FX and Macro Outlook for Week 28/2022

RBA Rate Statement, FOMC Minutes, BOE Financial Stability Report, ISM Services and more

Welcome to edition #13 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (RBA Rate Statement, FOMC and ECB Minutes, Speakers)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved

Japan: the BOJ making an unexpected U-turn; note that BOJ sources this week talked it down, though

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit; have a look at the BOE Financial Stability report covered below in this issue

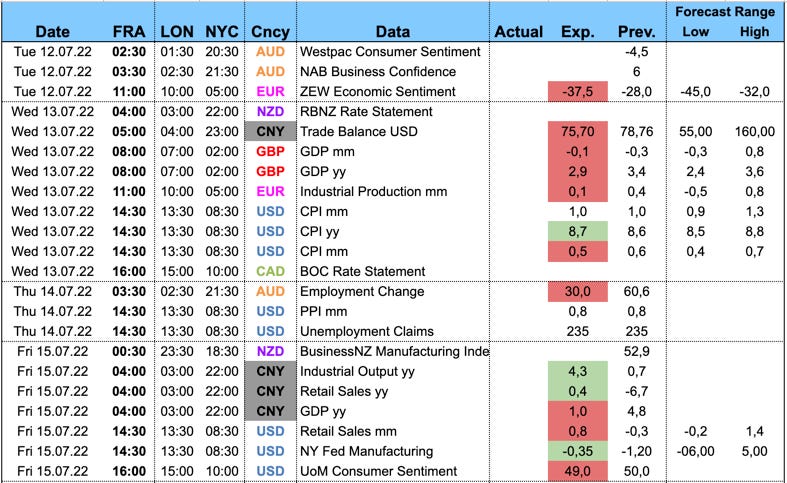

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Rate Statement (05.07.)

Link to full text. Summary and difftext below:

Hike by 50 bps to 1.35% as expected, forward guidance unchanged: “The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.”

Inflation in Australia is lower than in other countries, mostly caused by global factors. Expected to peak later this year and then decline towards 2-3% goal.

Medium-term inflation expectations remain well anchored

The Australian economy is resilient and the labour market is strong

BOE Financial Stability Report (05.07.)

Link to full text here. It's a long and interesting read, here are some bullet points from the summary (emphasis mine):

In addition, cryptoasset valuations have fallen sharply, exposing a number of vulnerabilities within cryptoasset markets, but not posing risks to financial stability overall.

Amid high volatility, liquidity conditions deteriorated even in usually highly liquid markets such as US Treasuries, gilts and interest rate futures. Core UK financial markets have remained functional, with participants able to execute trades, albeit at a higher cost. However conditions could continue to deteriorate, especially if market volatility increases further.

Debt vulnerabilities in China remain elevated, particularly in the property market. The Chinese economy faces headwinds from continued Covid disruption, and a crystallisation of debt vulnerabilities would weigh further on activity.

A more severe downturn and tighter financial conditions could also put pressure on public sector debt in some countries, adding to the strains already caused by the pandemic. The FPC has previously highlighted vulnerabilities created by high public debt levels, including in Europe where yields on public sector debt in some countries have risen significantly during 2022.

Despite the volatility, commodity and wider financial markets have continued to function, although the London Metal Exchange temporarily suspended trading in nickel contracts and cancelled trades between 8 and 15 March after a specific set of circumstances contributed to a sharp spike in prices.

Heightened uncertainty following the Russian invasion means there is a significant risk of further disruption in commodity markets. Further increases in volatility could increase the credit needs of the commodity sector for a given level of activity. Banks have sufficient capital to continue to meet these needs, although there is uncertainty over the amount of credit that will be supplied since it is subject to banks’ judgements on risk management criteria and appetite.

The recent disruption has highlighted how vulnerabilities within commodity markets – and interconnections with the wider financial system – could propagate and amplify macroeconomic shocks.

Some of these are similar to vulnerabilities in the system of market-based finance. Due to opacity and lack of data in some markets, quantifying the size and scale of these fragilities and interconnections remains challenging, and addressing this globally should be a priority.

FOMC Meeting Minutes (06.07.)

The Minutes did not provide anything new, no mention of 100 bps hikes but of an “even more restrictive stance” if inflation persists. Link to full text here. Some relevant quotes below (emphasis mine):

Despite further increases in borrowing costs, financing conditions in domestic credit markets remained generally accommodative.

Spreads on longer-tenor commercial paper (CP) and negotiable certificates of deposit narrowed moderately, with no signs of spillovers beyond the stablecoin market following the collapse of a large algorithmic stablecoin.

Participants observed that some measures of inflation expectations had moved up recently, including the staff index of common inflation expectations and the expectations of inflation over the next 5 to 10 years provided in the Michigan survey.

Against this backdrop, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 75 basis points at this meeting. One participant favored a 50 basis point increase in the target range at this meeting instead of 75 basis points.

All participants judged that it was appropriate to continue the process of reducing the size of the Federal Reserve's balance sheet, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that the Committee issued in May.

In light of elevated inflation pressures and signs of deterioration in some measures of inflation expectations, all participants reaffirmed their strong commitment to returning inflation to the Committee's 2 percent objective.

In particular, participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting. Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.

Many participants noted that the Committee's credibility with regard to bringing inflation back to the 2 percent objective, together with previous communications, had been helpful in shifting market expectations of future policy and had already contributed to a notable tightening of financial conditions that would likely help reduce inflation pressures by restraining aggregate demand.

Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted.

As the further firming in the policy stance would likely result in some slowing in economic growth and tempering in labor market conditions, members also agreed to remove the previous statement language that had indicated an expectation that appropriate policy would result in a return of inflation to 2 percent and a strong labor market.

ECB Meeting Minutes (07.07.)

Overall not much news. Link to full text here, some relevant points (emphasis mine):

Members broadly agreed that the monetary policy normalisation process should continue to be guided by the four principles of optionality, data-dependence, gradualism and flexibility.

Overall, members agreed to retain gradualism as one of the four guiding principles for the monetary policy normalisation process, on the understanding that this did not rule out interest rate steps in increments larger than 25 basis points if and when needed to protect price stability over the medium term.

A number of members expressed an initial preference for keeping the door open for a larger hike at the July meeting.

A larger increment would be appropriate at the September meeting if the outlook for medium-term inflation had not improved by that time.

Looking beyond September, members widely agreed that, on the basis of the current assessment, a gradual but sustained path of further interest rate increases would be appropriate, with the pace of adjustment depending on incoming data and developments in the medium-term inflation outlook.

Attention was drawn to the widening of sovereign spreads over recent months. A call was made for work on a possible new anti-fragmentation tool to be accelerated and completed rapidly since the risk of fragmentation could intensify as the ECB advanced with its monetary policy normalisation.

Confab, Speakers, News

Federal Reserve

Bullard (Hawk). Thu: 75 bps hike in July makes a lot of sense, wants to get to 3.5% and see where we are on inflation, then make “tweaks” including possible rate cut, high inflation is straining Fed's credibility, forward guidance helps bringing inflation under control more quickly, good chance at soft landing, labour market could cool off a bit and still be strong

Waller (Hawk). Thu: supports 75 bps in July and probably 50 bps in September, need to frontload hikes with large increases early, after we get to neutral we can flatten out further increases, needs to see Core PCE come down to 2.5-3% before easing rates, no chance he'd be comfortable with 3% inflation, effect of balance sheet reduction already priced in, good chance of soft landing, not clear we're going to have a recession, slowing down growth for 9-12 months would be sufficient to get inflation back down without a recession

Bostic (Dove). Fri: supports 75 bps in July, need to move aggressively, economy is starting to slow and that's what we need, we can move 75 bps without a lot of damage to the broader economy

Brainard (Dove). Fri: crypto platforms are highly vulnerable to deleveraging, cannot wait to see the crypto ecosystem become so big and interconnected that it could pose a risk to financial stability

Williams (Dove). Fri: debate on 50 vs. 75 bps is right position for July meeting, wants Fed Funds Rate at 3-3.5% by the end of the year, lot of uncertainty after that, full effect of Fed pivot won't be apparent until later in the year, economy is slowing but recession is not a base case

European Central Bank

Nagel (Hawk). Mon: anti-fragmentation tool must be strictly temporary with narrowly defined conditions, impossible to determine whether widened spread is fundamental, cautions against using monetary policy to limit risk premia of indebted countries, unanchoring of inflation expectations must be prevented no matter what

De Guindos (Dove). Mon: “excessive” divergence of bond yields makes uniform transmission of monetary policy impossible, ECB will react to prevent fragmentation, inflation pressures have broadened and intensified, inflation will remain elevated for some time, expects positive growth throughout the projection horizon

Enria. Thu: higher interest rates have a positive impact on banks’ earnings, but in the broader context of an economic recession they would deteriorate

Visco (Dove). Fri: rate hike bigger than 25 bps could be appropriate in September if medium-term inflation expectations don't improve, interest rate to increase by 25 bps in July, 10y BTP/Bund spread of 250 bps in early June was not consistent with Italy's economic fundamentals, financing conditions must not become too tight

Sources. Thu: new ECB tool (Transmission Protection Mechanism) still has a lot of work to be done, not certain it will be ready by the July meeting

Bank of England

Bailey (Neutral). Tue: global financial conditions have tightened significantly, UK banking system remains strong

Tenreyo (Dove). Tue: expects QE unwind to have no material effect on UK economy

Cunliffe (Neutral). Wed: current inflation is primarily coming from abroad, price rises will not continue forever, we can already see that the economy is slowing

Pill. Wed: open to interest rate moves >0.25% if economic circumstances warrant, emphasizes focus on returning inflation back to 2% target, sees his role as being “in the price stability business”, big one-off moves can be disturbing to markets, there's a case for a steady-handed approach, sceptical of forward guidance. Thu: willing to adopt faster pace of tightening if required

Mann (Hawk). Thu: UK inflation is broadening, medium inflation expectations elevated, uncertainty about inflation strengthens case for front-loading hikes, output is slowing but PMIs suggest growth is still positive

Bank of Japan

Sources. Thu: BOJ will raise its inflation forecast to slightly above 2% at their July meeting but maintain ultra-low interest rate, BOJ may tone up view on inflation expectations, warn of risks from global slowdown

Economic Data

Monday, 04.07.22

German Trade Balance and Eurozone PPI: both surprised to the downside, EUR was weaker

Swiss CPI: hotter than expected, CHF was weaker

Canadian Manufacturing PMI: below the previous print, CAD was largely unchanged. Below are charts and summaries from the PMI report (link) and from the BOC Business Outlook Survey (link):

"There were signs of difficulty in Canada’s manufacturing sector in June. The PMI dipped to the lowest for 17 months amid softer uplifts in output, new orders, purchases and employment. Global supply issues and steep price pressures were at the heart of the issue, and are expected to continue to disrupt the manufacturing economy this year.

"Canadian manufacturers particularly struggled with sourcing key materials. A notable slowdown in purchasing activity could hinder production significantly over the coming months. Sales was also hit hard, but more so from international markets at the end of the quarter.

"A dip in confidence indicates firms are aware of the real difficulties that could hit the global economy in the next 12 months. Firms have recovered well from the pandemic and will now have to gear up for further hardship."

BOC Outlook Survey:

Many businesses continue to expect strong sales growth, but an increasing number of these firms expect the pace of growth to return to normal following a fast recovery from the pandemic. Some firms also anticipate that labour shortages will limit growth in their sales.

The number of businesses reporting labour-related constraints and supply chain bottlenecks remains at a record high, suggesting that supply is not keeping up with demand. About half of firms with supply chain challenges expect them to persist until the end of 2023 or beyond.

As in recent surveys, many businesses anticipate significant wage and price increases. Pressures on input and output prices continue to be linked to supply chain issues.

Businesses’ expectations for near-term inflation have increased, and firms expect inflation to be high for longer than they did in the previous survey. Still, most see inflation returning to 2% over time. They noted various factors needed for inflation to return to target, including higher interest rates, improved supply chains, lower oil prices and a resolution of the war in Ukraine.

Consultations with firms and experts in the energy sector suggest that growth in capital expenditures will be robust but less than in previous commodity price booms.

Tuesday, 05.07.22

Kiwi NZIER Business Confidence: below the previous print, NZD was initially weaker

Chinese Caixin Services PMI: above consensus and above the 50 mark, AUD was weaker

The RBA Rate Statement was met with AUD weakness as well

Kiwi Dairy Price Index: below the previous release, NZD was stronger

US Factory Orders: above the forecast range, USD was indecisive

Wednesday, 06.07.22

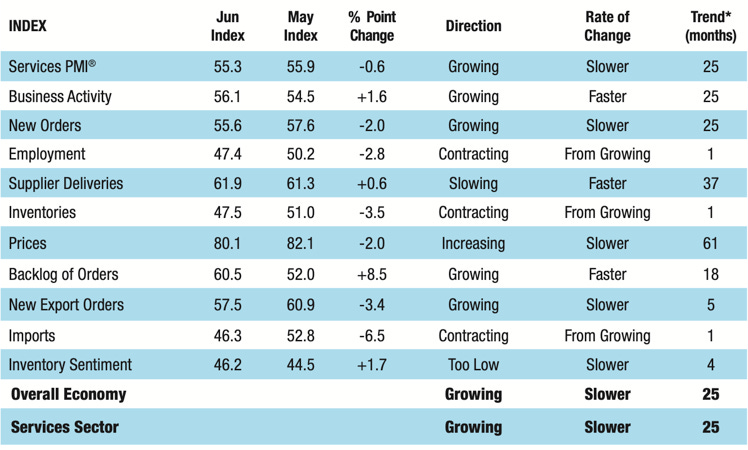

US ISM Services PMI: beat expectations, USD was stronger. Summary and relevant parts from the report below (link to full text):

“According to the Services PMI®, all 18 industries reported growth. The composite index indicated growth for the 25th consecutive month after a two-month contraction in April and May 2020. Growth continues — albeit slower — for the services sector, which has expanded for all but two of the last 149 months. The slight slowdown in services sector growth was due to a decline in new orders and employment. The Employment Index (47.4 percent) contracted, and the Backlog of Orders Index grew 8.5 percentage points, to 60.5 percent. Logistical challenges, a restricted labor pool, material shortages, inflation, the coronavirus pandemic and the war in Ukraine continue to negatively impact the services sector.”

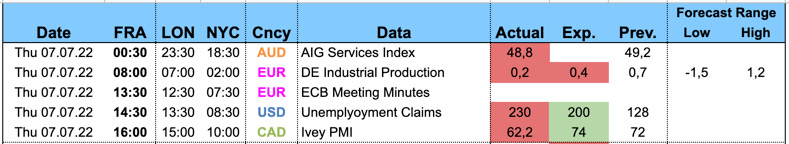

Thursday, 07.07.22

Aussie AIG Services Index:below the previous value, AUD was unchanged. Here's the summary from the report (emphasis mine, link to full text):

"With interest rates rising for the first time in a decade, we have seen a 'two-speed' services sector emerge in June. Industries which are sensitive to sentiment changes – such as business & property, and personal & recreational services – declined into contraction. Less interest-rate-exposed services remained in a growth phase. With the RBA increasing rates by 50 basis points again this week, we would expect this two-speed pattern to gather pace."

German Industrial Production: below expectations, EUR was weaker

ECB Meeting Minutes: EUR reacted weaker

US Unemployment Claims: worse than expected, USD zig-zagged

Canadian Ivey PMI: very weak, CAD was initially lower but recovered

Friday, 08.07.22

Canadian Employment Change: weaker than expected, but the Unemployment Rate was unexpectedly lower as well; CAD strengthened

US Non-Farm Payrolls: above consensus, USD was knee-jerk higher but sold off afterwards. Here's a link to a great Twitter thread by Alfonso Peccatiello a.k.a. Macro Alf explaining what's going on under the hood there.

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow stands at -1.2%:

The NY Fed Weekly Economic Index puts four-quarter GDP growth at 3.17%.

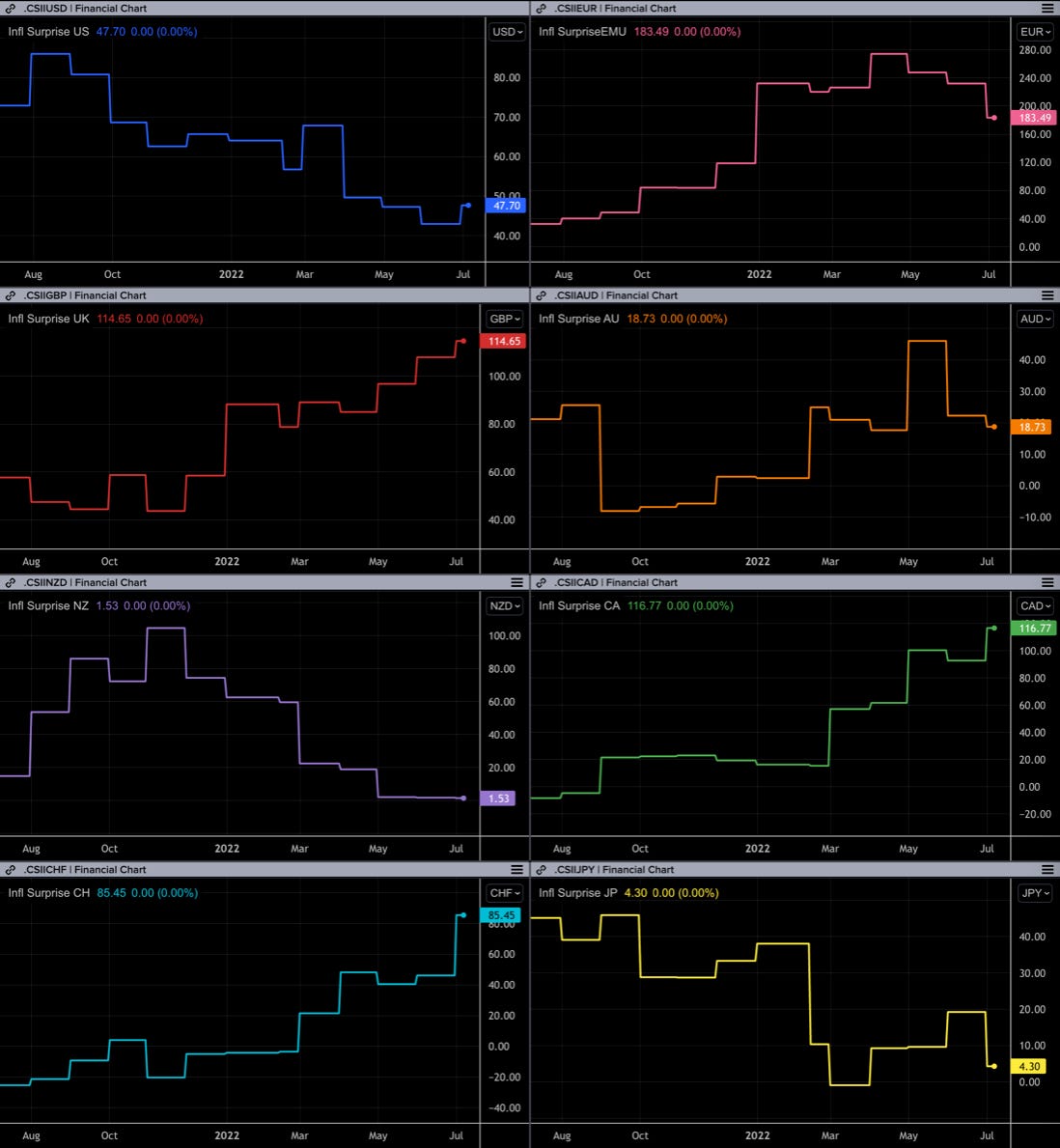

Citi Economic Surprise Indexes:

USD is improving and AUD has been outperforming massively over the last week

EUR and GBP slowly deteriorating further

CAD off highs and rolling over

Global PMIs are similar to last week:

Mostly weaker

China is improving a bit (not surprising given their April PMIs), but other that that there's not much positive coming out of Asia

As for PMIs, there's quite a divergence between Citi Economic Surprise Indexes for Emerging Markets (rising) and the G10 (plummeting):

5y5y forward inflation expectations are 2.12, so somewhere in the middle of the range they've been trading in since the beginning of 2021:

The Inflation Expectations ETF is down as well:

Citi Inflation Surprise Indexes:

UK, Canadian and Swiss inflation still continues to surprise to the upside

Eurozone, Australian and Japanese inflation surprises are negative

Yields

Looking at the chart and table below:

All G8 2s and 10s have weakened considerably

Swissie is a remarkable underperformer with the 2-year yield negative once again

CAD looks like the relative outperformer

US 10-year yield back above 3%

Yield curves along the 2s10s spread:

USD and CAD curves are flattening heavily, the US curve is inverted once again, the Canadian one is 2.2 bps above zero

The German curve is steepening. It's very unlikely that this is about expected growth, but rather about higher inflation and a constrained central bank.

Central Banks

FedWatch prices the upcoming FOMC meeting at 75 bps (and a chance for a 100 bps hike of 8%):

Two 50 bps hikes and one 25 bps hike in September, November and December, respectively

This puts the FFR at 3.5-3.75% at the end of the year

First rate cut priced in July 2023

Short-term interest rates: expectations for the Fed hiking path this year are holding up while pricing for rate rate cuts next year is getting more pronounced:

Sectors and Flows

Relative currency strength: USD and CHF are the strongest over a 1-month horizon, AUD, EUR, NZD and GBP are the weakest:

Bond ETFs starting to show up in ETF flows… it's been a while:

BNY Mellon iFlow:

Flows into CHF on a 1-week basis

Flows into JPY on a monthly basis

Equity flows mostly negative

Relative sector performance: all sectors in the red over three months. Defensives are leading (Healthcare, Staples, Utilities, Value) while Energy, Materials and Consumer Discretionary are the laggards. The relatively good performance of Tech (XLK) is a bit surprising:

Sector-wise it's been a relatively offensive week in markets with Communication/Tech and Cyclicals leading. Over a longer timeframe it's still looking very bearish:

It's not a sector per se, but here's the 24 largest-cap IPOs of the last quarter:

International stock markets:

Divergence between Asian markets with Hang Seng (HSI), Topix, Nikkei outperforming, and Taiwan (TW50C) and South Korea (KOSPI) lagging

European indexes are holding up surprisingly well despite the geopolitical and energy situation

Commodities are also having a rough time: Palladium is the outperformer, followed by Silver. Almost everything else is in the red with Copper being down almost 20%.

Sentiment and Positioning

The AAII Bull-Bear spread is basically unchanged from last week:

The Euphoriameter is tanking:

Currency sentiment is still very bearish on CAD, CHF and USD, and it's very bullish on JPY.

Another sentiment source:

Traders added significantly to their long EUR positions vs. JPY and GBP

USD pairs mostly have bearish sentiment vs. USD

Every JPY pair is bullish on JPY

Commitment of Traders:

Still very supportive Commercial and Large Trader positioning for equity indexes

Metals are deep in the red with Palladium being the sole exception. Commercials are positioned at an extreme long for all metals

COT/TFF data for FX futures: no extreme positions with regards to Z-score or %R here.

Citi PAIN indexes show USD long positioning is increasing vs. all other G8s:

Market Risks

Credit spreads are still wide albeit a bit off recent highs:

And an index of Credit Stress remains elevated:

Currency volatility seems to be taking a bit of a breather by moving sideways:

The VIX term structure is looking relatively benign with spot VIX about 1.5 points discount relative to VX1:

MOVE and VIX are diverging once again. VVIX remains thoroughly unimpressed and could lead VIX lower:

Some more specialized volatility indexes:

TDEX is very low, i.e. tail hedges are cheap because no one seems to be buying them

SDEX and VIX/VOLI also show OTM puts are very cheap

Various

25-delta risk reversals:

The divergence between JPY and its risk reversal is still stark, i.e. the options market expects a strong yen appreciation

AUD and NZD are priced higher

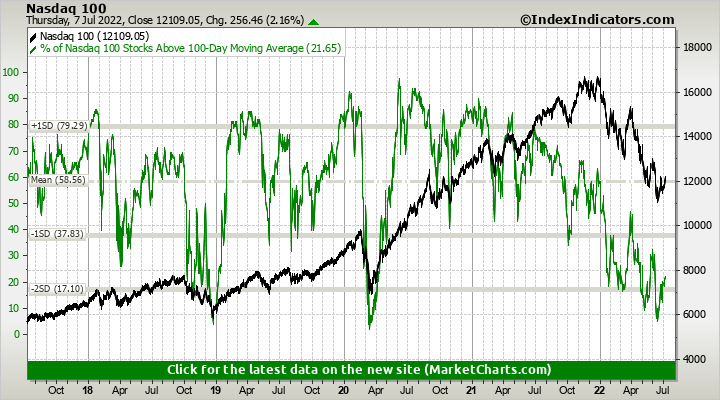

Market breadth in the S&P and the Nasdaq still looks pretty bad. The number of stocks above their 100-day moving average is low and it's barely moving up.

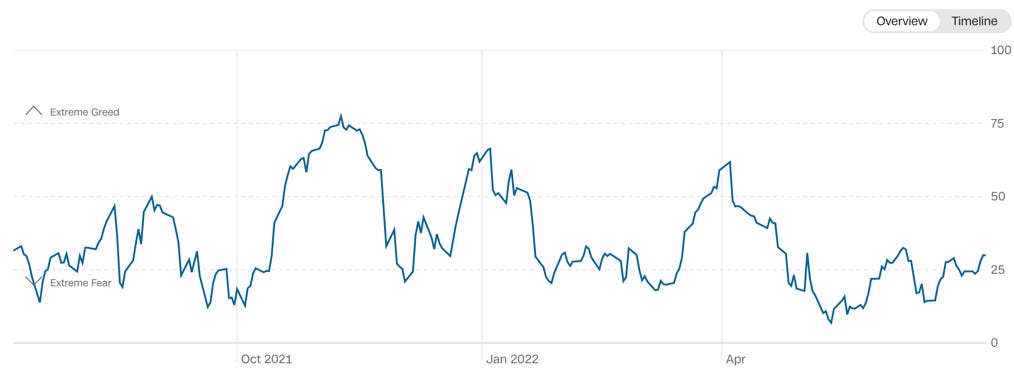

The CNN Fear & Greed Index is at 30, and it's been trending upwards since mid-May:

BlackRock Geopolitical Risk Indicator virtually unchanged from last week:

Other Stuff I've been looking at

Great mnemonic for the interest rate cycle:

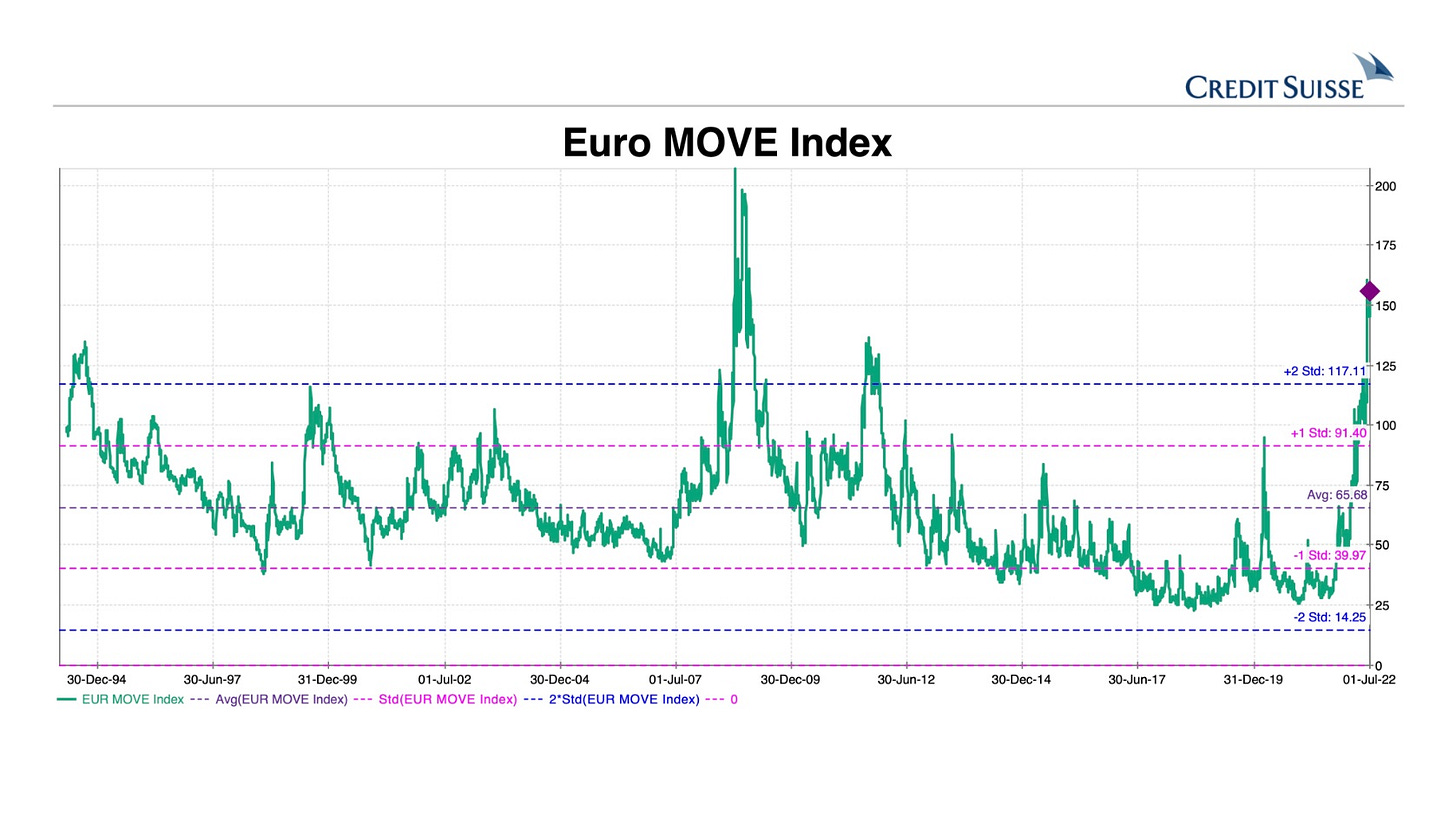

The (US) MOVE index is nothing compared the the Euro MOVE:

Consumer Sentiment and Profit Margins are diverging hard:

Earnings drop less in recessions with high inflation:

Market implied recession probabilities:

Cyclical vs. defensive fund flows are at an extreme:

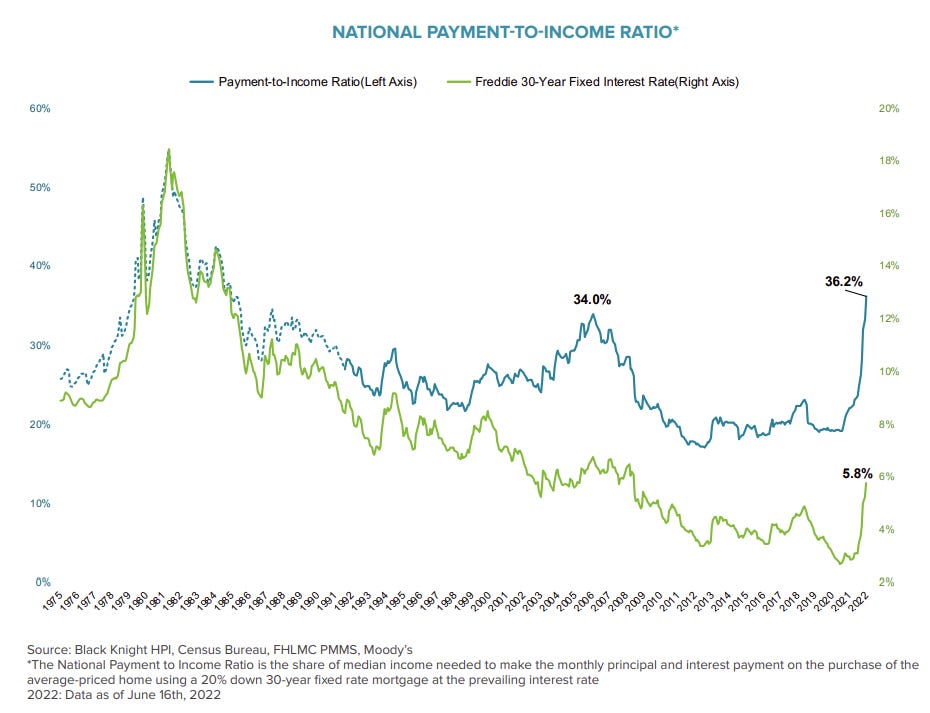

Housing affordability is at its worst point since the 1980s:

The Global Credit Impulse is weakening:

Bloomberg GDP and Inflation forecasts now vs. at the beginning of the year:

We're in a bear market, but retail investors have continued to put money into the market while institutionals have pulled amost $200 million:

Historical DXY performance during Fed hiking cycles:

awesome analysis! highly appreciated