Hi there! It's already Sunday, so it's time for another edition of fx:macro Lite! Great to have you here!

The cover image is what Midjourney thinks someone committing a chart crime looks like. If that sounds interesting to you, just go on reading…

In case you missed the usual deep-dive yesterday, you can still sign up for that here and get access to the premium content:

💎 Central bank speaker recap for the week

Keeping up with central bank chatter (and economic data) is probably one of the most important pieces of homework when you’re trading currencies. Here’s a summary of everything that was said this week:

💡 Chartcrime 101 for traders

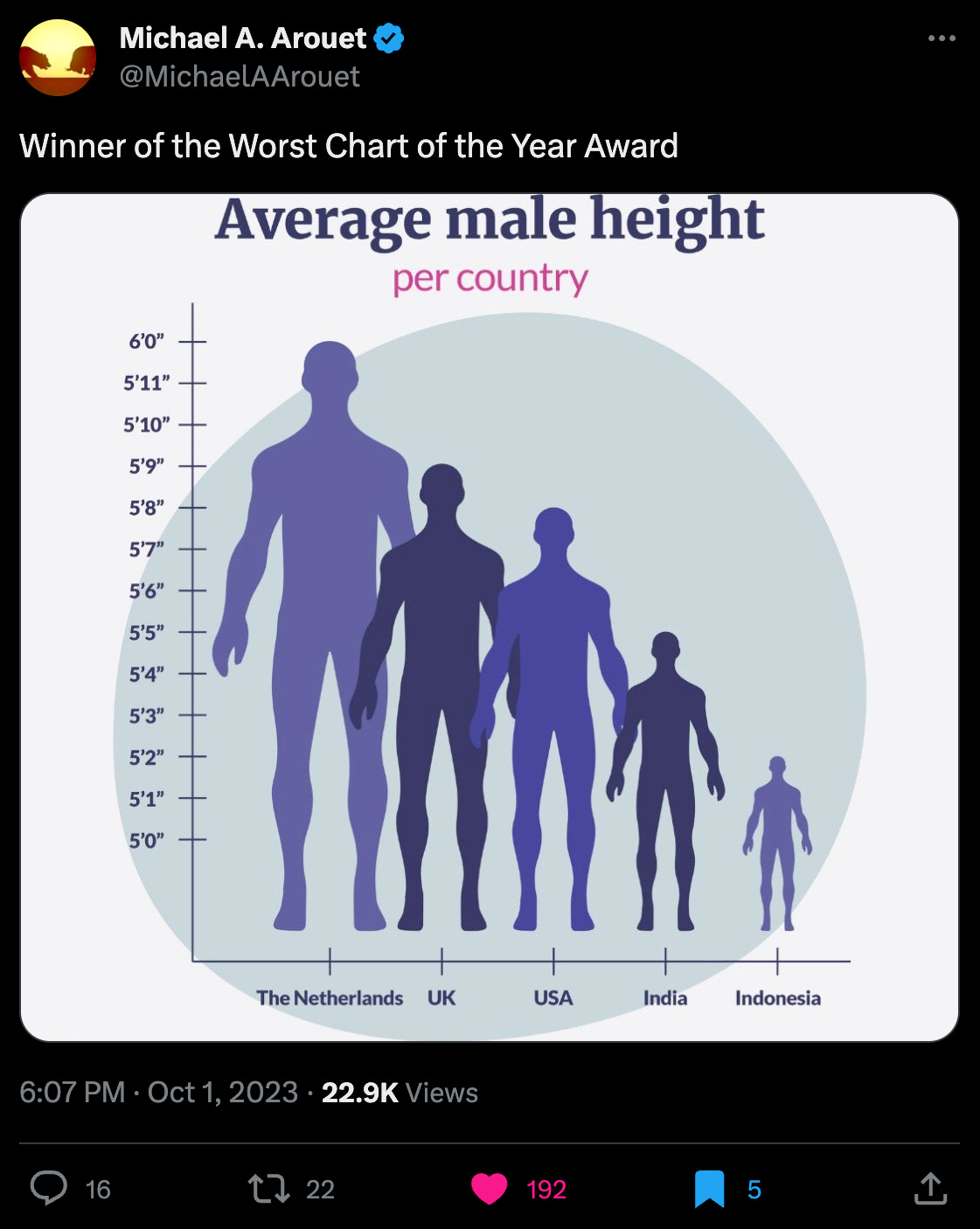

This week, I came across the following tweet by @MichaelAArouet:

It's immediately obvious why this chart is funny and bad:

The sheer proportions of each figure look strangely alien, and

You just can't scale the figures that way when the y-axis doesn't go all the way to zero. A height of 6” (about 1.80 m) is 20% taller than 5” but the tiny Indonesian in the chart is only about a quarter of the size of the Dutch giant on the left.

Charts are among the most essential tools we use in trading, so it makes sense to look at some common pitfalls around them.

⏳ Linear charts over long timespans

This is an easy one. Look at the monthly chart of AAPL 0.00%↑ on a linear y-axis and you'll see that you can't see much except for a humungous rally that started around 2009. And the candles are only getting bigger over time:

Compare that to a logarithmic y-axis: The period up until 2009 was actually a lot more volatile compared to everything since. You would have missed most of the action when looking at a log chart:

Notice the numbers on the y-scale: they are not increasing linearly. A certain price move in percentage terms will always be of the same size no matter if it happens at $0.10 or at $200. The longer the time scale and the larger the difference between lowest low and highest high, the more relevant log charts are:

It's a good idea to look at stock charts on a log scale,

It doesn't matter for FX (because currencies typically don't move by orders of magnitude),

It's a very bad idea to look at most futures charts on a log scale, and we'll see why that's the case below

Oh, and Bitcoin… log scale, of course

So, the AAPL 0.00%↑ chart nicely brings us to the next topic: did AAPL 0.00%↑ really trade at around $0.08 in the 1980s?

💸 Dividends matter… and splits, too

Short answer: no, it didn't.

First, we have to account for stock splits: in case of a 2-for-1 split, for example, every price before the split is cut by 50%. That makes sense because if we didn't do that, we'd have huge gaps on the chart when the price is cut in half (or in the case of AAPL 0.00%↑ in 2014, in 1/7th):

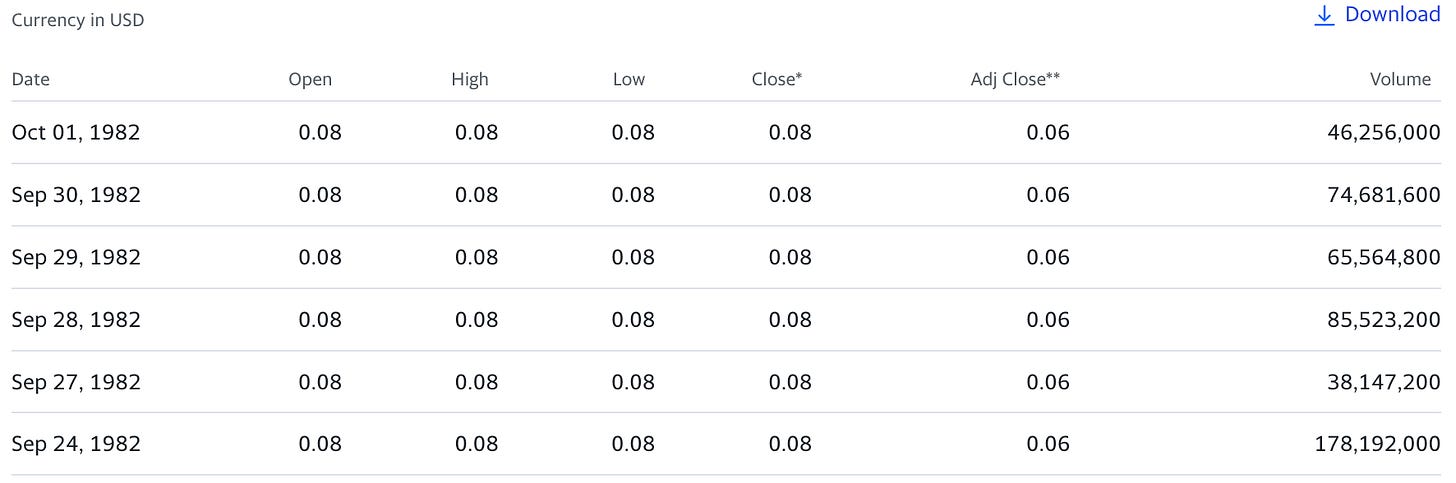

AAPL 0.00%↑ IPO’ed at $22.00 but with all the adjustments in place, historical data puts it well below $1. Here's a snip from Yahoo Finance:

The “Close” is where Yahoo Finance factors in stock splits, and the “Adj Close” is where they also take dividends into account. Notice that the open, high, low, close are all identical. In reality, they certainly weren't: it's the side effect of rounding the whole calculation to two decimals. If you strip out the entire movement of a stock over days and weeks, that's a lot of lost information due to rounding…

Second, we need to look at dividends: when a stock pays a dividend, its price immediately drops by the amount paid out per share. Similar to a stock split, we have to adjust everything prior by the same percentage amount as the dividend payout, and we have to do that every time a dividend is paid out.

AT&T T 0.00%↑ is a great example. Here's the chart with splits and dividends included (i.e. prior prices are adjusted accordingly):

And here it is without dividends: it looks quite different, and if you check the y-axis, you'll see that it starts at around $3.30 instead of $0.50 or so.

What's the truth now? Well, if you're a long-term holder then you're probably interested in the first chart that factors in dividends and better shows your total return. If you're in it for very short periods, then it probably doesn't matter too much.

And what about technical analysis because levels and trend lines (if you're into that)? There's no clear answer, and I guess that most traders are looking at adjusted charts with both splits and dividends factored in. But: there is no truth here.

By the way, you can toggle dividend adjustments on TradingView by clicking on the “ADJ” button in the bottom right:

But wait, it gets weirder…

⚠️ Futures data is always a mess

And I mean it. Stocks don't have an expiration date, so there is just one AAPL 0.00%↑ or NVDA 0.00%↑ stock trading. But there are tens of different expirations trading for many commodity futures, each with a different price. So, how can we look at the historical price of, say, crude oil or wheat?

The short answer: we construct what is called a “continuous chart” by taking the front-month expiration and rolling that over into the new front-month as soon as the old one expires. Sounds simple enough but consider this: there's no standardized way to do this or when to roll. Every platform has a different way of doing it. Every single one. That's why two futures charts from different platforms will often look very different.

The way most continuous charts are created is by adding or subtracting the difference between the old front-month contract and the new one. That sounds kind of similar to how dividends are factored in when looking at stocks. But the crucial difference is: with futures, the price difference is added or subtracted while with stocks, it's adjusted on a percentage basis.

The way the calculation in futures is done means that a move from $5 to $7 in CL is worth $2,000 per contract but it's not a 40% move. That's very different from stocks: going from $5 to $7 is, in fact, a 40% gain.

If that sounds weird to you, welcome to the club. But have a look at this chart:

Two things stand out here:

TradingView tells us that the 1-day price change was 1,522%, or in other words: the price of ZM has increased 15-fold or so on one day with a candle that doesn't look much out of the ordinary…

Prices to the left of the crosshair are all negative. ZM didn't really trade with negative prices but that's an artefact of the adjustments that have been made on this continuous contract.

That brings us to the golden rules of futures charts:

Don't use percentages when dealing with adjusted continuous charts, and

Always use the linear scale because log magnify numbers close to zero like this:

Alright, so we're already beyond the 5-minute mark but I wanted to spare you another cliffhanger. There are more nuances to this, of course, but that's it for this week.

Let me know what you think and leave a like if you… like this post.

See you next week!

Been doing data charts and graphs for 40 years. I am a fan of Edward Tufte. The above is excellent work as applied to charting.

Love the lightheartedness in the explanations. Fun and engaging. Have a great week ahead!