FX and Macro Outlook for Week 29/2022

RBNZ and BOC Rate Statements, a lot of Fed speakers after the hot CPI print, and more...

Welcome to edition #14 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly if you want to reach out.

One more thing. I've recently written a Twitter thread on how to measure and quantify one of the nemesis psychological biases every trader faces: overconfidence. It includes a link to a simple spreadsheet-based test. Check it out if you like:

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks

Economic Data

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved

Japan: the BOJ making an unexpected U-turn; note that BOJ sources this week talked it down, though

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

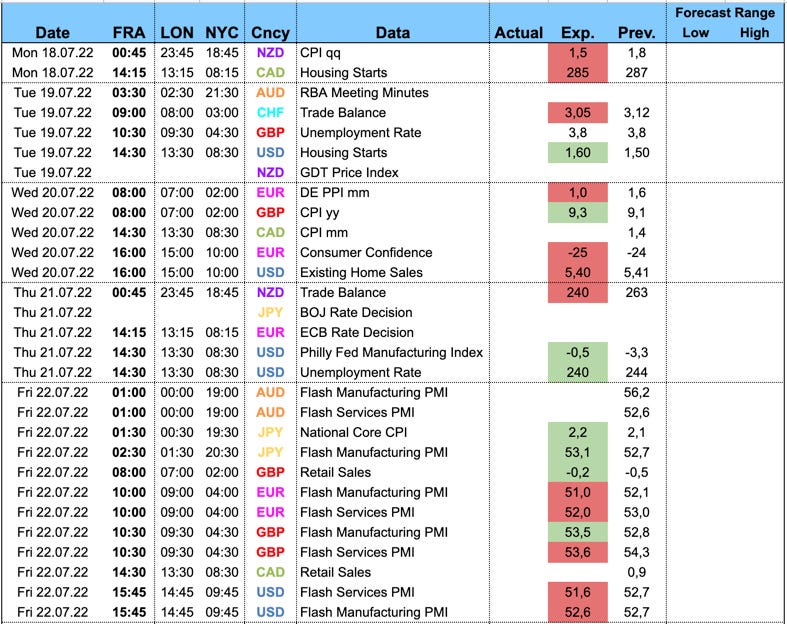

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBNZ Rate Statement (13.07.)

The RBNZ hiked by 50 bps to 2.0% as expected, guidance remains unchanged. Summary of the statement and difftext below (link to full text):

New Zealand economy is strong: high employment, resilient household balance sheets, etc.

Spending and investments are outstripping supply capacity

Employment remains above its maximum sustainable level

Core Inflation measures are around 4%

Near-term upside risk to CPI and emerging medium-term downside risks to economic activity

Two paragraphs from the Summary Record (emphasis mine):

Financial conditions have continued to tighten with mortgage rates rising in response to, and in anticipation of, increases to the Official Cash Rate (OCR). Asset prices, including house prices, continue to decline. Members agreed that the increase in mortgage interest rates will assist to bring house prices more in line with sustainable levels. The Committee also agreed that both high food and energy costs and rising mortgage interest rates will lead to more subdued household discretionary spending in coming quarters.

The Committee agreed to maintain its approach of briskly lifting the OCR until it is confident that monetary conditions are sufficient to constrain inflation expectations and bring consumer price inflation to within the target range. The Committee remains broadly comfortable with the projected path of the OCR outlined in the recent May Monetary Policy Statement. Once aggregate supply and demand are more in balance, the OCR can then return to a lower, more neutral, level. The Committee viewed this strategy as consistent with achieving their primary inflation and employment objectives without causing unnecessary instability in output, interest rates and the exchange rate.

BOC Rate Statement (13.07.)

The BOC surprised with a 100 bps hike. Summary and difftext below:

Guidance dropped the “Governing Council is prepared to act more forcefully if needed”

QT continues unchanged

Inflation is high and broadening, business and consumer inflation expectations increasing, inflation is higher and more persistent than projected in April, will likely remain around 8% in the next few months

Domestic price pressures from excess demand are becoming more prominent

GDP estimate for Q2 is about 4%, expectation is a moderation to about 2% in Q3

Inflation is expected to come down to about 3% by the end of the year and 2% by the end of next year

From the Monetary Policy Statement:

