Podcast Write-Up #7: Boiler Room w/ Mr. Blonde

Expect a market bottom somewhere between November and Q1/2023

Welcome to issue #7 of my mid-week podcast write-up series!

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Here’s the latest issue of my regular weekend FX and Macro deep-dive in case you’ve missed it:

I’m using the opportunity to ask you a small favour: I’ve designed a short reader survey that will help me understand my audience a bit better. It’s only around ten questions and should take you no more than five minutes to complete. Thanks for taking the time to participate if you haven’t already!

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Release date: 14.09.2022

Host(s): Alfonso Peccatiello @MacroAlf

Guest(s): Mr. Blonde @MrBlonde_macro, here's a link to his Substack:

Charts were all added by me.

Notes

Q: Financial conditions are tightening, and they feed into your macro framework. What's going on there? 01:00

Financial conditions have been in a tightening trend since late last year, and that trend has been accelerating. The primary drivers were rising real yields and the dollar.

The tightening is happening at a quicker rate and a higher level, and that has consequences for asset markets and future growth. The last 15-20 days have been the fastest pace of tightening since the start of the cycle late last year.

Q: How does that kind of tightening affect equity valuations? (02:26)

Credit spreads are important: Mr Blonde uses BBB corporate credit as a proxy for the cost of capital for companies since they cannot borrow at the 10-year treasury rate. The dollar is very important as well since a stronger dollar usually leads to weaker sales growth and weaker profit growth.

He uses and has published a model that says: a 10% move in the trade-weighted dollar index that lasts for a bit usually takes 150-200 bps off earnings growth over 6-12 months. Earnings growth is usually about 7-8% on average, so that's a significant impact.

Q: How does a stronger dollar affect sales growth of US companies (04:21)

The main reason is that about 40-50% of the revenue of the S&P 500 comes from overseas. Some companies are better than others at hedging that FX exposure, but it usually flows through to EPS 100%. Most analysts aren't taking that into account in their EPS forecasts. Another reason is that the US dollar is usually strengthening in times of weak global growth.

Q: Real yields reflect the monetary policy stance and long-term real growth. When growth was slowing and monetary policy was accommodative to support growth, real yields would normally have rallied. However, right now, rising real yields are adding to the problem of tighter financial conditions. What are your thoughts on real yields with regard to equities? (06:36)

The Fed made clear that their priority is getting inflation down, especially at Jackson Hole, and that has led to another upswing in real rates. One reason for the strong dollar is that US real rates are outpacing real yields in other parts of the world. You could look at 5s5s for the US and Japanese real rates, and they look like USDJPY:

The FCI has inputs from different markets, and if all of the financial tightening came from real rates then they would have to be a lot higher than they are today.

As for what it means for equities, higher risk-free real rates are much more attractive source of return compared to where BBB rates or equity earnings yields are trading.

Alf adds that one effect of higher real rates is the discounting factor of future cash flows and the other is the way capital is allocated: capital is going to flow to the risk-free assets unless the valuations of riskier assets adjust accordingly.

Q: Before Jackson Hole, Powell had said he wanted real yields positive across the curve but the frond-end was still trading in negative territory. After Jackson Hole, the bond market has now adjusted, and now 5-year real yields are the highest since 2018. What do you expect the Fed to do over the next 3-6 months? (10:16)

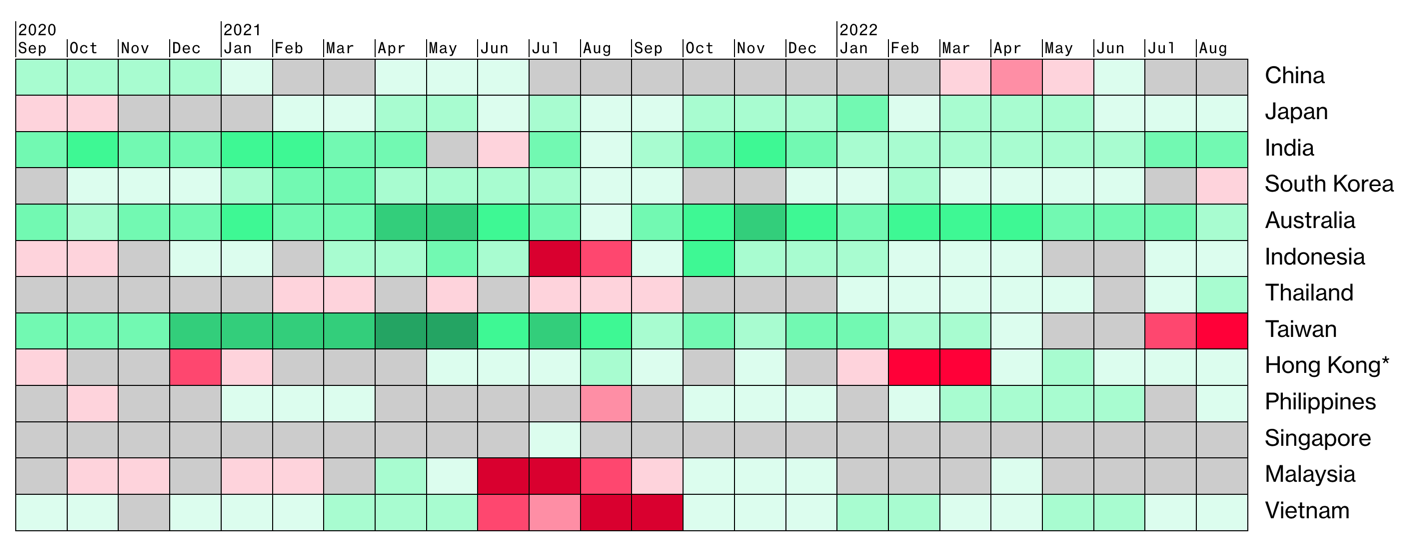

Mr. Blonde thinks the Fed will hike as expected over the next few meetings, but beyond that, it will depend on what happens to growth. He says he has a more negative growth outlook and outlook on profit growth than the average investor. Growth is already showing signs of weakness, in other parts of the world more than in the US: Korea and Taiwan are important global manufacturing hubs and data from there is not looking good.

If growth slows down in Q4 that could change what the Fed does. They are anticipating and hoping for growth to slow, so they will be more willing to accept “pain for households” than in the past. That sounded like a codeword for recession and is as close as you can get a central banker saying they need growth to be below trend for an extended period of time. They will probably be at higher rates for longer than anticipated a few months ago.

Alf adds that the bond market is pricing the terminal rate at around 375 bps, so not very different than before, but it has priced out rate cuts in 2023 because the hurdle is now so high.

Q: What are the implications for the equity markets? Can you give us your assessment of US equities going forward and an overview of sectors? (15:58)

There were different phases this year: We started the year at peak liquidity, peak valuations and peak earnings. Regarding peak liquidity and peak valuations, the market has been effective at taking those away. But we're still on peak earnings, which is an important risk. Mr. Blonde expects earnings to come down substantially as we go into 2023, and it's not an environment for valuation expansion, so simple valuation models point to “fair value” at S&P 500 levels of around 3,000 to 3,200. That seems the path of least resistance to Mr. Blonde. He expects periodic rallies because of sentiment and positioning, and he prefers to sell the rallies until either

The Fed puts in a pivot, which isn't a pause but a change in direction or a change in attitude or

Various leading indicators show a definitive bottom and turn higher.

Sector-wise, he thinks it's best to stay as defensive as possible.

Q: Please do the math for us on your S&P target of 3,000-3,200! (19:49)

Mr Blonde sees a number of around $200 on the S&P 500 EPS, consensus right now is about $240. $200 is equivalent to about 15% below 2022. The ISM PMI cycle is consistent with EPS running about 25% above trend. The rise in rates and energy costs are preconditions for a more meaningful growth slowdown.

Q: When is the moment to say we're at or near the trough of this bear market? (21:52)

Mr Blonde wants to do more work in that area, but the market tends to bottom 6-9 months before EPS bottoms out. His current timeframe for EPS making their lows is Q3 2023. So, after October or November this year into Q1 next year the window opens for price to bottom.

He doesn't necessarily think that the market has structural issues and that we will have a bear market that lasts 12-18 months. The market went through a significant shock and it's now digesting that. However, a market bottom doesn't mean that it is going to make new highs: it could just be that the trend is flattening out.