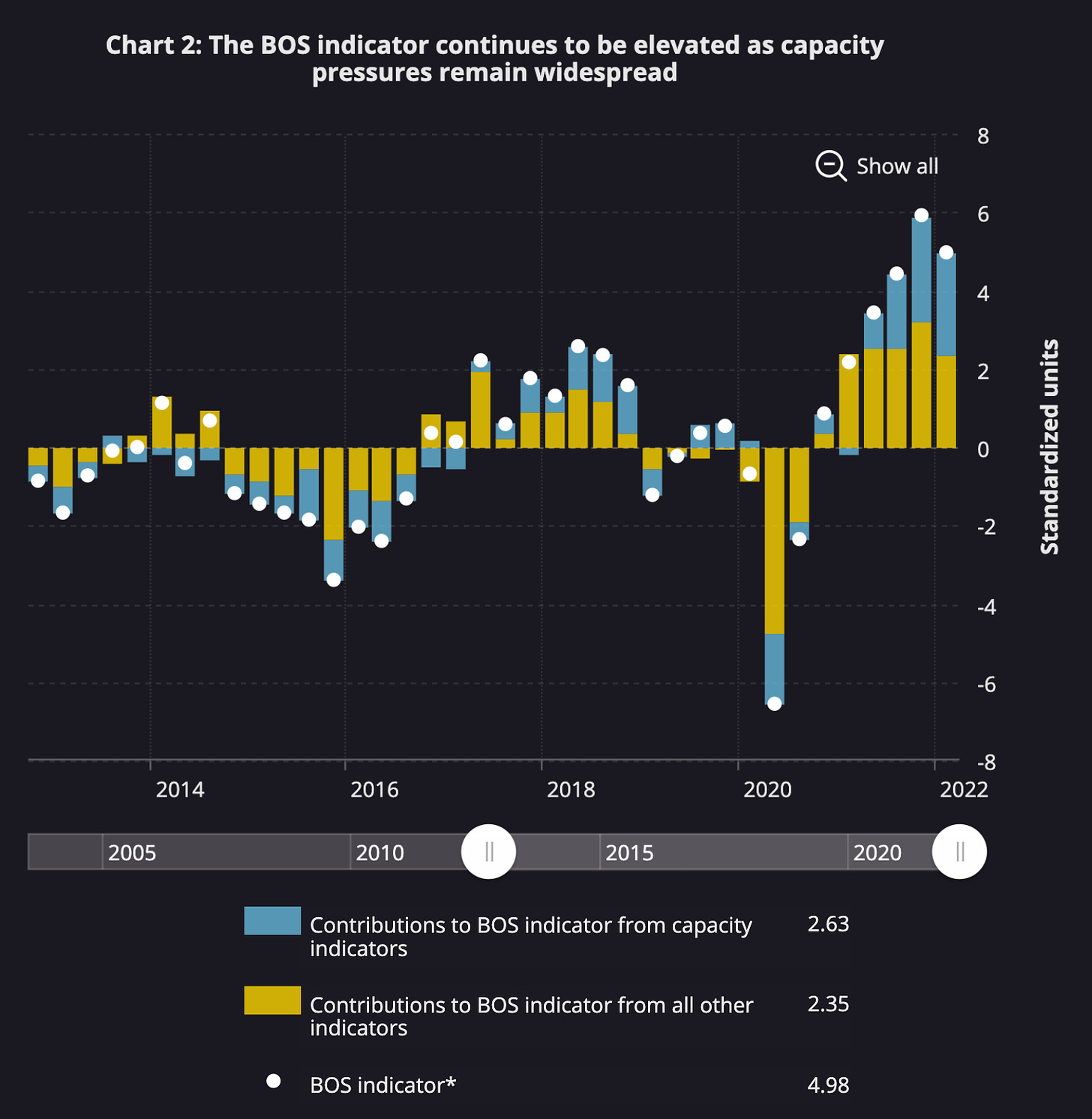

RBC upgraded their forecast for the next BOC meeting from 25 bps to 50 bps after the release of the BOC Business Outlook Survey

Bank of Japan

Kuroda: BOJ will keep powerful monetary easing to support economy recovering from virus-induced hit

reaffirmed commitment to buy unlimited 10y JGBs not just as a last ressort

policy would be less effective if 10s moved about 25 bps

Noguchi said it was “most important” to maintain current monetary easing

prefers a weaker yen because benefits to the economy outweigh the drawbacks

inflation excluding energy in Japan remains low; rising energy costs might push up inflation, but it will take “significant time” until target is reached

Japanese Core CPI to accelerate to around 2% from April

Uchida defended the current policy, low interest rates reflect low growth and subdued inflation; excessive decline in very long yields would negatively impact the economy

Senior BOJ Official expects CPI to hover around 2% from April

Economic Data

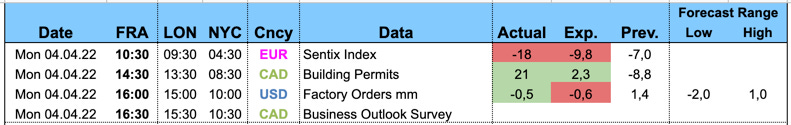

Monday, 04.04.22

Eurozone Sentix Index came in below the forecast, EUR was weaker throughout the day

Canadian Building Permits above expectations, no change from CAD. The Business Outlook Survey Indicator declined from the record high in Q4/22, and the Canadian Dollar was weaker after the release. RBC upgraded their expectation from a 25 bps hike to a 50 bps hike at the next meeting in light of the report. Main points of the survey:

capacity pressures (reported by 81% of firms, up from 78%)

inflation pressures: firms expect significant increases in input and output prices, wage growth

44% of firms see inflation at 2% in two years (prior 51%)

US Factory Orders broadly in line with the forecast, no reaction from USD.

Tuesday, 05.04.22

AUD was sharply higher after the hawkish hold from the RBA

US ISM Services PMI beat expectations with a headline number of 58.3. USD was very strong immediately after the release (and before hawkish Fedspeak). The report was almost entirely bullish: New Orders are up, Employment is up, Prices are up. The main points sound familiar (emphasis mine):

There was an uptick in business activity in March, but respondents have indicated that they continue to be impacted by capacity constraints, logistical challenges and inflation. Labor shortages have eased slightly, as COVID-19 cases have declined and public-health restrictions have been relaxed. Geopolitical concerns — particularly the Russia/Ukraine war, which has impacted material costs, most notably fuel and chemical prices — have created uncertainty for many businesses.

Global Dairy Prices came in weaker than previously. NZD was lower, but the impact of the data was overshadowed by the action in the USD.

Wednesday, 06.04.22

The Caixin Services PMI came in at 42.0, well below its forecast around 49.2 and deep in recession territory. There was barely an immediate reaction from AUD, but it traded lower throughout the day.

German Factory Orders printed below the forecast range, and Eurozone Producer Prices were below expectations as well. The Euro was briefly weak on both data points, but it outperformed throughout the day.

Canadian Ivey PMI was well above consensus at 74.2, but the currency did not show strength.

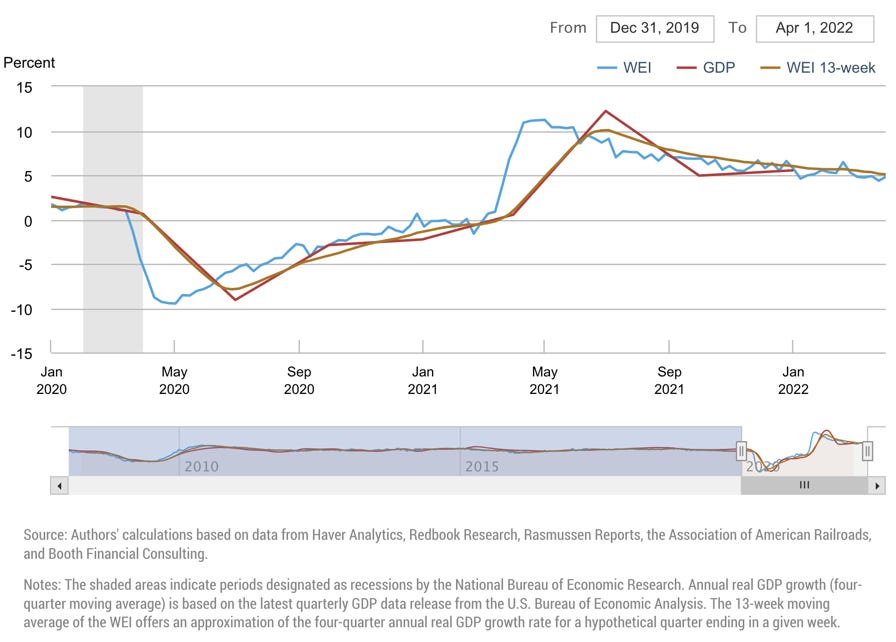

Thursday, 07.04.22

AIG Services Index was 56.2, well below the previous 60.0. Aussie Trade Balance was below consensus as well. AUD was significantly weaker.

German Industrial Production above forecast, Eurozone Retail Sales below; EUR traded weaker. The ECB Minutes were perceived hawkish (see the summary above), EUR was up sharply.

US Initial Claims beat the consensus estimate, but there was no reaction from the Dollar.

Friday, 08.04.22

The Canadian Labour Market Report was mixed with the Employment change coming weaker while the Unemployment Rate dropped to 5.3% (below the consensus of 5.4% and the previous 5.5%). CAD was mixed with a stronger bias.

Market Analysis

Growth and Inflation

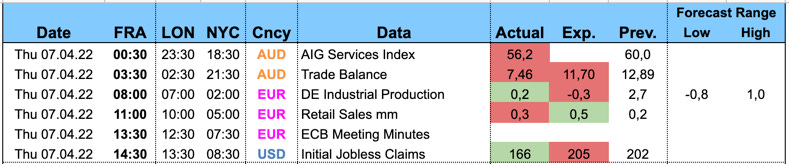

The Atlanta Fed GDPNow currently stands at 1.1%.

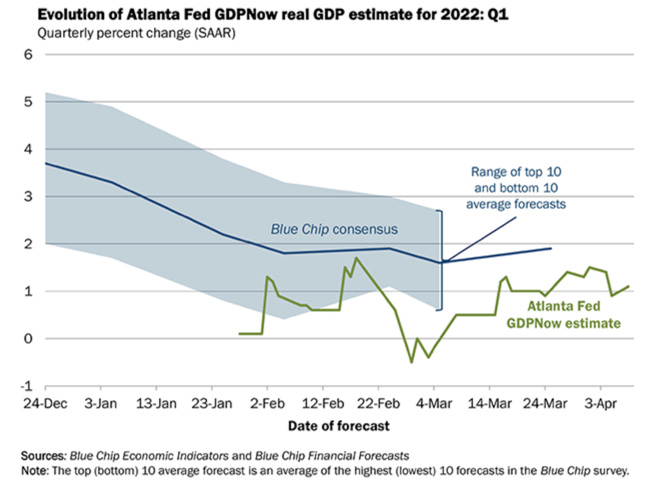

The four-quarter GDP growth is estimated at 4.80% according the the Weekly Economic Index:

The Citi Economic Surprise Indexes show a weakening EUR and AUD while the USD and GBP are staying afloat:

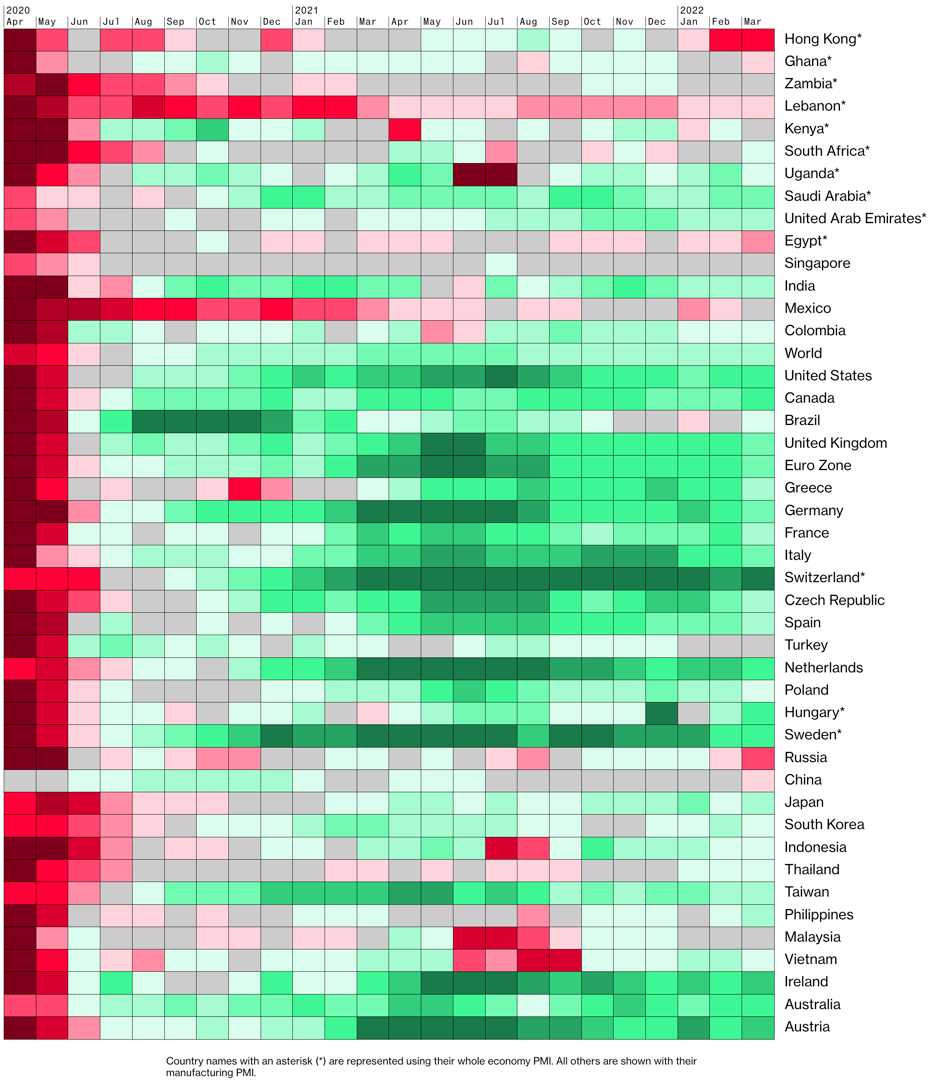

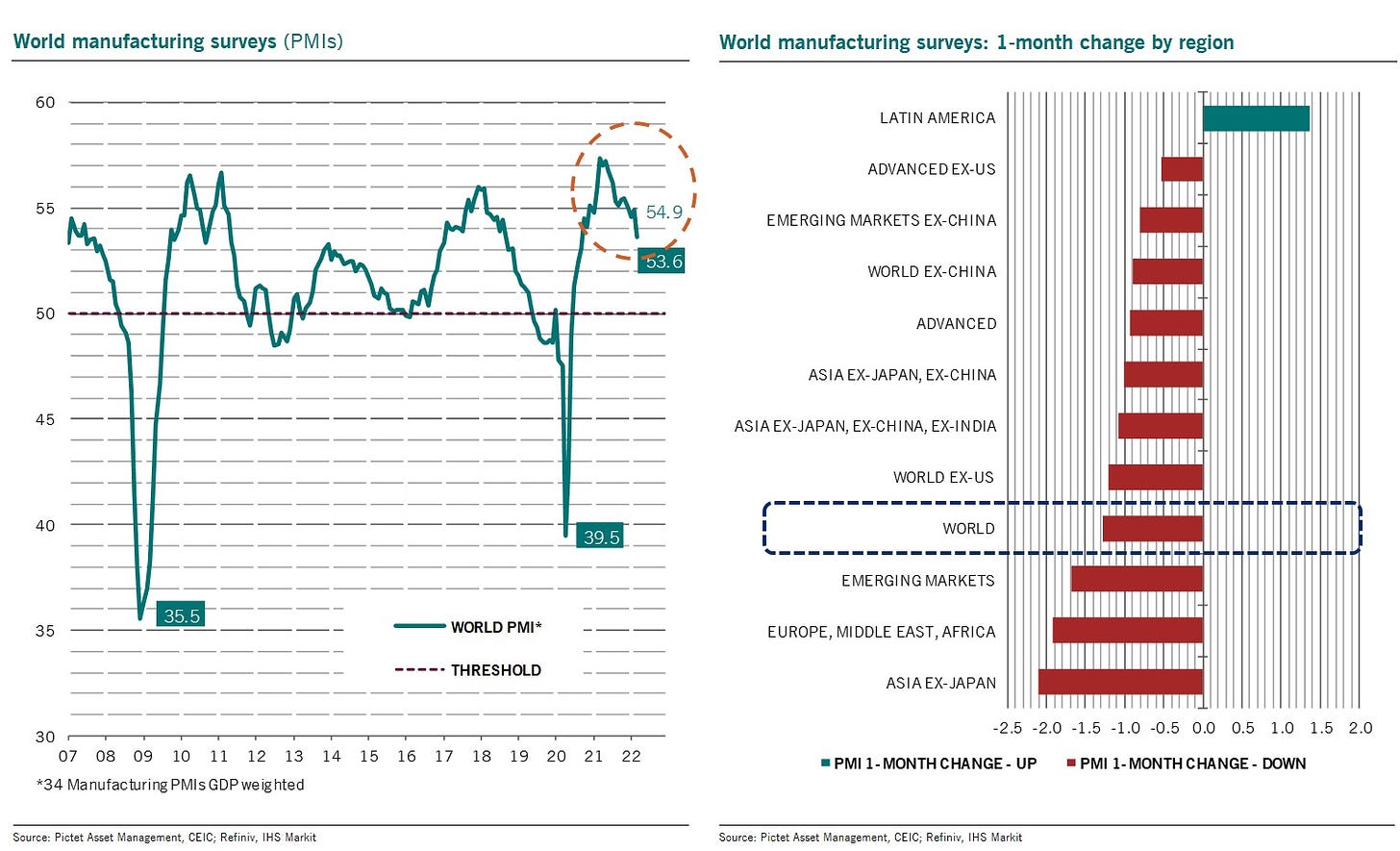

International PMIs:

Stronger CAD, CHF, JPY

Weaker EUR, GBP

Hong Kong is really bad, China is weaker, South Korea is weaker as well. This does not look great for the global economy.

The 5y5y Forward Inflation Expectation Swap stands at 2.41%, the highest since somewhere mid-2014. It hasn't broken out of its recent range, though.

The Inflations Expectations ETF hasn't changed much and has not moved higher:

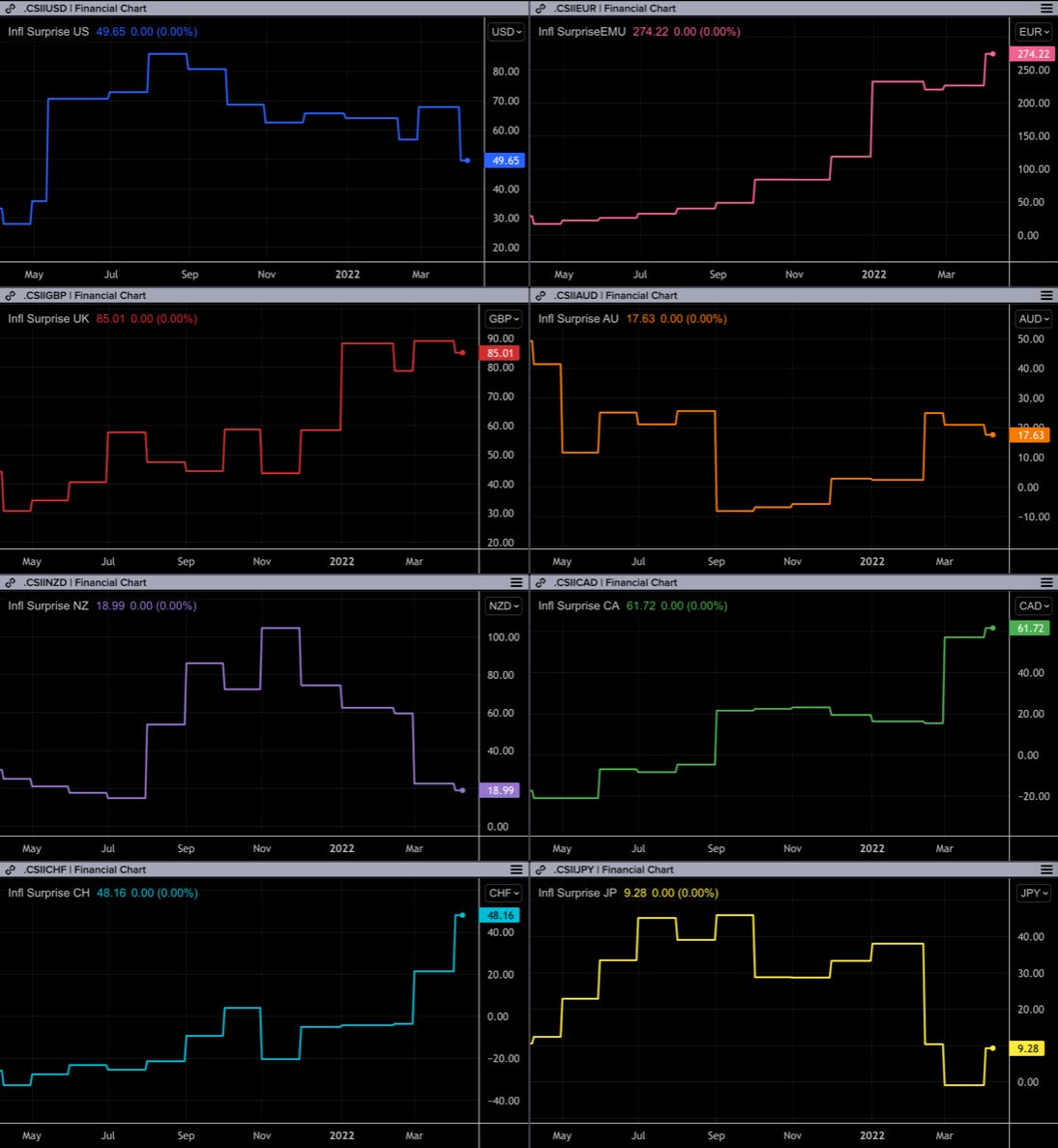

Citi Inflation Surprise Indexes are lower for USD, AUD and NZD while up for the EUR, CAD, CHF and JPY:

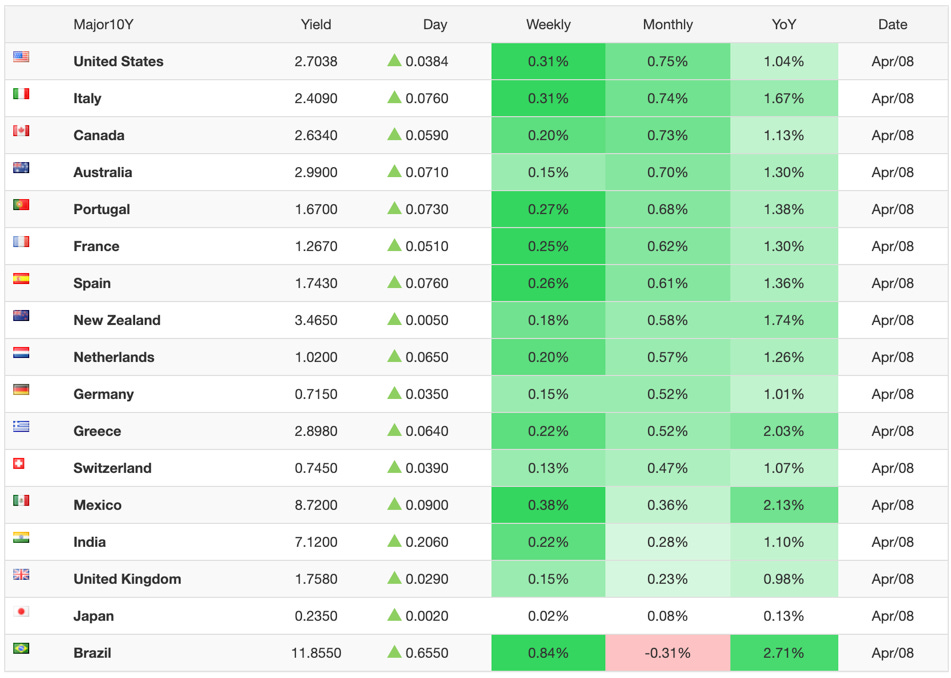

Yields

I'm looking at the chart and table below: US yields seem to be the strongest, German, Canadian and Swiss more or less flat. UK put in a fresh high, NZ looks strong as well (especially the 2s), Japanese yields are weak and Chinese trending lower. On a higher timeframe all of the G8 have broken resistances to the upside and/or are around major decision areas.

US 2s10s have rebounded sharply from below zero. The spread is flattening in Aussie yields, pricing the steeper hiking path of the RBA after this week's rate statement.

Central Banks

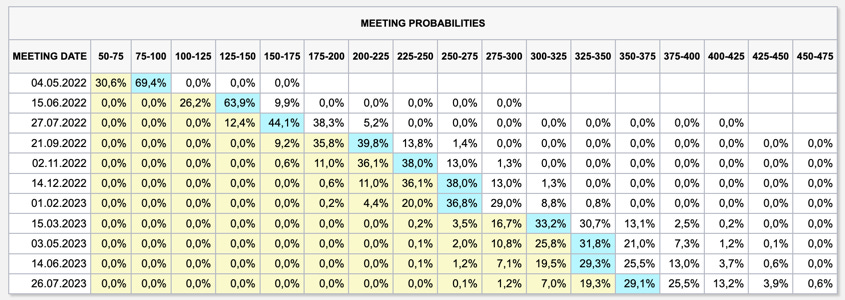

Target rate probabilities for the next FOMC meetings is interesting this week:

80.5% chance of a 50 bps hike at the next meeting (last week: 69.4%), followed by a 58.7% chance of another 50 bps hike at the meeting after that (before: pricing for a 25 bps hike)

Pricing for December 2022 remains at 250-275 bps

The far-out meeting expectations have cooled a bit: July 2023 now pricing 325-350 bps target rate (last week: 350-375)

The market is pricing in more and more front-loading.

Similar picture from the direct look at STIRs:

still pricing 7-8 more hikes this year and 2-3 hikes next year

2-5 cuts in 2023

Sectors and Flows

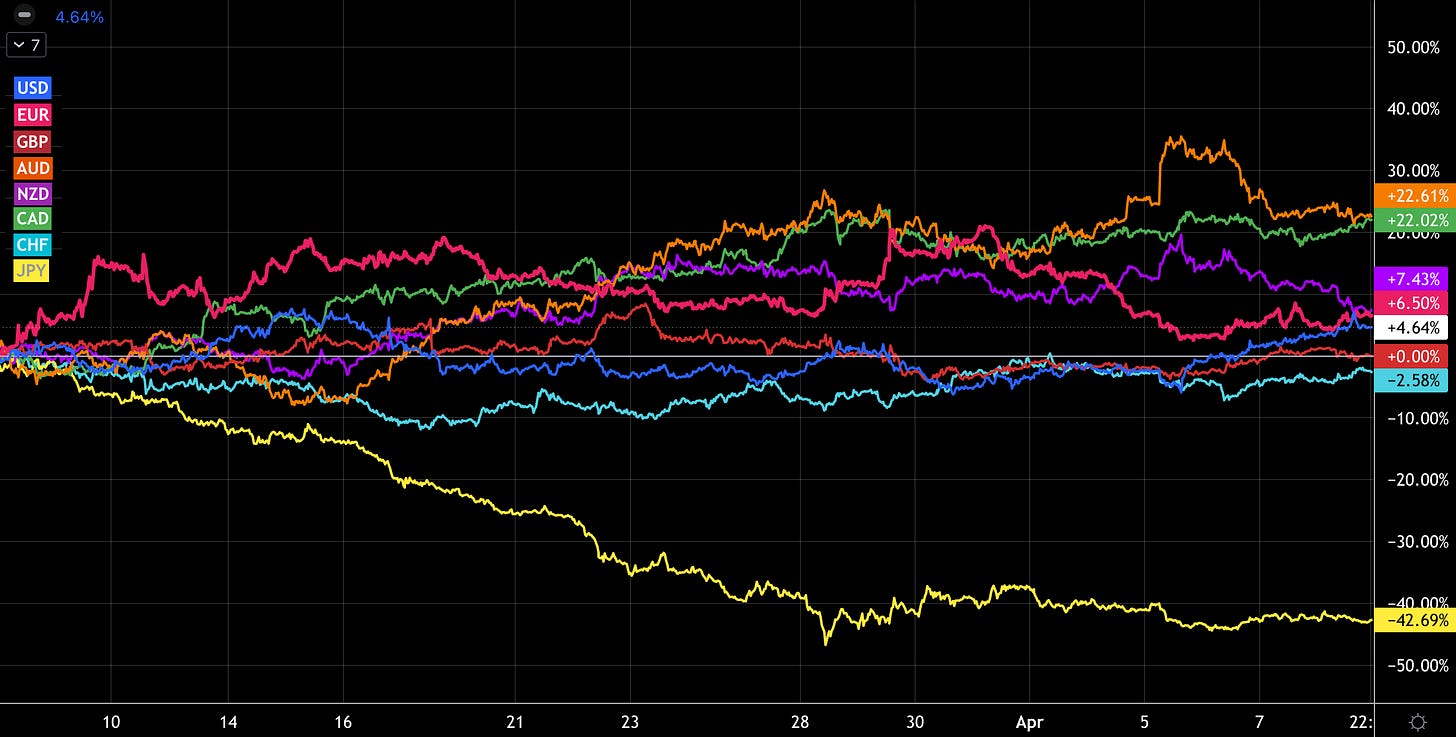

Currency strengths show a very weak Yen (but not getting much weaker anymore), AUD and CAD outperforming and NZD continuing to lose strength:

Stock market: outperformance in Energy and Metals/Mining continues to level off, Utilities (XLU) continue to perform, other Defensives like Health Care (XLV), Staples (XLP) are starting to catch up. Growth underperforms value (VUG vs. VTV). Semiconductor weakness is noteworthy. Overall very defensive sector performance (and getting even more defensive):

Similar data, only with numbers:

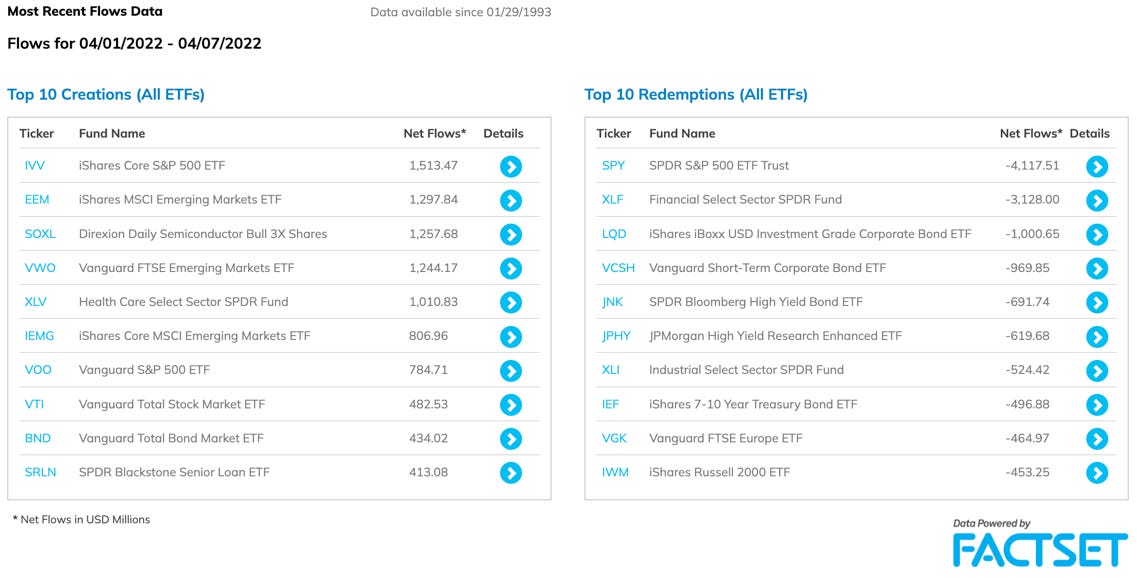

Money is flowing out of SPY, Financials, IG Bonds, Corporates and Junk. Doesn't look like a bull market:

Similar picture from different source below. Interestingly, Energy already sees some outflows:

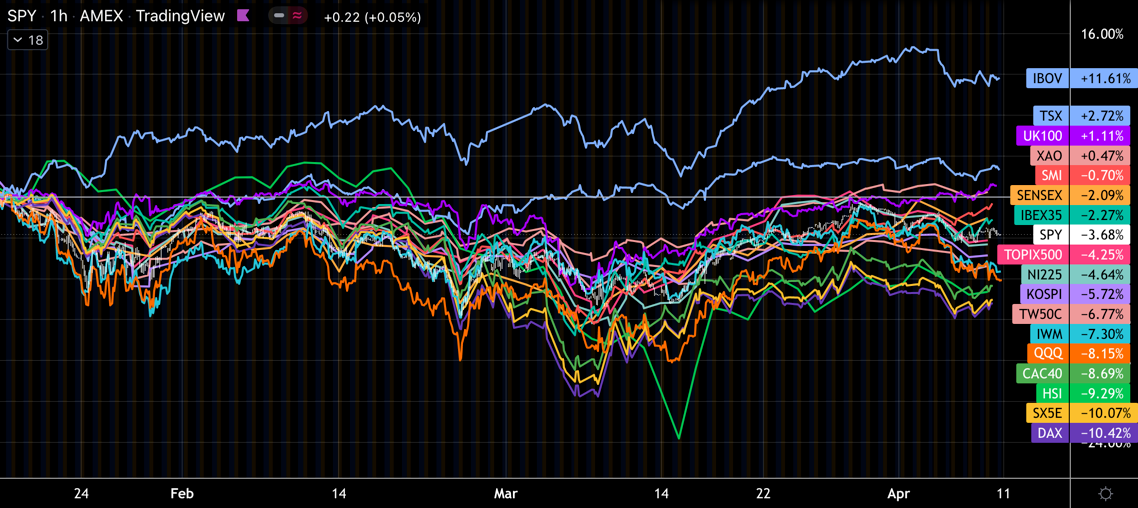

International stock markets haven't seen much change from a relative strength perspective. Commodity-heavy stock markets are still outperforming.

Sentiment and Positioning

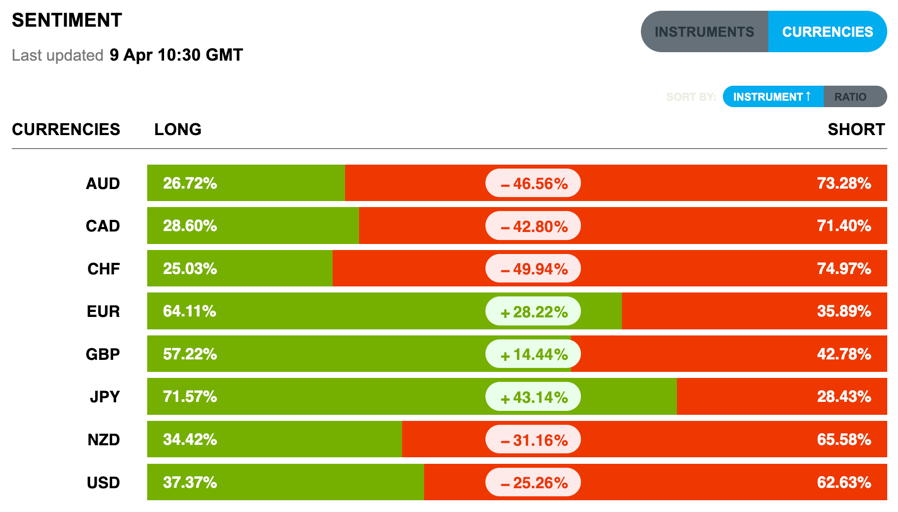

Similar to last week, sentiment is pretty clear: it's bearish AUD, CAD, CHF, NZD, USD, and it's bullish EUR, GBP and JPY. This means:

Long AUD, CAD, CHF, NZD, USD

Short EUR, GBP, JPY

Same here from a different source: bullish sentiment for EURUSD, EURCHF; bearish for every JPY pair (i.e. bullish JPY). Some interesting observations:

Sentiment is bullish EURGBP and EURCHF. The latter I understand (short EURCHF), but I'd be hesitant with the same call on EURGBP.

Sentiment on Gold an Silver is still very bullish, especially Silver, i.e. short GC and SI

Bearish Sentiment in the FTSE100 should support this index (see also relative stock market performance above).

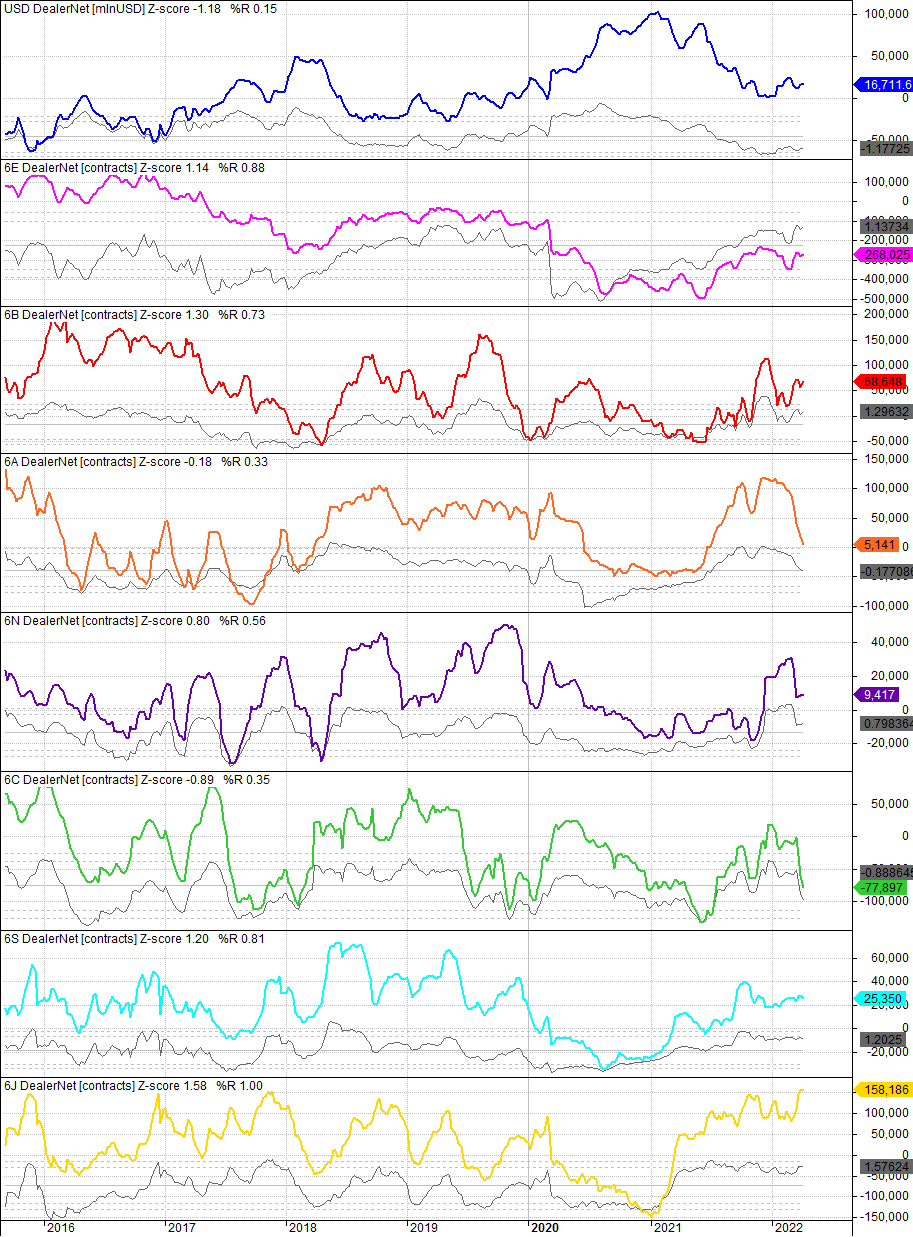

Commitment of Traders data for the G8 currencies shows that JPY positioning got even more stretched this week (yellow graph, bottom of the following chart). Dealers are long 6J, so everyone else is short. COT data is horrible for timing, but it's worth to keep it in mind.

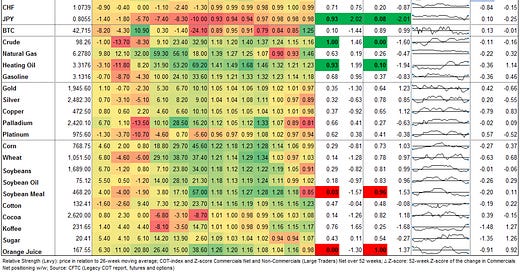

COT Positioning in other futures below. Noteworthy: Commercials are positioned relatively long in equity futures and in Ultra 10y T-Notes and T-Bonds (net positions are at 2.68 standard deviations). Positioning in Crude Oil and Heating Oil is supportive of higher prices. The Commercial net position in AUD and CAD decreased significantly (by 2.35 and 1.54 standard deviations), which reflects a distribution of the street's short position in these currencies.

Market Risks

The discrepancy between VIX and MOVE is still there and continues to be a warning sign:

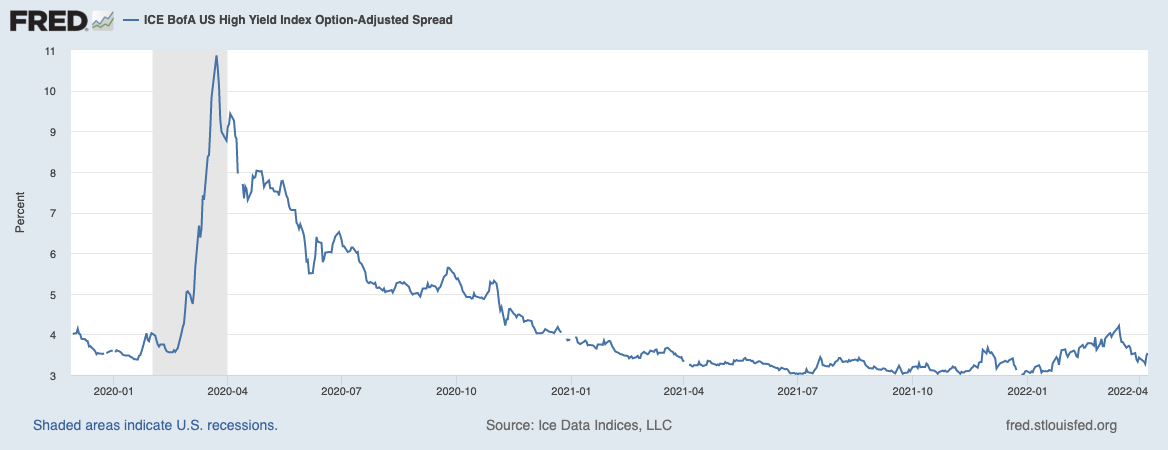

High yield spreads moved down nicely during the recent stock market rally, but they're picking up again:

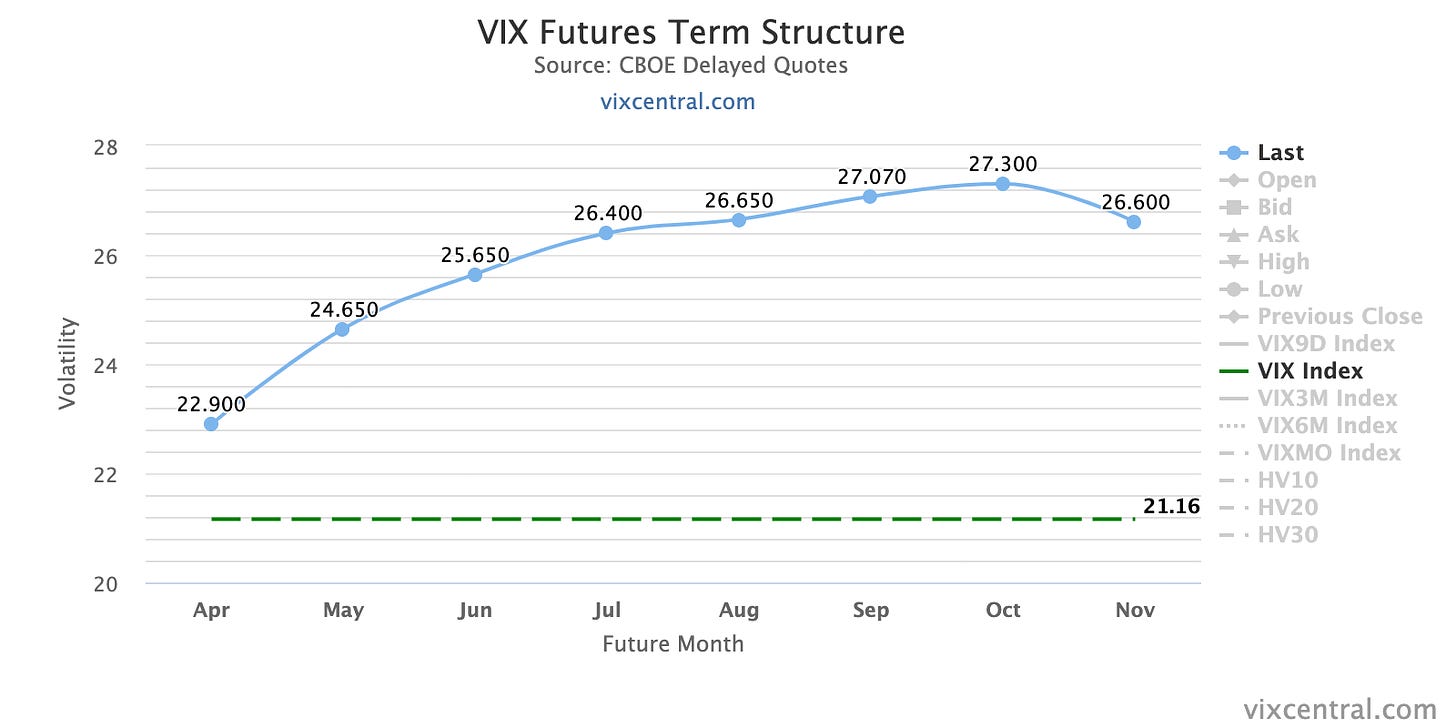

The VIX term structure still bending down far out, but overall not looking too upset. Spot VIX moved closer to VX1 with only about ten days remaining.

The CNN Fear and Greed Index is neutral:

Various

25-delta risk reversals are pricing the EUR and GBP up:

Other Stuff I've been looking at

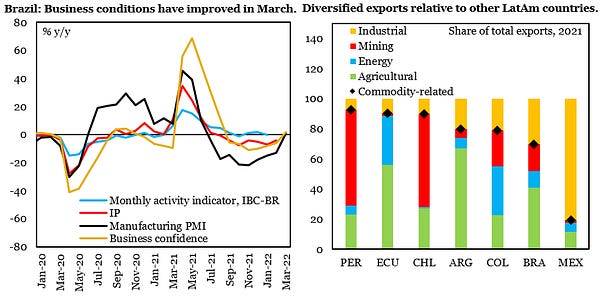

Global Manufacturing PMIs have been falling, Latin America being the only exception:

… which should be bullish for the Brazilian Real:

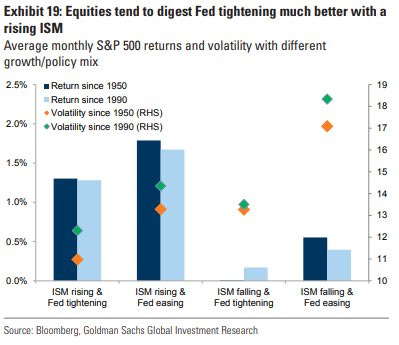

… but less good for stocks when the Fed is hiking interest rates:

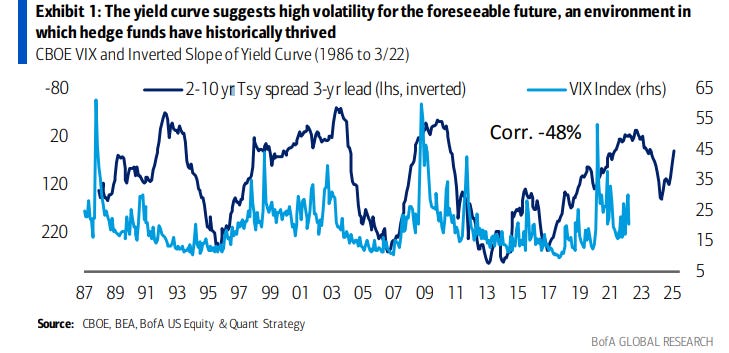

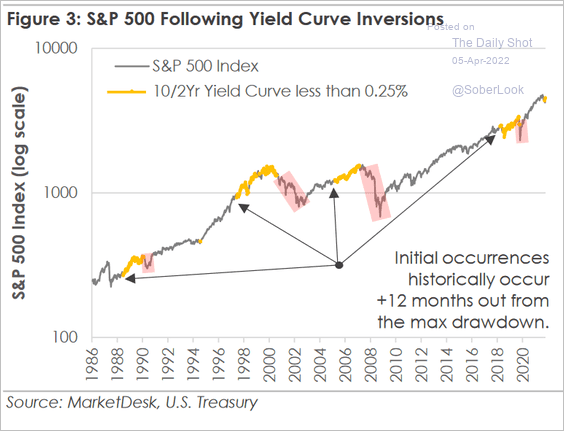

The slope of the yield curve suggests a higher VIX and thus higher volatility in the stock market…

… which fits with what the SPX actually does (note the corrections marked red):

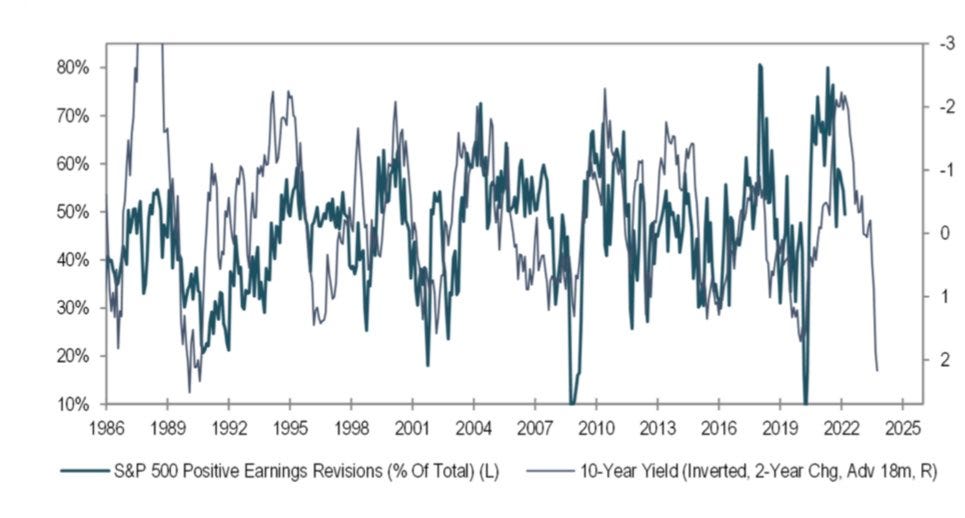

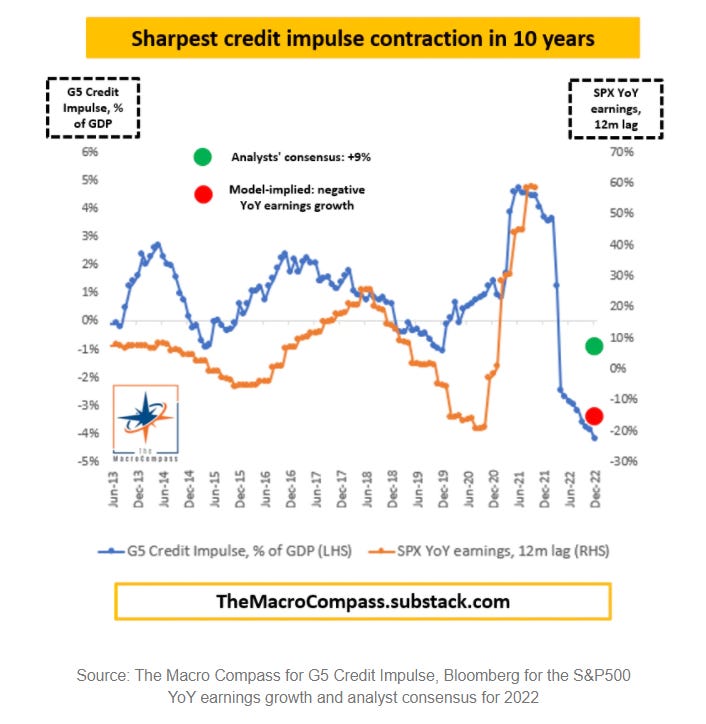

Higher rates are leading earnings revisions lower:

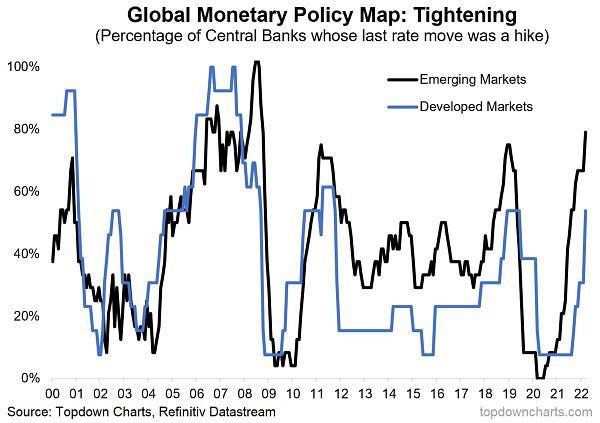

Here's the what the central bank cycle is looking like globally:

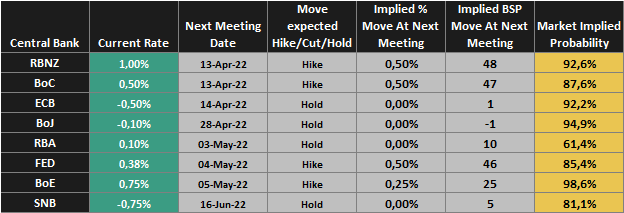

Current pricing of upcoming G8 central bank meetings:

… and the expected RBA policy path after this week's rate statement:

The Global Credit Impulse is contracting:

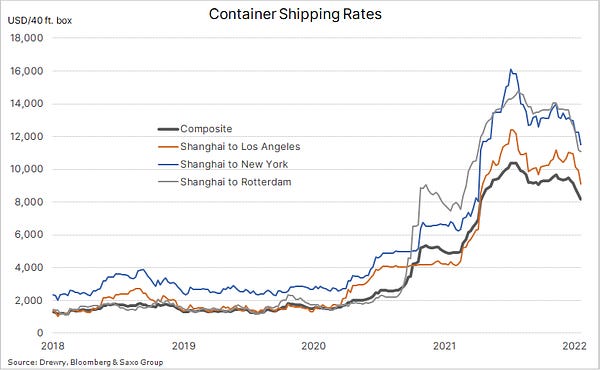

Shipping rates are falling despite Shanghai being locked down:

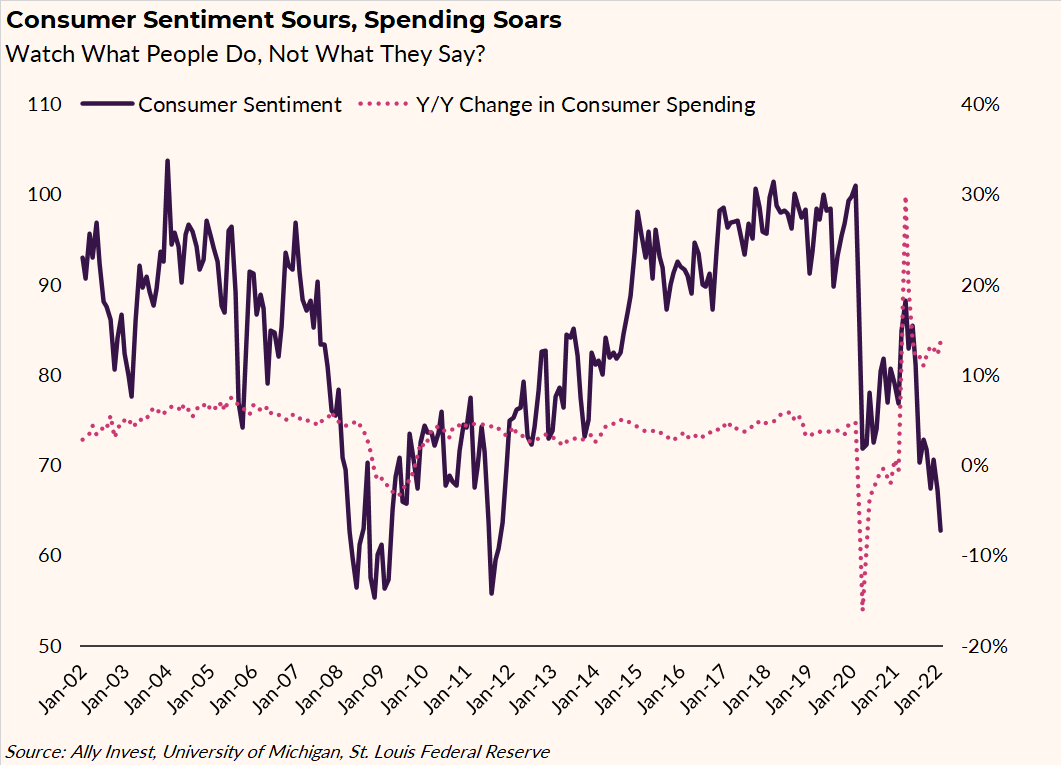

There's an interesting divergence between Consumer Sentiment and Consumer Spending:

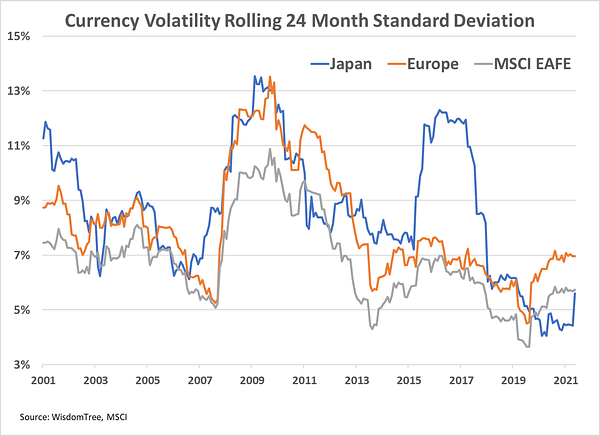

Interesting take on JPY volatility and how it compares to previous regimes (spoiler: it's actually pretty low at the moment):

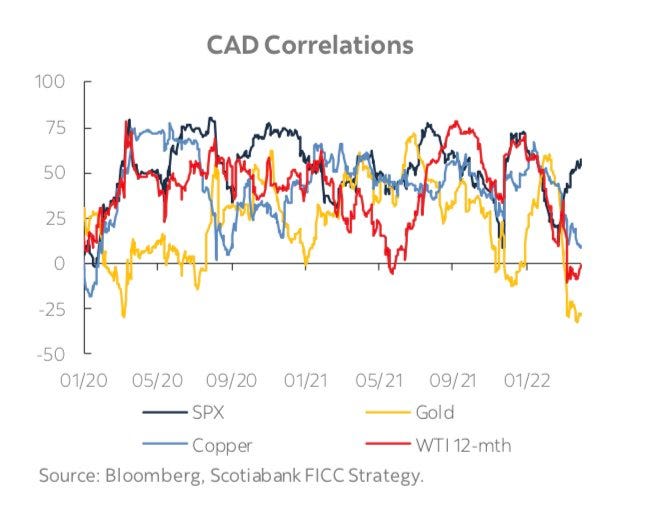

CAD correlates with SPX. I wonder why they didn't include Crude Oil, though.