Confab, Speakers, News

Federal Reserve

Bullard (Hawk). Mon: supports 75 bps hike at July meeting, economy likely expanded in H1 this year, jobs report points to a solid economy with little signs of recession on the horizon, signs from financial markets that economic downturn could arrive sometime next year. Thu: favours a 75 bps hike, that will get us to neutral, good idea to get to 3.5% this year, possible to reach 4% by the end of next year, expects inflation to decline next year, possible we don't have to do much or anything in 2023. Fri: 75 vs. 100 bps doesn't make much of a difference, will leave the decision to the chair and his colleagues, policy can be adjusted over the rest of the year, CPI report means Fed should now target 3.75% by the end of the year, commitment to getting inflation to 2% is unconditional, takes yield curve inversion seriously but this time is different, evaluation of the balance sheet reduction is a topic for later

George (Neutral, 50-bps-dissenter). Mon: uncertain about how high rates need to rise, speed of rising rates should be an open question, communication of the interest rate path is fare more consequential than the speed of policy change, pace of rate increases has to be balanced carefully against the economy and financial markets, moving too fast risks oversteering, nature of inflation suggests tight economy rather than specific supply disruptions are driving prices

Bostic (Dove). Mon: economy can withstand a 75 bps hike in July, current policy is accommodative, we will adapt to the data beyond July, demand is starting to respond in housing and elsewhere. Wed (post-CPI): “everything is in play” when asked about 100 bps in July, inflation has broadened and that is concerning, inflation not moving in the right direction. Fri: moving too dramatically could undermine the economy and create uncertainty, 75 bps was a big move

Barkin (Neutral). Tue: hasn't decided between 50 vs. 75 bps in July, wants to see positive real rates along the yield curve, would take a negative GDP reading “seriously”, expects a higher CPI reading, definitely sees signs of the economy softening. Wed (post-CPI): asked about 100 bps hike: doesn't want to front-run FOMC decision but the CPI report makes case even stronger to fight inflation

Waller (Hawk). Thu: supports another 75 bps hike in July, would lean towards a bigger hike if retail sales and housing data come in “materially stronger than expected”, 75 bps gets us to neutral, don't want to overdo rate hikes, expects policy rate to be restrictive until there has been a sustained reduction in Core PCE, inconceivable to have a recession with unemployment at 3.6%

Mester (Hawk). Wed: inflation too high, no convincing evidence inflation has peaked, decision on rates does not have to be made now, Fed will need to go above neutral, risk of recession has increased but the Fed needs to lower inflation

Daly (Neutral). Thu: 100 bps within range of possibilities, preference for 75 bps in July. Fri: dialling back support for the economy, UoM consumer inflation expectations were a good thing

European Central Bank

Rehn (Neutral). Fri: 25 bps hike next week likely, 50 bps in September

Bank of England

Bailey (Neutral). Mon: range of things on the table for MPC meeting in August, we should not pre-commit to what we will do, UK is facing a very big real income shock, expects inflation to get back to target in about two years. Tue: options other than 25 bps are on the table, inflation should come down rapidly next year, if we see signs of inflation persistence we will act forcefully

Bank of Canada

Macklem.

Wed Post-BOC Q&A: front-loading to avoid even higher rates down the road (stressed multiple times), not seeing a wage-price spiral, there's a lot of room to reduce job vacancies without increasing unemployment significantly, good reasons soft landing is achievable, high commodity prices bring income into the country.

Thu: stressed multiple times that front-loading means that we're trying to avoid the need for higher interest rates later, haven't seen much appreciation of the CAD which means have to do more through interest rates, inflation is going to go up a little and come down slowly in the beginning

Rogers. Wed Post-BOC Q&A: housing prices have been unsustainably high, aiming to restore balance to the housing market

Bank of Japan

Kuroda. Mon: BOJ will maintain ultra-loose policy, ready to ease further without hesitation if needed, expects policy rate targets to remain at current levels or lower, Japan's financial conditions are easing

Suzuki (Fin-Min). Tue: will monitor exchange rate closely, will take appropriate measures if necessary, will communicate closely with other countries FX authorities; note: US Yellen said FX intervention has not been discussed with Japanese officials

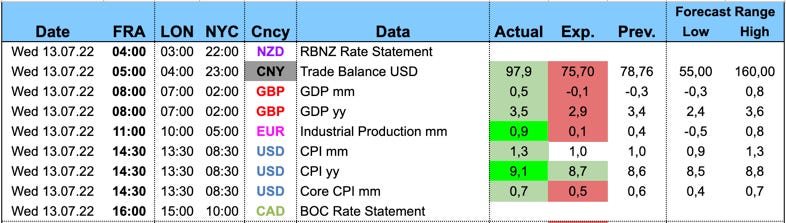

Economic Data

Monday, 11.07.22

No relevant data today. The NFIB Small Business Index made headlines, though. Here's a Twitter thread by Alfonso Peccatiello going through the release:

Tuesday, 12.07.22

Aussie Westpac Consumer Sentiment and NAB Business Confidence: both below the previous prints, AUD was weaker/unchanged

Eurozone ZEW Economic Sentiment: below the forecast range, EUR was unchanged

Wednesday, 13.07.22

RBNZ Rate Statement: dovish, NZD weaker

UK GDP: surprise to the upside, GBP stronger

Eurozone Industrial Production: above consensus, EUR unchanged

US CPI and Core CPI: hot, USD up immediately but volatile zig-zag overall

BOC Rate Statement: hawkish surprise, CAD stronger initially

Thursday, 14.07.22

Aussie Employment Change: above consensus, AUD stronger

US PPI and Unemployment Claims: mixed, USD stronger

Friday, 15.07.22

Kiwi BusinessNZ Manufacturing Index: below previous print, NZD unchanged

Chinese Industrial Output and GDP below, and Retail sales above forecasts: AUD weaker

US Retail Sales, NY Fed Manufacturing and UoM Consumer Sentiment all better than expected (and UoM Inflation Expectations lower): USD was weaker

Market Analysis

Growth and Inflation

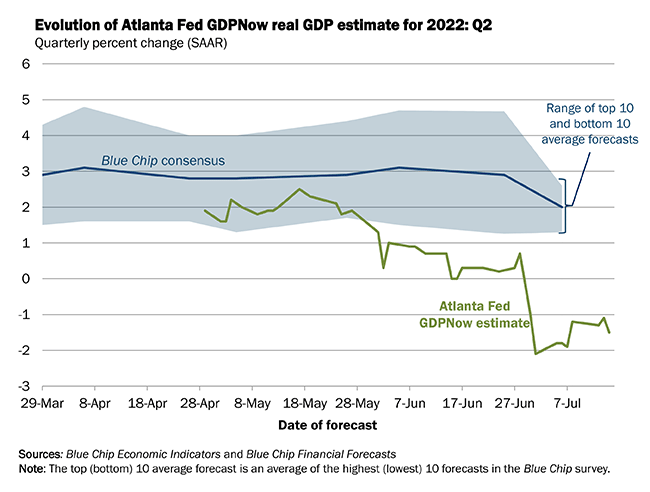

Atlanta Fed GDPNow stands at -1.5%:

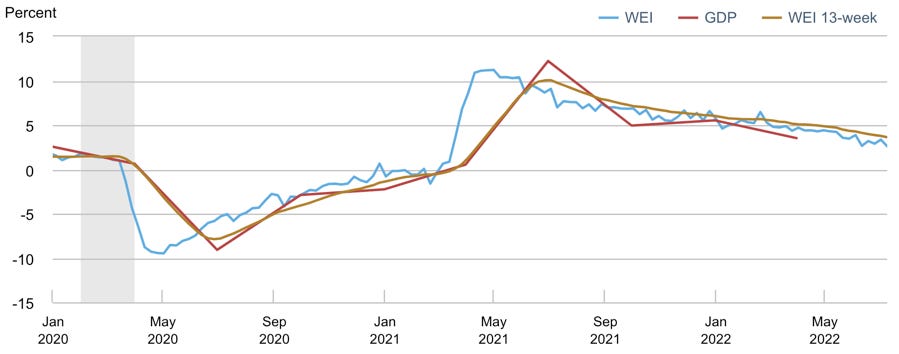

The NY Fed Weekly Economic Index estimates four-quarter GDP growth at 2.60%:

Citi Economic Surprise Indexes:

USD seems to have bottomed

EUR falling further, GBP got a boost from the GDP beat but trend is down

AUD outperforming

CAD continues to trend lower

Global PMIs are unchanged from last week:

Mostly weaker

China is improving a bit (not surprising given their April PMIs), but other that that there's not much positive coming out of Asia

5y5y forward inflation expectations are pretty much unchanged from last week and near the bottom of their 1-year trading range:

Inflations expectations ETF also unchanged from last week:

Citi Inflation Surprise Indexes are unchanged from last week:

UK, Canadian and Swiss inflation still continue to surprise to the upside

Eurozone, Australian and Japanese inflation surprises are negative

Yields

See chart and table below:

All G8 yields have come down

USD looks comparatively strong, bear flattening with 2s rising and 10s flat

NZD and CAD 2s look strong as well

CHF very weak especially in light of the SNB decision

The US yield curve along the 2s10s spread is continuing to flatten:

Central Banks

Fedwatch has been quite volatile this week with the hot CPI print and talks about a 100 bps hike later this month. As it stands now:

71% probability of a 75 bps hike and a 29% probability of 100 bps

Another 75 bps hike in September (50 bps last week)

Overall more front-loading. The probabilities for the highest FFR of the cycle have moved up a bit, but it's been a tough call before between 3.25 and 3.75%.

Short-term interest rates: the hot CPI print on Wednesday is clearly visible with a jump in pricing for hikes this year from around 1.6% to almost 2% in the Fed Funds Futures. Most of it has been priced out again, expectations are now for 1.76% worth of hikes.

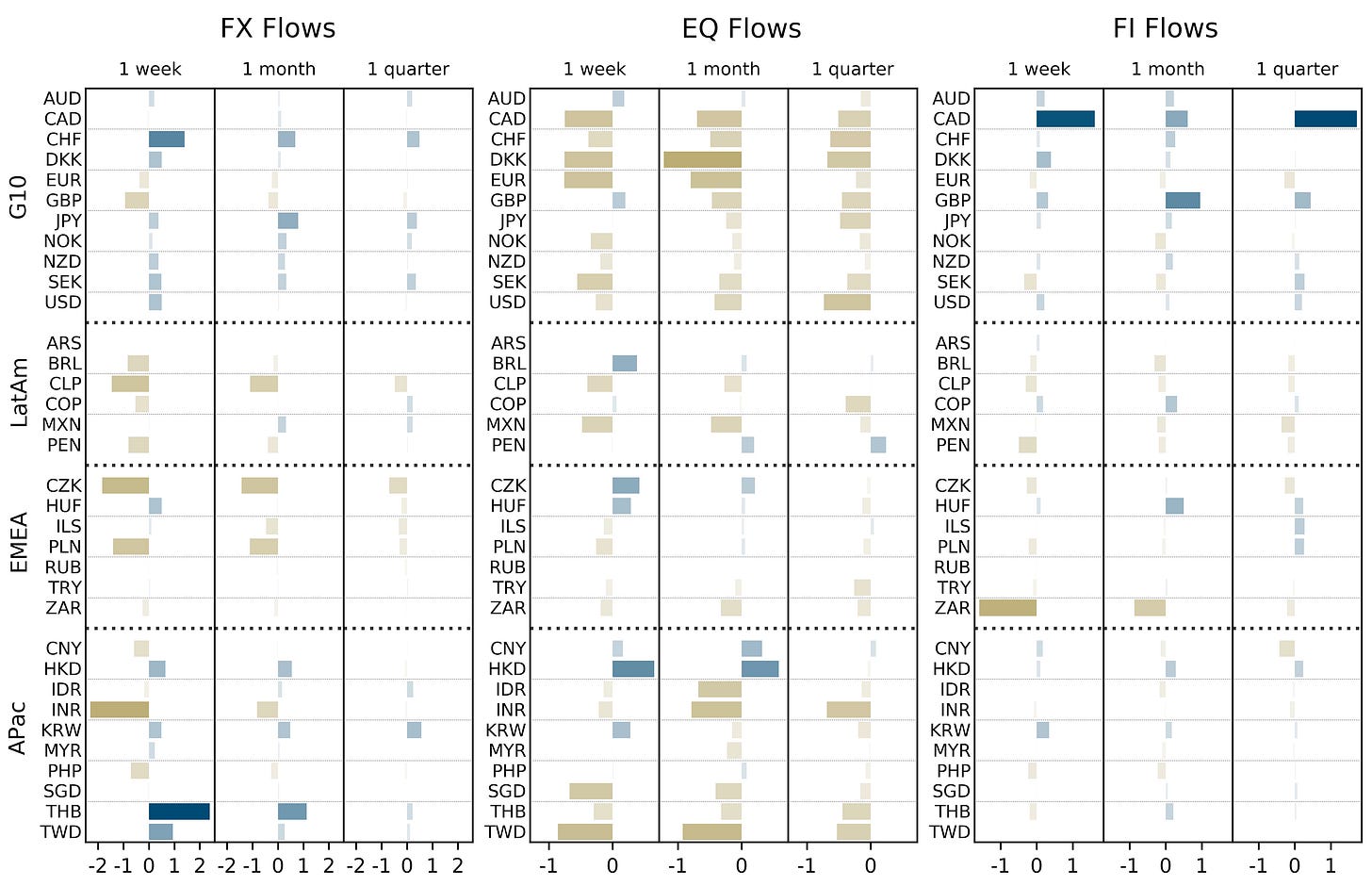

Sectors and Flows

Currency strength:

Swissie still the strongest over one month, but has flattened out

USD and CAD strong as well

EUR is the weakest

Inflows into CHF and JPY on a 1-month basis are a positive, but a bit underwhelming. Flows out of equities:

Equity sector performance:

Defensives are leading: Healthcare, Staples, Utilities, Growth (XLV, XLP, XLU, VUG)

Energy, Metals and Mining, Basic Materials, Industrials are lagging (XOP, OIH, XLE, XME, XLB, XLI)

Similar data in another chart:

International stock markets are mixed over one month: TW50C (Taiwan) is worrisome especially since it's also impacted by tensions with China.

Commodities are also mostly underwater. The outperformer is… sugar, but copper is down 22%:

Sentiment and Positioning

AAII Bull-Bear spread is easing a bit. In the last section you'll find a tweet that shows that retail positioning is finally catching up to the negative sentiment.

Twitter Macro sentiment is nosediving:

Currency sentiment:

Bearish sentiment for CHF, CAD, USD

Bullish sentiment for JPY, GBP, EUR

Different sentiment source:

Bearish sentiment for USD in every USD pair except USDJPY

Bullish sentiment for JPY in every pair

I'm not trading it, but I'm fascinated by how much retail loves silver…

Commitment of Traders:

Equity positioning of Commercials is bullish

Significant Commercial VIX buying (+1.8 SD) and concurrent selling by Large Speculators this week… someone wanted to hedge themselves there

Metals are having a tough time, Commercials continue to build their positions and Large Specs continue to sell.

COT/TFF Dealer positioning for FX futures:

6E is approaching a 2-year high in Dealer net positions

Dealers are offloading their record net long position in 6J

Citi PAIN Indexes are similar to last week with USD long positions near highs:

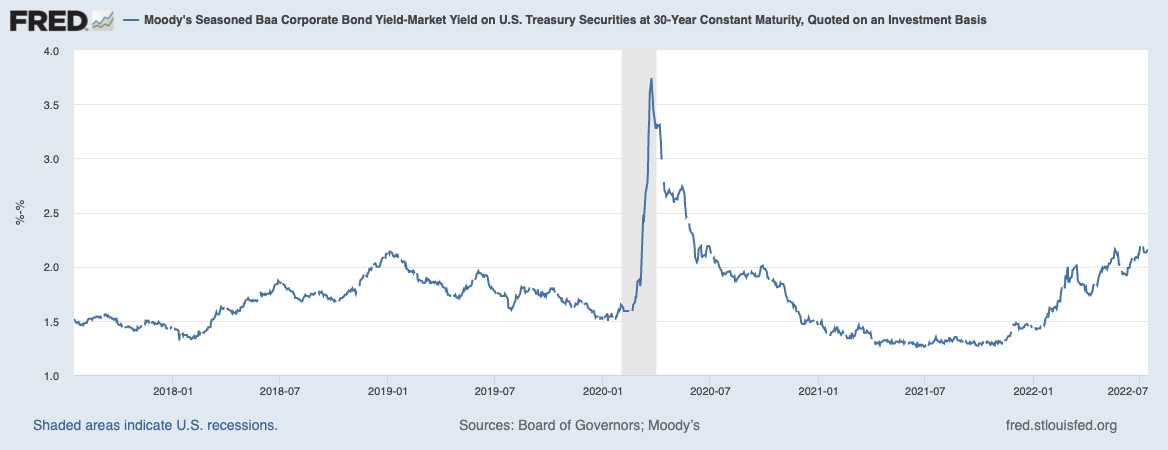

Market Risks

Credit spreads are still relatively wide:

And a credit spread index remains elevated:

The VIX term structure looks quite normal along the front, but it flattens out from November. The front-month has three days to expiration but it still has a discount of about 1.3, so either VIX is moving up until Wednesday or VX1 drops.

Volatility overview:

MOVE still above 120 but has come down while VIX remains complacent

VVIX near lows, this could lead the VIX lower

TDEX made a new low, i.e. the market is not hedging tail risks

Another look at SPX volatility indexes: skew is relatively flat, VIX/VOLI also tells that OTM options are cheap vs. ATM.

FX volatility remains elevated, but isn't moving higher for now:

Various

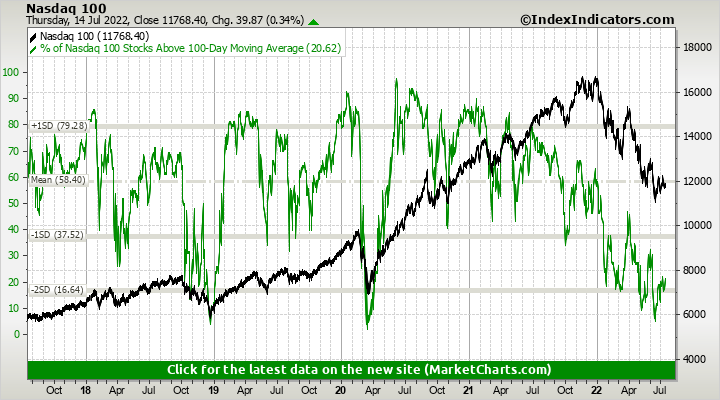

Market breadth still looks weak with the percentage of stocks in the S&P and the Nasdaq at around -2 SD.

CNN Fear & Greed Index at 27:

25-delta risk reversals: they aren't going any lower for EUR, GBP, AUD, NZD. The risk reversal for USDJPY is moving up a bit, but the divergence still remains remarkable.

Other Stuff I've been looking at

Earnings downgrades are up ahead of earnings season:

And another look at earnings expectations:

But analysts still expect record margins ahead:

Retail positioning is catching up to retail sentiment:

Growth over value outperformance highest in over 20 years:

Investors are dumping Energy and Materials stocks:

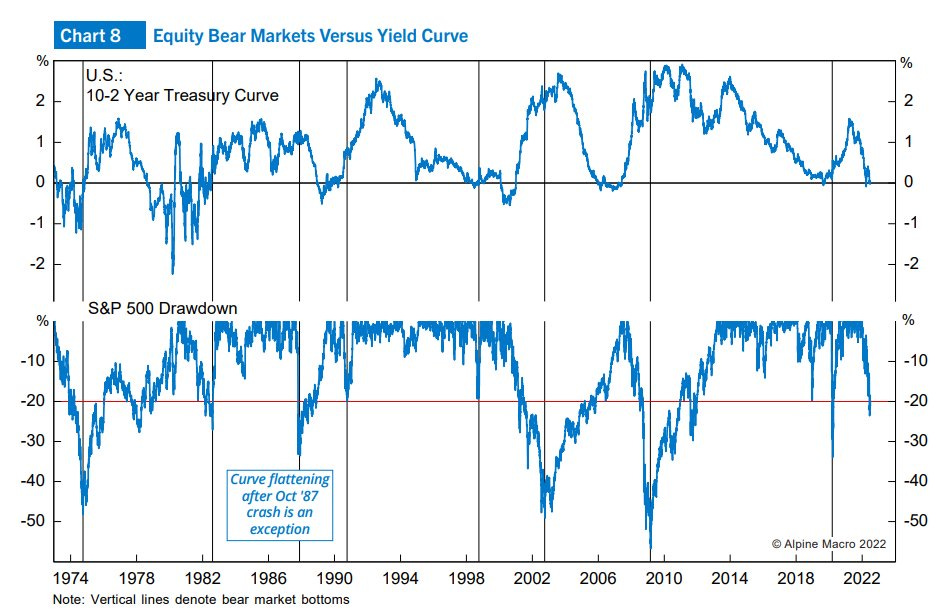

The stock market bottoms when the yield curve bull steepens after inversion:

Crude oil price vs. inflation:

Transportation costs out of China have been tanking:

As for end of the dollar…

And this one is my favourite this week: UoM inflation expectations before and after a one-month revision:

Great analysis as always!

This post is incredible man! Thansk for sharing.