State of play in FX and Macro (13/2022)

Welcome to the first edition of FX & Macro Weekly. This is a newsletter that I write first and foremost to myself to prepare for the trading week ahead. It has become a bit longer than I anticipated, but I hope you will find it useful.

The basic structure is to put the most important and summary stuff on top, so if you want to dive deeper you can just go on reading.

After the summary section I will first review the SNB statement from Thursday and then summarize the most important talking points from central bankers of the week. Next, I will go through last week's data releases and see how each currency reacted to its data.

The next section is an extensive market analysis to figure out how to approach FX markets in the week ahead. That's the heart of the whole thing.

The final part is a collection of interesting charts I've found while reading through Bloomberg, Twitter, etc.. They are not part of the main analysis, but they do influence my thinking.

If you like this kind of content, please consider subscribing and sharing it.

Now, let's get this show on the road…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (Events, Confab, Speakers, News)

Economic Data (check out Thursday's PMI releases at least, they're worth a read)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Europe switches to Summer Time on Sunday and catches up with the US. The time difference FRA-NYC will be 6 hours again (finally!).

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

SNB Policy Statement (Thursday)

Overall: nothing really new. They are now taking into account the inflation differentials when deciding when to intervene in the FX market and they still see the Franc as “highly valued” even after its outperformance during the initial phase of the Ukraine invasion. I guess that means that they actually want the Franc to be a bit higher to dampen inflation somewhat. Here's my summary and the statement:

Maintains its policy rate at -0.75% as expected

"The Swiss franc remains highly valued" (no change from previous statement), will "intervene as necessary" (unchanged), and will take the inflation differentials into consideration (that's new)

Revised their inflation forecast upwards to 2.1% for 2022 from around 1.5%

Risks in the real estate and mortgage markets have increased further; will monitor developments closely; has reactivated the sectoral countercyclical capital buffer in January

Jordan said during the press conference that they only intervene when necessary, that they look at all currencies and inflation differentials when deciding on interventions and that he can't give a pain threshold for the CHF exchange rate (which kind of implies that there is one).

Confab, Speakers, News

Federal Reserve

Powell out-hawked himself: you need price stability to have a strong labour market (i.e. inflation is all he cares about at the moment), and he's open to 50 bps hikes

Bostic (Hawk) sees six hikes this year, estimates neutral to be around 2.25%

Daly (Dove) does not think inflation will be back at 2% by the end of the year, sees inflation expectations well anchored, Fed might need to go over neutral, open to 50 bps hike in May, neutral rate around 2.5%, “we are prepared to do whatever it takes to get price stability”

Mester (Hawk) wants to front-load hikes, thinks they need some 50 bps hikes (plural!), Fed needs to reduce excess demand (i.e. demand destruction), inflation is a bigger concern than growth, sees that some wage increases are outstripping productivity growth (read: wage-price spiral)

Bullard (Hawk) says the Fed needs to reduce the balance sheet “now”, does not think the run-up in Crude will cause a recession

Kashkari (Dove) reckons with seven rate hikes this year, cautions that there's a risk of overdoing it, expects neutral to be around 2%

Evans (Neutral) is comfortable with 25 bps hikes but open to 50 bps, supports reducing the balance sheet in a “pretty brisk pace”

Williams (Dove) supports a 50 bps hike if it's appropriate, financial markets have “adjusted expectations with minimal disruption” (!!!), inflation is at the forefront of his thinking

Morgan Stanley: forecasts two 50 bps hikes in May and June, then 25 bps at every meeting in 2022, peak Fed Funds Rate at 3%, start of QT in May

Bank of America: expects two 50 bps hikes in June and July, sees risks these are being pulled forward to May and June, peak FFR at 3-3.25% in May 2023

Goldman Sachs: seven hikes in 2022 and up to five in 2023

Citi: four 50 bps hikes in May, June, July and September, FFR at 275 bps by the end of this year

European Central Bank

Lagarde: ECB and FED will be out of sync (i.e. the ECB remains dovish while the FED hikes)

Nagel (Hawk): emphasised risks of tightening too late, said low inflation was unlikely to return

De Guindos (neutral-hawkish) can't dismiss the possibility of stagflation ahead

Elderson (neutral) expects inflation to remain high even if oil prices stop rising, does not exclude rate hike this year

Centeno (neutral-dovish) says that a recession is not in the ECB's scenario (!), normalization of policy will be done gradually and proportionally at the end of this year

Schnabel (neutral-hawkish): if there's a “deep recession”, the ECB could extend QE; otherwise, i.e. if there's just a shallow recession, end bond purchases in Q3 and then raise rates depending on how inflation develops

Mueller (Hawk) would only extend APP if there was a “dramatic shift” in the inflation outlook

Here's your ECB Hawks & Doves cheatsheet:

Bank of England

Morgan Stanley expects the BOE won't be able to tighten as much as the market is currently pricing, which is 5 hikes this year, because of the cost-of-living crisis with real disposable incomes going down; MS is bearish USD

The BOE said that margin calls on commodity derivatives had risen to an all-time high (!)

Bank of Australia

Lowe said the RBA will not respond until they see evidence of pervasive price pressures, and he wants to see rising labour costs

Bank of Canada

Kozicki said they are actively thinking about pace and size of rate hikes (i.e. expect a 50 bps hike)

Bank of Japan

Kuroda expects CPI to rise, but only short-term, it's premature to talk about a change away from its easing policy, BOJ will continue to buy ETFs as needed; powerful easing will be maintained, inflation may accelerate to 2% but that's mainly driven by higher energy costs

Kataoka sees risks to the economy skewed to the downside because of commodity prices, sees no prospect of the BOJ tightening policy because CPI won't achieve its 2% target sustainably

Economic Data

Monday, 21.03.22

Weak Credit Card Spending pulled the NZD lower, weak Consumer Sentiment did not have much of an impact

German PPI m/m disappointed (y/y was 25.9, which is obviously crazy, but it still disappointed as well), but EUR was initially stronger and sold off later during the day

USD strengthened from around 18:00 on hawkish Powell confab

Tuesday, 22.03.22

EUR saw weakness after Current Account below expectations

Strong Richmond Manufacturing brought some short-lived strength for the USD

Wednesday, 23.03.22

BOJ Core CPI came in above expectations, JPY was immediately weaker, but saw some strength during the London session until the NY open

CPI in GB surprised to the upside, but the Pound was subsequently weaker. The market seems to believe the BOE will have to stay behind the curve re: inflation because of low growth and a the looming cost-of-living crisis the UK is running into, i.e. demand destruction.

US New Home Sales disappointed with a print below the forecast range; USD saw some immediate weakness and was lower into the fixing. Rising mortgage rates taking their toll.

EU Consumer Confidence came in worse than expected, EUR stronger after the release

Aussie PMIs below the the previous month's prints lead to a bit of AUD weakness. The report says that wage pressure is clearly growing, something the RBA is looking at:

Higher employment levels in March had been a positive sign, though firms also widely reported higher wages.

Thursday, 24.03.22

Lots of data that tells us a ton about the state of play.

BOJ Meeting Minutes were stale and did not contain any relevant news. the Japanese Manufacturing PMI came in weaker than forecast.

The SNB Monetary Policy Statement has been covered above. A bit of erratic movement from CHF, a bit of strength throughout the day.

Eurozone PMIs beat on their headline numbers, UK PMIs were mixed with the Services PMI above expectations and the Manufacturing PMI coming in below. But when you read the actual reports, it gets really bad. Here are some excerpts from the Eurozone PMI report (emphasis is mine):

Firms' costs and average prices charged (...) rose at unprecedented rates as commodity prices surged higher and supply chain delays hit the highest since last November. Falling exports meanwhile led to a renewed cooling of demand and business confidence sank to the lowest for nearly one-and-a-half years (...).

Average input prices across both manufacturing and services rose at a rate far in excess of any previous increase since (...) 1998.

Expectations of output in the coming year fell to the lowest since November 2020 in the services sector, and down even further in manufacturing to the lowest since May 2020 (!!!)

Backlogs of work, another indicator of future business activity, meanwhile rose at the slowest rate for a year.

"While the headline indicators on current output from the PMI survey may have beaten expectations, the detail reveals a significantly darker economic outlook compared to February, signalling slower growth and higher inflation in the months ahead."

And here's some quotes from the UK PMI report. It's are as bleak as it can get:

"However, the outlook darkened as concerns over Russia's invasion exacerbated existing worries over soaring prices, supply chains and slowing economic growth. Business expectations are now at their lowest for almost one and a half years, pointing to a marked slowing in the pace of economic growth in coming months.

"Meanwhile, price pressures have spiked higher due to increased energy and commodity prices resulting from the invasion. With March seeing by far the largest rise in selling prices for goods and services ever recorded by the survey, consumer price inflation is set to rise further in the months ahead.

"The survey indicators point to potentially sharply slower growth in the coming months, accompanied by a further acceleration of inflation and a worsening cost of living crisis, which paints an unwelcome picture of 'stagflation' for the economy in the months ahead.”

Compare that to the US PMIs, which both posted stronger headline numbers. The report reads a lot more upbeat:

The sharp expansion in activity was broad-based and signalled a further recovery from January's Omicron-induced slowdown.

(...) a marked rise in new orders, (...) new export orders rose at a quicker pace at the end of the first quarter, (...) costs increased at one of the fastest rates on record, (...) output charge inflation remained well above the series average, (...) backlogs of work grew steeply in March

In terms of the outlook, business confidence slipped to the lowest since last October but remained encouragingly resilient, as rising geopolitical concerns over Russia's invasion of Ukraine, higher living costs and Fed policy tightening were largely allayed by hopes of the economy gaining strength as the drag from the pandemic continues to recede

There was not a lot of change in strength after the PMIs, neither from EUR and GDP nor from the USD.

Friday, 25.03.22

Yen strength after the Tokyo Core CPI beat its consensus forecast

UK Retail Sales disappointed, the GBP weakened

EUR weaker after the German ifo Business Climate came in below consensus

Market Analysis

Growth and Inflation

Atlanta Fed GDPnow stands at 0.9% for Q1.

The Citi Economic Surprise Indicator for the G8 economies below:

US getting stronger, UK still alive, CAD kicking after recent labour market report

EUR might have rolled over, AUD and NZD weak

PMIs have been updated for a couple of countries so far. UK is weakening, Japan improving. Eurozone remains stable, but I suspect this will change with the next release. The fact that Brazil is looking so anaemic from a PMI perspective contrast with the outperformance of the BOVESPA.

The 5y5y inflation expectation is not moving higher:

The Inflation Expectations ETF RINF has broken out of its range, but it hasn't moved higher, yet.

The Citi Inflation Surprise Indicator for the G8 economies below

EUR, GBP, CAD, CHF at or near highs

USD has ticked up

NZD and JPY very weak; AUD weakening a bit

As bullish as it might look for the Pound, for example: recent CPI surprised to the upside, but GBP was a lot weaker. That tells me: demand destruction, and central banks are stuck between a rock and a hard place (especially BOE and ECB even more than the rest of them).

Yields

I look at the following chart and table below.

Yields have moved up for all G8s

US, Canada and Australia are outperforming yield-wise

UK and Switzerland yields are comparatively flat, Germany is somewhere in the middle, Japan is hardly moving at all

Spreads between Germany and the periphery in Europe have narrowed a bit after talks about joint EU bonds

I see a stronger AUD, NZD and CAD here; a weaker GBP, CHF and JPY.

2s10s for the G8 in the following chart:

Australia widening probably reflects improving economic conditions more than inflation getting out of hand (they're commodity exporters after all).

Germany (=Europe) is widening, which is pure inflation in the long end and too little action from the ECB.

2s10s for the UK are just 27 bps above zero and quite volatile. Weak economy meets a relatively hawkish central bank.

Canada is mirroring what the US does, as their economies are closely linked.

Central Banks

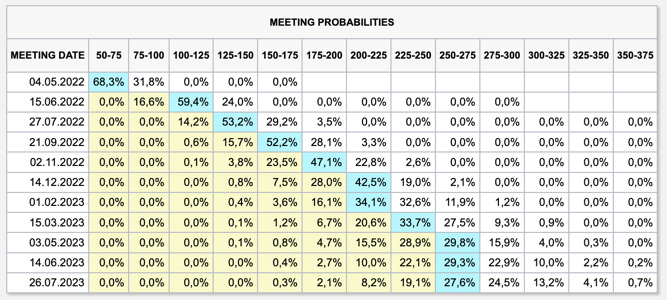

There has been a dramatic repricing of hiking expecations this week. You can see that in the two charts below.

The probability of a 50 bps hike at the next meeting is 68% right now (compared to 32% last week)

The market expects two successive 50 bps hikes now

Pricing is for eight more hikes this year (!!!), up from seven last week

The entire probability distribution has shifted upwards

The market clearly does not want to fight the Fed.

The following chart shows that the Fed Fund Futures currently price the FFR at 194 bps higher by December compared to today, they imply a rate of another 50 bps higher for 2023 and then a reduction of 77.5 bps in 2024. Wow.

Sectors and Flows

AUD, NZD and CAD are outperforming “bigly,” JPY weakness is epic. EUR and GBP are weaker as well.

Sectors are mostly green for the week and month, which they haven't been in a while. Outperformers are still Energy and Materials, i.e. the top-of-the-cycle sectors. It's not a broad-based reflation rally in stocks. The fact that Utilities are starting to perform somewhat could mean that we're moving from the top of the business cycle towards a downturn.

The outperformance of Energy (XLE, XOP, OIH) and Mining (XME) is staggering. Utilities (XLU) are starting to perform, Value (VTV) is outperforming Growth (VUG), Consumer Discretionary (XLY) is near the bottom. This is not a healthy market.

Brazil (IBOV), Canada (TSX) and UK (UK100) are the only indexes with a positive performance over 3 months. It doesn't matter if your economy is going down the drain (see UK): if you have enough commodity exposure in your stock market index, you're going to outperform. Germany (DAX) and the EuroStoxx (SX5E) are near the bottom, and China (CHCOMP) is even worse.

ETF flows are a bit hard to interpret, see next two tables. On a percentage of AUM basis there have been inflows into US equities (and to a markedly smaller degree into international equities and FICC). Commodities have seen large inflows (no surprise). Currencies are interesting, I suspect these are flows out of the USD into commodity currencies.

Sentiment and Positioning

Traders are extremely bullish on the Yen, and they like EUR and GBP while they hate everything I like: AUD, CAD, NZD. The fact that CHF has the worst sentiment of all makes me reconsider my neutral-bearish bias here.

Commitment of Traders dealer net positioning in the USD is still relatively short near its 104-week low. Compared to historical levels it's not really extreme, though, but it could weigh on the dollar. The extreme long positions in the AUD and NZD have been pared back to a great extent, so the dramatic part of the short squeeze might come to an end soon. Dealers are still extremely long JPY and they have increased their position; Z-score is >1.50 and it's at a 2-year high. Everything the dealers are long the street has to be short, and this is setting up an epic short-squeeze in the JPY.

The move in SPX E-mini positioning is interesting. Dealers are getting longer, so everyone has been shorting the ES. They are not at extreme positions seen after the March 2020 crash, but we could be getting there, and this could be supportive for stocks.

Market Risks

Breadth is very weak in the S&P 500 as shown by the Advance/Decline Line. It has barely moved over the last couple of days while the index has rallied.

The MOVE index and the VIX are diverging hard. If you believe that bonds are the smart money, then this does not look good at all here. Note the divergence in January and how it worked out (just the other way round this time).

The VIX term structure is back in a shaky-looking contango. It's a bit flat and rolls over in November, but it's a contango.

High yield spreads have come down from their recent high, but they're still elevated compared to where they were in January.

Various

25-delta risk reversals for G8 and CNY vs. USD below:

EUR, CHF and CNY are being priced higher

pricing in AUD is catching up with the move higher

Seasonality is bullish for AUD, GBP, CAD in April. Fiscal-year end in Japan has a bullish bias for the JPY as well (even though it does not show up in the first of the next two charts… seasonality is tricky).

Other Stuff I've been looking at

Global financial conditions are dispersing at the moment, and it's telling me to short the EUR and the GBP:

One more chart showing that EUR, GBP, and CHF are likely to underperform, especially with their central banks being as dovish as they are:

Global growth forecasts have been slashed in recent weeks by just about everybody:

Not sure who's out-hawking who here… the FED is saying it, the market it saying it… but I don't want to believe:

Stock market performance during hiking cycles depends on the speed of hikes, and we're going to be pretty fast:

Oldie but Goldie… 2s10s and recessions:

… and where we're headed according to the market, 2s10s 1 year forward:

Meanwhile, this is more like what Jay Powell is looking at, the 3mo10y spread (he mentioned the 3mo18mo spread on Monday, so he's incorporating the very short end):

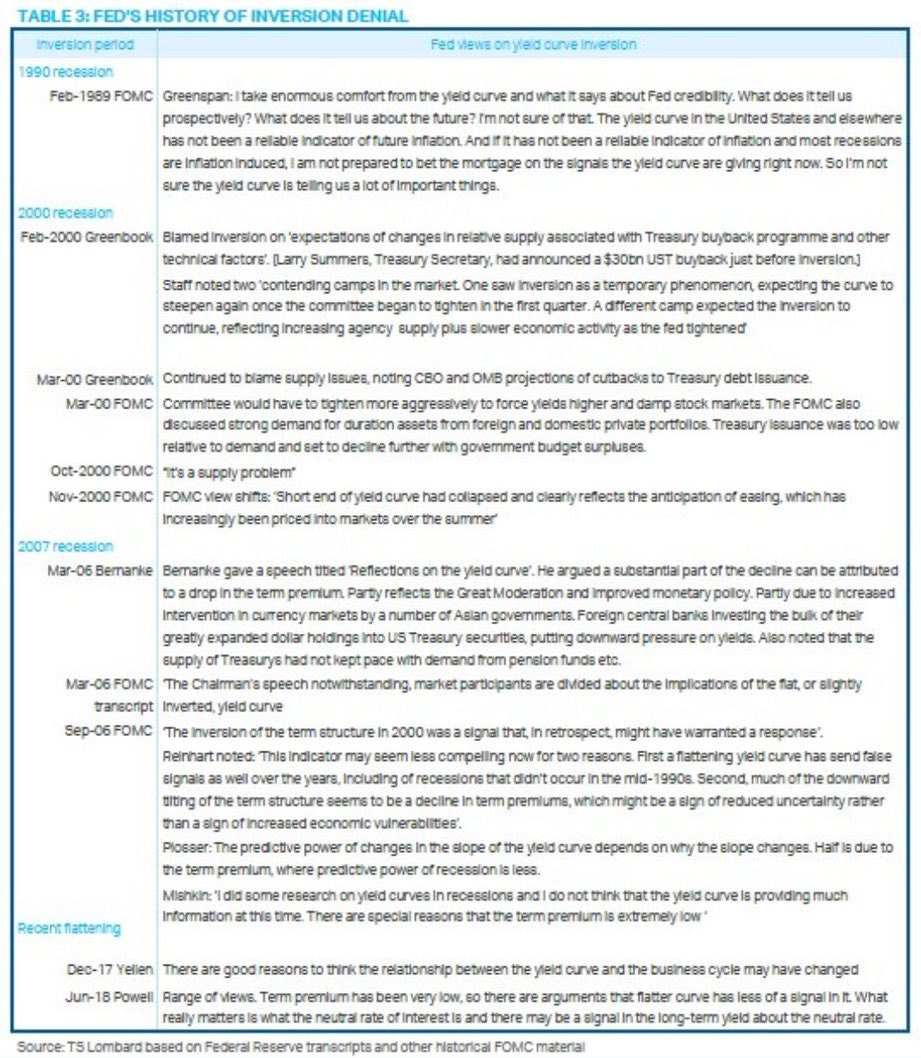

It's not the first time the yield curve inverts and it isn't the first time that the Fed finds reasons to ignore it. Here's a history of Yield Curve Inversion Denial by the Fed:

Ratio of Tech/Bonds (lagged by 7 months) vs. 5s30s. This does not look good for Tech…

… and this chart doesn't, either. Bonds are smart money, and they say that this rally in the Q's is standing on very weak legs:

Why being bearish on stocks is so damn hard:

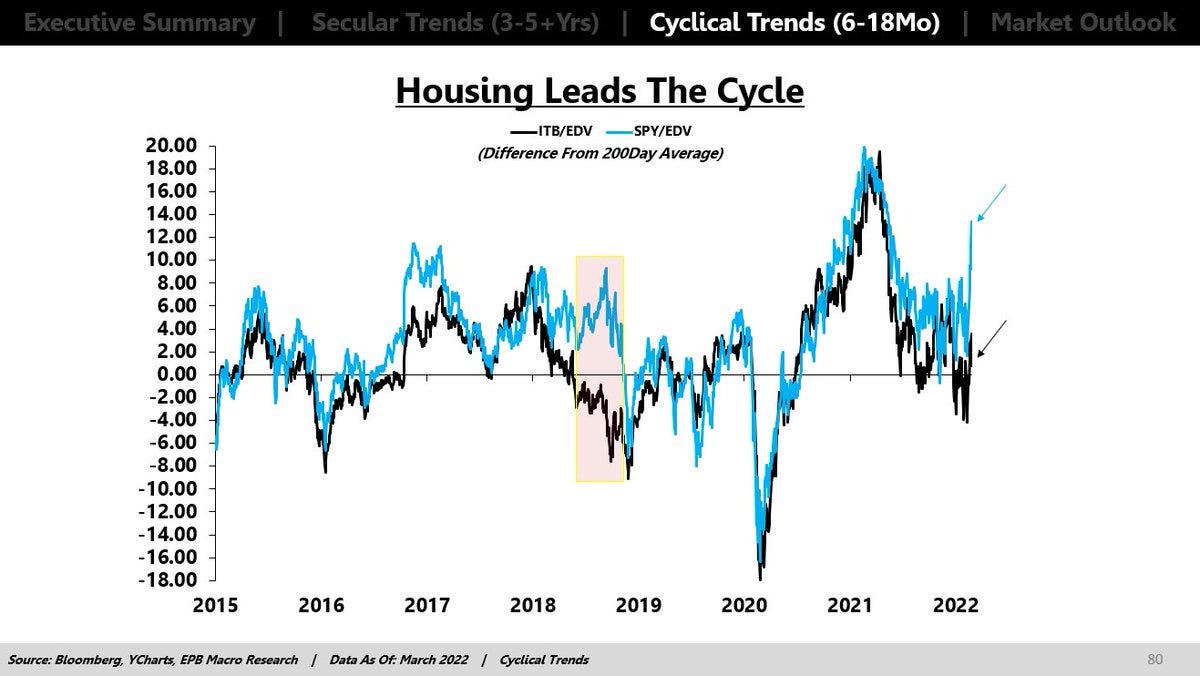

Housing leads the cycle... Wealth Effect:

Mortgage Rates are going through the roof:

Personal Income is taking a hit:

This is what inflation in the OECD looked like in January. Even if you're stripping out the Energy subcomponent it's already more than double what it was before and during Covid. And it does not even include everything that happened since February.

If this doesn't predict a bull market in Energy and Metals, I don't know what does:

UK Economic Sentiment is down near Covid-crash levels. This fits with the PMI data discussed above.

And UK exports have not recovered from their pandemic slump… they can thank Brexit for that: