Welcome to edition #12 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

Thanks everyone for participating in last week's poll! The result was a unanimous 100% vote in favour of keeping the last section with the assorted charts and tweets.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks

Economic Data

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Monday is going to be a US holiday. Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved, PM Johnson is still under pressure and could be ousted (probably short-term negative for the pound but bullish over days)

Japan: the BOJ making an unexpected U-turn

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

Confab, Speakers, News

Federal Reserve

Williams (Neutral). Tue: at the next meeting the debate will be 50 bps vs. 75 bps, reasonable to get the Fed Funds Rate to 3.5-4%, baseline forecast is to get moderately restrictive next year, expects economy to slow and unemployment to rise to 4%, recession not the base case, no sign of a taper tantrum, the bond market is functioning

Daly (Neutral). Tue: Fed can address inflation at least partly, expects unemployment to rise slightly but not like in a recession. Fri: wants to get to around 3.1% at the end of the year, 75 bps in July and then figure out what to do to get to 3.1%, inflation coming down rapidly or supply chains improving would change that goal, sees no systemic risk from housing

Mester (Hawk). Wed: in favour of a 75 bps hike in July right now, debate is whether it's going to be 50 bps or 75 bps, wants to see rates above 4% next year

Powell (Neutral). Wed: going too far with tightening is not the biggest risk, the biggest risk is failing to restore price stability, markets have been pretty well aligned with where the Fed is headed, aim is to moderate growth, getting inflation back to 2% with a strong labour market is possible but the path has narrowed

European Central Bank

Lagarde (Dove). Tue: intends to raise rate by 25 bps in July, optionality to raise by more in September, after that further hikes will be “gradual but sustained”; ECB will use flexibility under PEPP to address fragmentation as well as a new instrument. Wed: move away from globalization will end era of low inflation

Wunsch (Neutral). Tue: comfortable with a 50 bps move in July, 200 bps worth of tightening are needed “relatively fast”, new anti-fragmentation tool should have no limits if moves are unwarranted, ECB should avoid hard triggers for spreads

Kazaks (Hawk). Tue: base case is 25 bps in July and 50 bps in September, may be reasonable to front-load hikes, may be worth looking at 50 bps in July already

Simkus (Hawk). Wed: 50 bps should be an option in July and is very likely in September, ECB should move decisively towards normalization, fragmentation tool should serve as a deterrent, it's just a matter of time until inflation comes down

Wunsch (Neutral). Wed: 150 bps of hikes by March 2023 reasonable

Sources. Wed: the bank is weighing whether to announce size and duration of new anti-fragmentation tool, PEPP reinvestments do not have any targets for now but rules will evolve. Thu: PEPP reinvestments will divide the Eurozone in to "donors, recipients and neutrals”: recipients will be Italy, Spain, Portugal and Greece, donors will be Germany, France, Netherlands.

Bank of England

Bailey (Neutral). Wed: leaves option of a 50 bps hike on the table, it's clear that the economy is slowing, it's possible we have to do more, have to act more forcefully if we see persistence in inflation, not surprised by the path of the sterling

Dhingra (MPC-elect). Wed: room for a very gradual approach, slowdown may be much more imminent than previously thought, BoE still had levers to act

Bank of Japan

Kuroda. Wed: monetary policy will continue to be accommodative because Japanese economy has not been affected much by global inflationary trend, core CPI above 2% almost all because of increase in energy prices

People's Bank of China

Yi Gang. Mon: monetary policy will remain accommodative to support economic recovery, inflation outlook for China is stable, real interest rates are quite low considering inflation

Economic Data

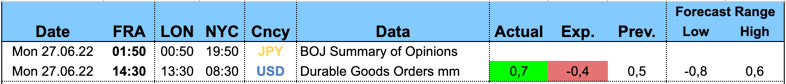

Monday, 27.06.22

US Durable Goods Orders printed above the forecast range, USD jumped but was sold off subsequently

Tuesday, 28.06.22

Japanese BOJ Core CPI was higher than the previous print, JPY was unchanged

German GfK Consumer Confidence came in better than expected, EUR was unchanged

US CB Consumer Confidence hit below the forecast range, USD was stronger. Here's the link to the release and the summary (emphasis mine):

The Conference Board Consumer Confidence Index® decreased in June, following a decline in May. The Index fell to 98.7 (1985=100)—down 4.5 points from 103.2 in May—and now stands at its lowest level since February 2021 (Index, 95.2). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined marginally to 147.1 from 147.4 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased sharply to 66.4 from 73.7 and is at its lowest level since March 2013 (Index, 63.7).

“Consumer confidence fell for a second consecutive month in June,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory—falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by yearend.”

“Purchasing intentions for cars, homes, and major appliances held relatively steady—but intentions have cooled since the start of the year and this trend is likely to continue as the Fed aggressively raises interest rates to tame inflation. Meanwhile, vacation plans softened further as rising prices took their toll. Looking ahead over the next six months, consumer spending and economic growth are likely to continue facing strong headwinds from further inflation and rate hikes.”

Wednesday, 29.06.22

Australian Retail Sales beat expectations, AUD was a bit stronger

German CPI disappointed, EUR was weaker

Thursday, 30.06.22

Kiwi ANZ Business Confidence was weaker than previously, NZD sold off. Summary and chart: (link to full text):

Chinese PMIs were mixed with the Manufacturing PMI underperforming and the Services PMI well above consensus; both above 50 again. AUD was stronger.

German Retail Sales disappointed, EUR did not react immediately

Swiss Retail Sales were stronger, CHF zig-zagged

Canadian GDP was in line, CAD did not react much

US Core PCE, Initial Jobless Claims and Chicago PMI all came in below the forecast, USD was weaker

Friday, 01.07.22

Aussie AIG Manufacturing PMI improved. Here's the chart and summary (emphasis mine):

Manufacturing continued to expand moderately in June. Most subsectors improved but the metals sector declined dramatically.

Labour challenges and supply chain disruptions remain the major structural constraints on manufacturing. Input prices rose again to mark the highest-ever reading in the Australian PMI® series.

Most manufacturing activity indicators expanded in June. However, sales declined and are now in contraction, reflecting weaker market conditions than in past months.

Manufacturing exports rebounded strongly, as shipping issues earlier in the year have cleared.

Japanese Tankan Manufacturing and Non-Manufacturing surveys were both disappointing

Chinese Caixin Manufacturing PMI printed above consensus

Swiss Manufacturing PMI was above consensus as well

Eurozone HICP Flash Estimate beat expectations

US ISM Manufacturing PMI disappointed. Here's the summary (emphasis mine, link to full text here):

“The U.S. manufacturing sector continues to be powered — though less so in June — by demand while held back by supply chain constraints. Despite the Employment Index contracting in May and June, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain, according to Business Survey Committee respondents’ comments. Panelists reported lower rates of quits compared to May. Prices expansion slightly eased for a third straight month in June, but instability in global energy markets continues. Sentiment remained optimistic regarding demand, with three positive growth comments for every cautious comment. Panelists continue to note supply chain and pricing issues as their biggest concerns. Demand dropped, with the (1) New Orders Index contracting, (2) Customers’ Inventories Index remaining at a very low level, though it increased and (3) Backlog of Orders Index decreasing but still in growth territory. Consumption (measured by the Production and Employment indexes) was mixed during the period, with a combined minus-1.6-percentage point change to the Manufacturing PMI® calculation. The Employment Index contracted for the second month in a row after expanding for eight straight months (September through April), but panelists again indicated month-over-month improvement in ability to hire in June.

“Backlog is high, but incoming orders slowing this month.” [Computer & Electronic Products]

“New orders have stabilized and not increased.” [Chemical Products]

“Continued strong demand for transportation equipment.” [Transportation Equipment]

“Business is slower than expected in volume, but revenue is on pace with our budget. Ocean freight costs are finally beginning to fall a bit. We are already receiving large orders for the fall, which is encouraging.” [Food, Beverage & Tobacco Products]

“Continued tightening of market, rising gas/diesel prices, and limited labor/drivers equates to increased cost. Few markets showing a levelling off.” [Petroleum & Coal Products]

“Our suppliers are experiencing a softening of orders. We are still running at the same high level we did throughout 2021 and in early 2022.” [Machinery]

“Business is still steady. Some customers are pushing orders out because they have too much inventory. We are able to backfill the pushed orders from customers that want theirs earlier, so we aren’t losing capacity.” [Fabricated Metal Products]

“We are hearing from customers that their inventories are high, and sales are coming down. We expect orders to decline in the coming months until inventories are leveled properly against demand.” [Apparel, Leather & Allied Products]

“Orders and production continue to be strong, but material availability is holding us back. Cannot run enough hours to eat into the backlog.” [Electrical Equipment, Appliances & Components]

“Supply seems to be settling to some degree, but what it is settling into remains in question. Diminishing cost and (continued) limited supply in aluminum make for an interesting combination. There are actually more questions than answers this month.” [Primary Metals]

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow: it's already been all over twitter on Friday, and if GDP turns out this way, wel'll have been in a recession over the last two quarters:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -2.1 percent on July 1, down from -1.0 percent on June 30. After this morning's Manufacturing ISM Report On Business from the Institute for Supply Management and the construction report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 1.7 percent and -13.2 percent, respectively, to 0.8 percent and -15.2 percent, respectively.

As a sidenote, the NY Fed GDP Nowcast is still on hiatus.

The NY Fed Weekly Economic Index stands at 2.62:

The decline in the WEI for the week of June 25 (relative to the final estimate for the week of June 18) is due to decreases in retail sales, steel production, tax withholding, consumer confidence, railroad traffic, and electricity output, and a rise in initial unemployment insurance claims, which more than offset an increase in fuel sales (relative to the same period last year).

Citi Economic Surprise Indexes:

USD and EUR weakening further

GBP and AUD seem to have levelled off for now

JPY plunging

Global PMIs:

Mostly weaker

China is improving a bit (not surprising given their April PMIs), but other that that there's not much positive coming out of Asia

Interesting divergence between Poland and Hungary considering their proximity to Ukraine

5y5y forward inflations expectations have come down hard:

The Inflations Expectations ETF is also plunging:

Citi Inflation Surprise Indexes are unchanged from last week:

GBP, CHF and JPY are the only surprisers to the upside. Note the comparatively small surprise that compelled the SNB to surprise the markets with a 50 bps hike.

USD and AUD moving lower

Yields

I'm looking at the chart and table below:

All G8 2s and 10s have moved down, JPY being the (unsurprising) exception

CAD yields look comparatively strong

Central Banks

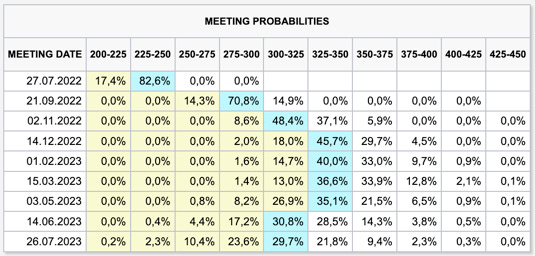

FOMC target rate probabilities according to FedWatch:

No relevant change in the front end: 83% chance of a 75 bps hike in July, followed by a 50 bps hike in September

Still pricing a rate cut in mid-2023 albeit from a bit higher maximum rate

Expectations for interest rate cuts in 2023 have been accelerating over the last two weeks with the deterioration of incoming economic data:

Sectors and Flows

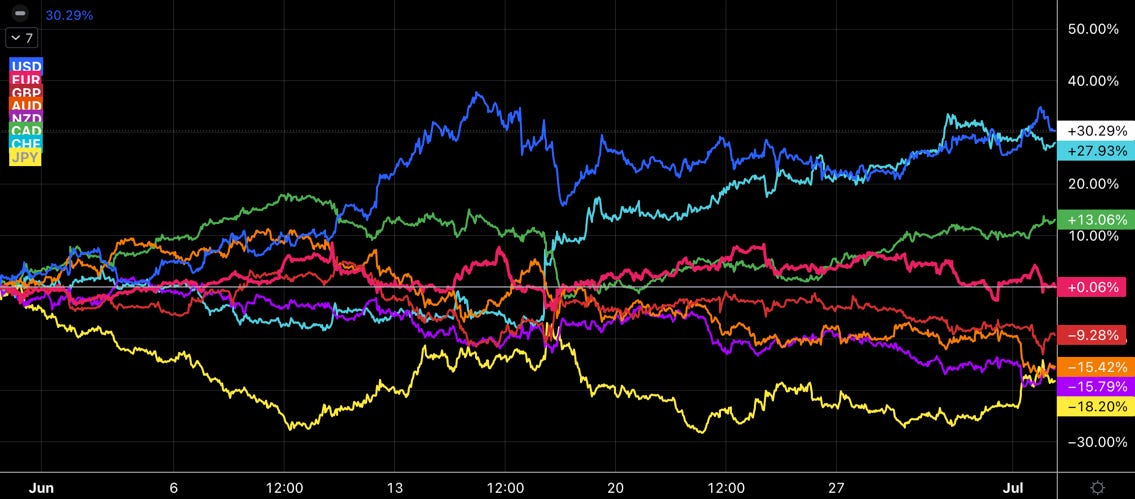

Relative strength:

USD and CHF are the clear outperformers (note: you can clearly see the SNB surprise hawk right in the middle and how the Swissie performed after that)

Antipodes and the Yen are the underperformers

Sterling very weak as well

All sectors are in the red over three months:

Energy (XLE, XOP, OIH) has come down hard. The outperformance of energy has ended for now.

Semiconductors (SMH) and Mining (XME) are the laggards

Defensive sectors like Staples (XLP), Utilities (XLU) and Healthcare (XLV) are outperforming

Value (VTV) outperforming Growth (VUG)

Healthcare, Defensives, Utilities are the relative leaders. Energy lagging here as well:

International stock markets are mostly under water as well:

TW50C is the Taiwanese index and it's the second-worst, KOSPI is near the bottom as well… not very encouraging for the global economy

France, Germany and Spain (IBEX35, DAX, CAC40) holding up surprisingly well, especially considering the geopolitical risk

Commodities have also been hit hard across the board:

Sentiment and Positioning

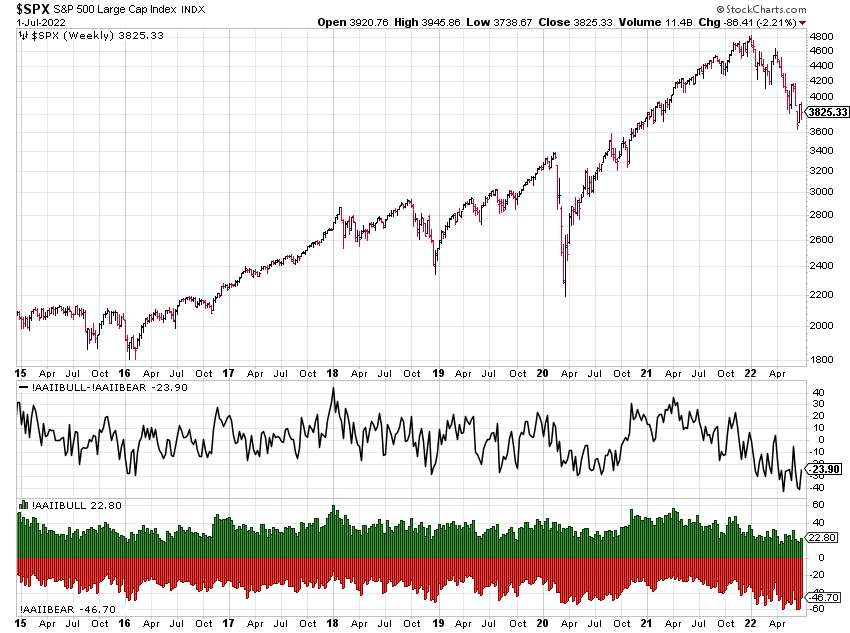

AAII Bull-Bear Spread has ticked up this week, but it's still near lows:

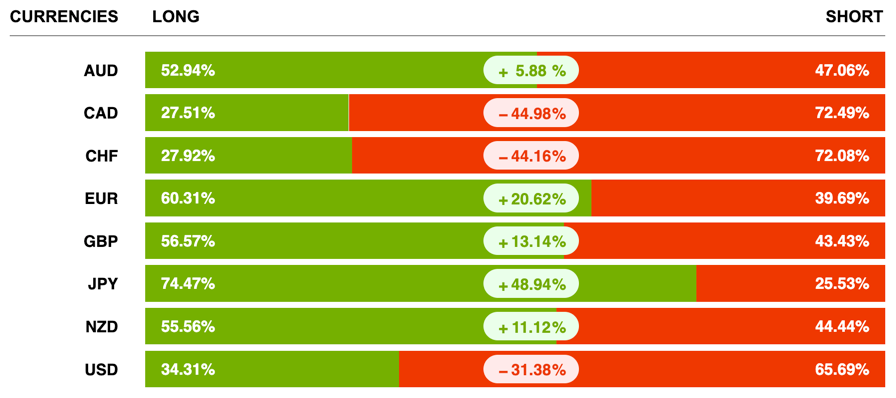

Currency Sentiment:

Not much change from last week

CAD and Swissie still the most unloved currencies at the moment

JPY has the most bullish sentiment

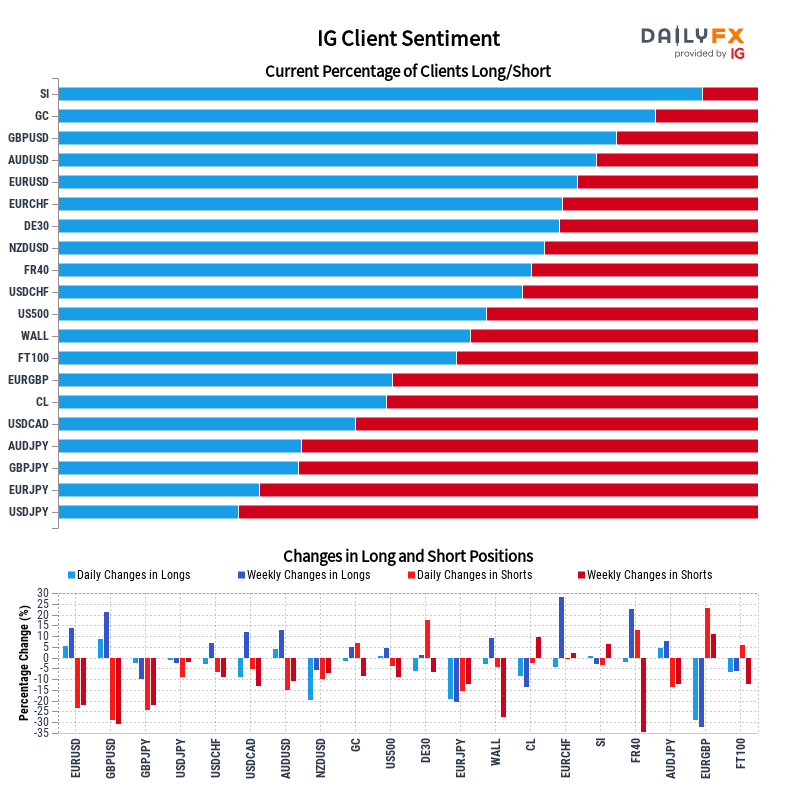

Different sentiment data:

USD pairs are bearish USD, except for USDCHF

JPY pairs are all bullish JPY

Commitment of Traders:

Still very supportive positioning in equity indexes with Commercials being extremely long positioned

Commercials are long positioned in 6E and short in DXY, so that's supportive of a stronger EURUSD

All metals have extreme Commercial long positioning (and consecutive Large Spec short positioning)

Performance-wise metals have been especially beaten down with copper down 24% over 3 months, silver down 21% and palladium down 20%.

COT/TIFF data:

No extreme positions

The 6J multi-year Dealer long still has a long way to unwind

Citi PAIN Indexes still show dollar positioning near an extreme long vs. all others:

Market Risks

Credit spreads are still widening at a considerable pace:

And here's a credit spread index:

The VIX term structure is in contango in the front futures, but it's still relatively flat. Overall a bit surprising given where equity markets stand right now.

Volatility overview:

MOVE just won't come down despite the selloff in bonds having had some pause now

VIX looks compared to what's going on in the equity markets right now

VVIX is completely unimpressed and continues to move lower

Lower volatility hasn't really boosted equities for now…

The CNN Fear & Greed Index stands at 24. Doesn't look like a fear capitulation:

Various

Market breadth is not looking good: the percentage of S&P 500 stocks above their 100-day MA is still low. Unless this bounces quickly we're still in danger-zone (look at 2019 and 2020!):

Same applies to the Nasdaq 100:

25-delta risk reversals are still pricing a stronger JPY (Refinitiv data as well as CME!)

FX volatility remains elevated. Volatility in CNY being the exception, it's moving down:

Geopolitical Risk is elevated and largely unchanged:

Other Stuff I've been looking at

Diesel demand is a proxy for how the economy is doing:

… the growth impulse is coming down hard:

There's still a pandemic going: overall mobility remains below pre-Covid levels:

There's a pretty significant disconnect between consumer sentiment and the unemployment rate:

And a word about Consumer Credit:

Financial conditions during hiking cycles… this one is an outlier:

The number of money-losing companies in the Russell 3000 keeps going up…

Price tends to bottom about six weeks before a growth trough, earnings revisions lag and start to turn upwards about two months after the trough. We haven't even seen EPS revisions come down, yet:

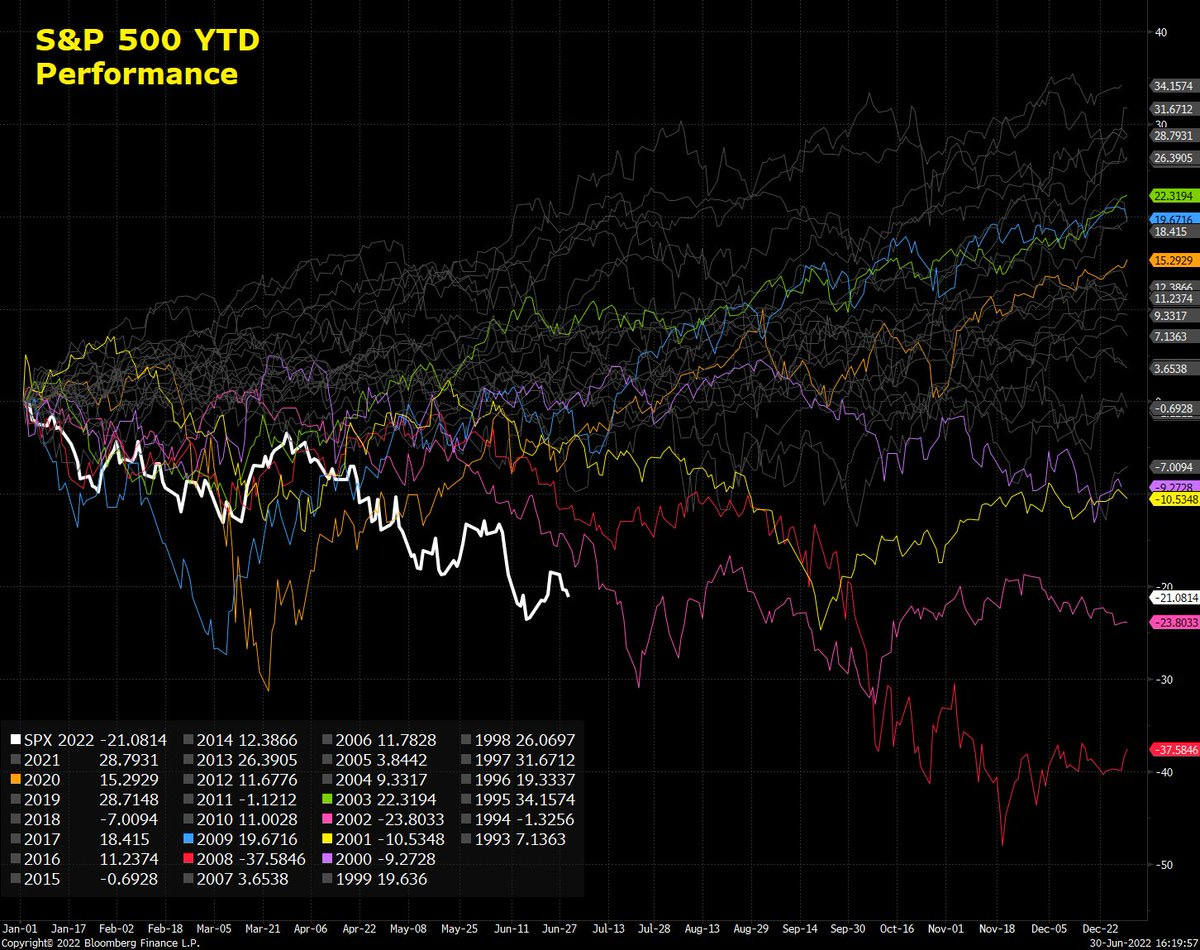

S&P 500 performance of 1H22 is the worst in 30 years:

Equity positioning still has some room to catch up with sentiment:

With everything that's going on… here's a reminder that the Commodities-to-Equities ratio is near lows: