Hi there! It's already Sunday, so it's time for another edition of fx:macro Lite! Great to have you here!

Below you’ll find a brief overview of how I look at sector rotation as one input in an overall macro picture. This is what MidJourney thinks the business cycle looks like in watercolours. I had to fish out all the images with bicycles but the result is pretty amazing.

In case you missed the usual deep-dive yesterday, you can still sign up for that here and get access to the premium content:

💎 ECB Prep for next week

We have two central bank meetings coming up this week: the BOC and the ECB. If you're trading a central bank meeting, the preparation for that should always include recapping the last rate statement and minutes, looking at the economic data that was released since then as well as the comments from decision-makers.

Here’s the prep for the ECB meeting, I’ll include the one for the FOMC next weekend:

Meeting preps are included in fx:macro Premium for every G8 central bank before their meetings. Sign up by clicking on the button above if you’re interested in that!

Let me give a quick shout-out to one of my favourite newsletters, Snippet Finance. They curate the most interesting snippets on finance and investing and deliver them in a short easy-to-digest form. Curated by an investor for investors. Check them out!

💡 Business Cycle and Equity Sector Performance

I was recently asked why I’m looking at equity sectors as part of a macro overview, so I thought it would be a good idea to write a few words on that.

Here’s a nice chart from Fidelity that shows how different sectors perform during the four phases of the market cycle:

After a recession, you want to be long Financials (because the yield curve steepens and demand for credit increases), Consumer Discretionary and Industrials (because businesses and people start spending more).

Late in the cycle, it’s Energy that outperforms, and

During a recession, defensive sectors like Consumer Staples, Healthcare and Utilities are where portfolio managers can hide.

The whole thing also works in reverse: if we know what sectors are currently performing, it gives us an indication of what stage of the cycle we’re currently in. Or at least what stage the stock market is currently in. Other assets might do their own thing.

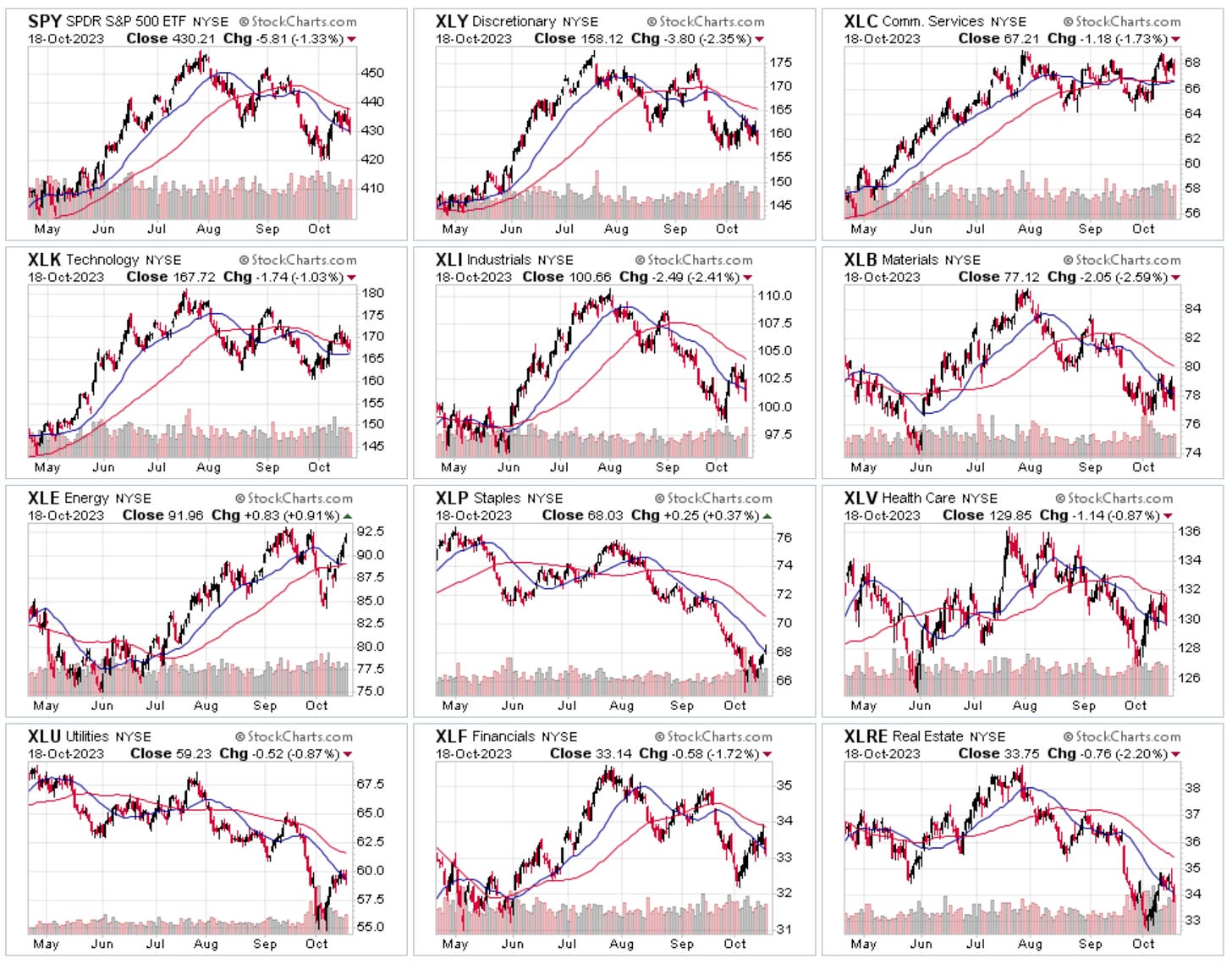

There are countless websites showing the performance of stock market sectors in various different ways. If you’ve followed me for a while, you know I like to look at the charts from Finviz and stockcharts.com. I also like checking out the thumbnail charts because they are a bit more fun:

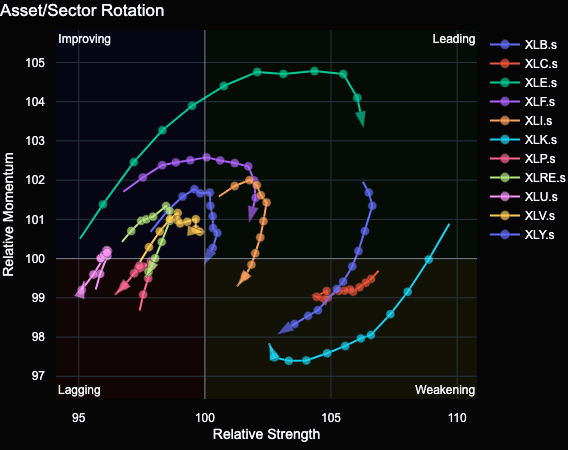

Another way is to look at rotation graphs: they look at the performance of every sector relative to a benchmark and plot the strength along the x-axis and the momentum on the y-axis:

Leading sectors are in the top right quadrant: they show both relative strength and momentum vs. the benchmark.

Sectors in the bottom right still show relative strength but have lost momentum: they are weakening.

The bottom left corner is where sectors end up when they have lost momentum and have become weaker than the benchmark: they are lagging.

Finally, if sectors are picking up momentum from there, they move into the top left quadrant and are considered to be improving.

Movement generally happens in the clockwise direction. Since the rotation chart is calculated on a weekly basis, it offers a higher-level view.

Currently, Energy XLE 0.00%↑ and Financials XLF 0.00%↑ are the only sectors in the top right quadrant. The outperformance of Energy fits the idea that stocks are at the top or in the late stages of the cycle. Utilities XLU 0.00%↑ and Consumer Staples XLP 0.00%↑ are in the bottom left quadrant and seem to be stuck there, which probably isn’t where theory would put them. What about Tech? XLC 0.00%↑ and XLK 0.00%↑ are both in the bottom right, i.e. “Weakening”, along with Consumer Discretionary XLY 0.00%↑. That makes sense when we believe in the idea of being in the late stages of the cycle.

One last thing I want to mention: just like the S&P 500, sectors can be dominated by a few stocks that are given outsized weights. Take XLY 0.00%↑ as an example where just two stocks make up 42% of the entire thing: AMZN 0.00%↑ and MCD 0.00%↑. It makes sense to look at the ETF holdings (or index constituents) if you’re working with sectors to put their moves into perspective.

Check out this chart of XLY 0.00%↑, AMZN 0.00%↑ and the ratio of the two since the bottom of the Covid low. It’s pretty clear that most of the performance of the ETF is driven by Amazon… in good times as in bad times:

🧠 Tweet of the week…

To be honest, when I saw this the first time, it didn’t have the context debunking it attached, and I believed it. Sorry Australians 😂

Looks like we’re perfectly on point: