In this article, we will go through a series of trading days from Monday to Thursday and see how news and data lead to trading ideas and decisions. Before we do that, however, I have included a short (-ish) introduction on how that ties in with my weekend prep (i.e. my newsletter) and with my overall trading style.

Please note that this post doesn’t go out via email because I don’t want to spam people’s inboxes.

Here’s a short Table of Contents with links to jump to the respective sections:

How my newsletter works

How to deal with incoming information

Before the week starts off...

Monday…

Tuesday with the RBA and Jay Powell

Wednesday and the BOC Rate Decision

Thank god it’s Thursday

Wrapping it up…

I've received a question from a reader who wanted to know how my trading week was going given that my outlook on this week was about 100% at odds with what actually happened.

It’s a very good question, and I believe the answer is valuable and instructive because it can illustrate two important points:

How my newsletter “works”, i.e. what the analysis in it can and can not provide, and

How to deal with incoming information and how that can completely change my outlook on the market in a very short amount of time.

Let’s talk about these two points before we get to the practical part of this post.

How my newsletter works

The first point concerning my newsletter actually has two dimensions:

How it works for me, and

How it works for you, the reader.

This has always bothered me a bit: it does work very well for me, i.e. by writing (and reading) it I get a very good picture of what’s happening in markets. But I realize that when I write, for example, that my “bias for USD” is long or short, this is very vague and not at all specific or actionable.1

Summing up the overall macro situation and the bias for each currency, there are a number of different things going through my mind, for example:

Sometimes I opt to leave a bias unchanged despite thinking I should change it just because I don’t want to make it a back-and-forth

Sometimes I change it but I fear the market will go the exact opposite way next week and it will look stupid

Sometimes I put in “neutral” even though I have a very specific trade idea in one direction or the other but it’s not general enough to justify it as a bias

To be honest, the whole assessment is very subjective and subconsciously influenced by what I believe you, the readers of fx:macro, might expect and probably a variety of other psychological biases that come with publishing and everything that hangs on that.

Writing has a recursive effect: as soon as you know others will read your writing this knowledge will have an influence on what you actually write (and think).

This is one of the main reasons why I will not publish specific trade ideas: the recursive effect of writing would very likely make my own results worse. It’s also one of the reasons why I have such a huge respect for everyone who does publish their trades.

I “solve” the problem of subjectivity, vagueness and ambiguity in my commentary by providing you with the raw bullish and bearish arguments for the overall macro situation and each of the G8 currencies as well as the raw data and charts I’m working with so that you can pretty much make up your own mind and develop your own view on your timeframe because it’s most likely different from mine.

Since the readership of my little newsletter keeps growing, it seems that you as the audience already understand the idea of how it is supposed to be used very well. Nevertheless, I thought it would be a good introduction to this post.

How to deal with incoming information

The second point, how I work with incoming information, is vital to how my style of trading works. My mantra is:

Strong opinions, weakly held

I think the first time I came across this concept was when I read something by Barry Ritholtz. He sums it up nicely in a timeless blog post (emphasis added):

Being a successful investor often requires you to hold numerous internally conflicting concepts simultaneously — something many the average psyche has difficulty with. One must think through the best possible analysis for your positions, and expend time and effort to thoroughly test them. You need to be able to strongly argue your postion — bullish, bearish or cash — but at the same time, be ready to admit error and change views.

And in another similarly timeless blog post, Peter L. Brandt applies it to trading as straightforward as it gets (emphasis added here as well):

When I express an opinion about a particular chart, it is most often a strongly held opinon. Keep in mind that for me a strong opinion does not necessarily equate to a trading position. Trading positions are brought about by a strong opinion PLUS a specific technical set up PLUS a favorable reward to risk relationship.

Strong Opinions, Weakly Held! What a great concept for a trader.

It sounds deceptively simple but it’s very hard to put into practice.

So, when I look back on this trading week and I see that I went into the week with plan A, ditched that on Monday for plan B and changed it to plan C on Tuesday, I feel pretty good about how I applied the concept of “strong opinions, weakly held” that week.

Now, let’s get to what this post is actually about.

Before the week starts off…

First, here’s my assessment of the general market situation and the G8 currencies on Saturday (you can read the whole report here), well before the market opens. To summarize it:

Macro, equities: I see more positives than negatives, fundamentals have improved and my expectation is for risk on rather than risk off.

US dollar: I go into the week looking for a USD short.

Aussie dollar: Since I'm expecting risk on more than risk off and I see the USD as a short, my bias is long AUD even though I'm not too happy with it because of the weak fundamentals.

Monday…

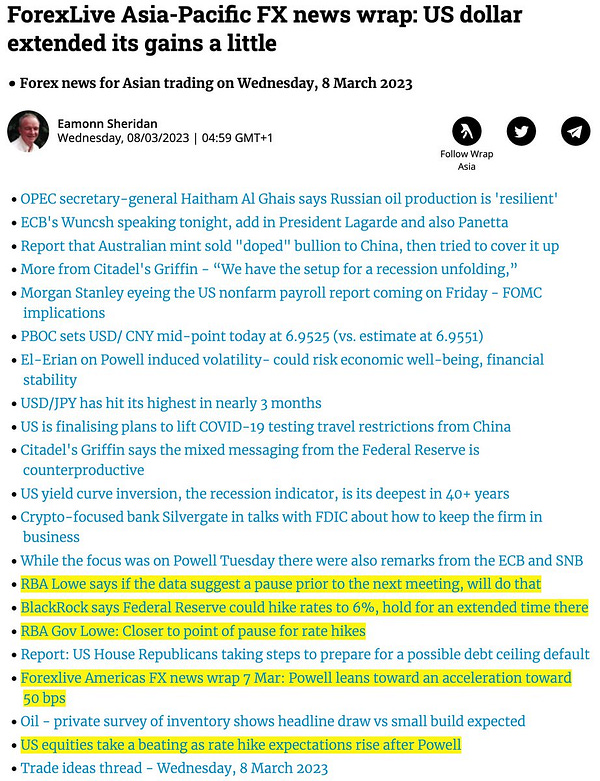

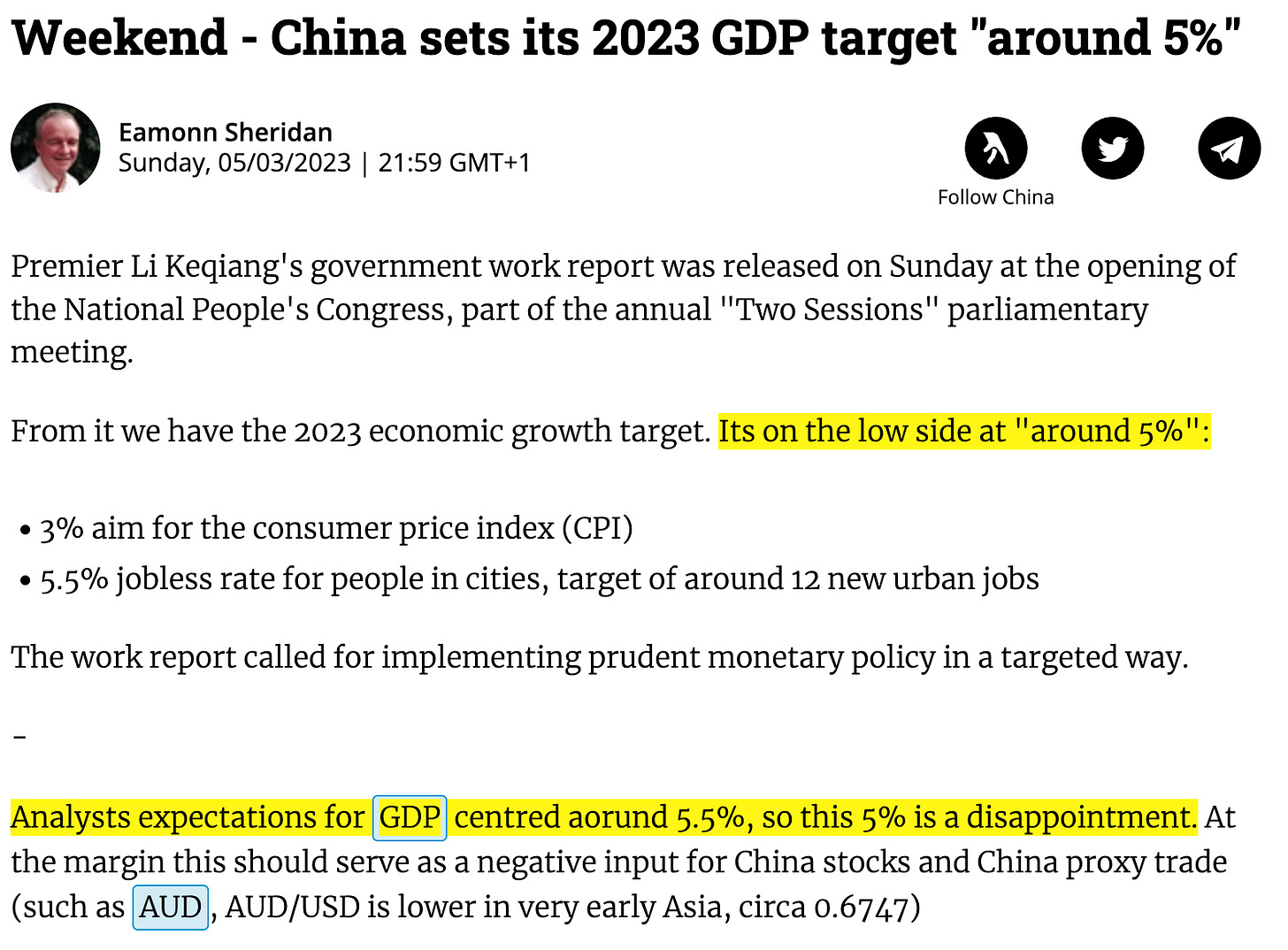

The APAC Session Wrap from forexlive.com is one of the first things I see when I go through my routine on Monday morning, and it's not looking bullish: China is targeting 2023 GDP growth at only 5% when expectations were for about 5.5%.

The article explains it:

So, I have a long bias for AUD, which I don't particularly like but which made sense (to me, at least) on Saturday. And with this headline, I know that the idea of looking for a long in the Aussie dollar at least today and probably tomorrow will be a stretch. I might still get the chance to go long AUD in the second half of the week, though.

Here's what the AUD did on Monday, it's the orange line near the bottom, and it sold off pretty much during the entire London session:

We have the RBA next morning, and a 25 bps hike is already about 75% priced in with the remaining 25% pricing a hold. So, unless they surprise with either 50 bps (very unlikely) or a very hawkish statement, there's no way I'll be going long AUD, and even if they do I'll be very cautious because of the China headlines.

Tuesday with the RBA and Jay Powell

As every morning, I start the day reading the APAC session wrap, and I don't like what I'm reading:

The debt situation in China is not looking good, this will potentially weigh on growth and on commodity demand. But the kicker is the dovish hike by the RBA:

So, here we are after more bad news from China and a disappointing hike from the RBA. We are now lightyears away from the long I had in mind on Saturday:

Here's the AUD after the RBA rate statement on Tuesday, again the orange line at the bottom:

But that's not all: we've also had Jay Powell on the docket to testify before the Senate Banking Committee later that day. He has been consistently dovish in his last appearances, so my bias was for him to come in dovish again despite the wealth of positive US data. That information also went into my weekend analysis as one tiny piece of input that supported a short dollar trade this week.

In any case, I'm not going into an event like this with a position because I don't have an edge in trying to guess what he's going to say. Here are a few things from his testimony, and they certainly weren’t dovish:

We are prepared to increase the pace of hikes if the totality of incoming data indicates faster tightening is warranted, ongoing increases in the policy rate are likely appropriate, ultimate level of interest rates likely to be higher than previously anticipated due to latest economic data being stronger than expected, the ultimate rate we write down in the dot plot may well be higher than December, history cautions against loosening policy prematurely, will continue to make our decisions meeting by meeting, little sign of disinflation so far in core services excluding housing, we need to lower core services inflation ex housing to get inflation back to 2%, housing services will come down in 6-12 months.

The dollar jumped immediately, stocks sold off and we had a pretty nice risk-off situation in the markets. You can see that in the following chart, USD is the blue line at the top, ES is the white line in the middle:

To sum it up thus far, this was pretty much the exact opposite of what I had in mind at the start of the week for stocks, the dollar and AUD. And it’s only Tuesday evening.

So, back to the question: how was the week so far?

Did I lose money? Thankfully no: the China headlines hit before I started the week, and even if they had come later, I don't even know if I'd have had a position on at that time.

Did I make money? Unfortunately no: my AUDUSD short on Tuesday morning did not get filled, and I was not able to trade Powell's speech.

All in all, no harm done besides a few hurt feelings that my well-thought-out trade ideas from Saturday (that were based on the information available at that time) have been for the bin.

Wednesday and the BOC Rate Decision

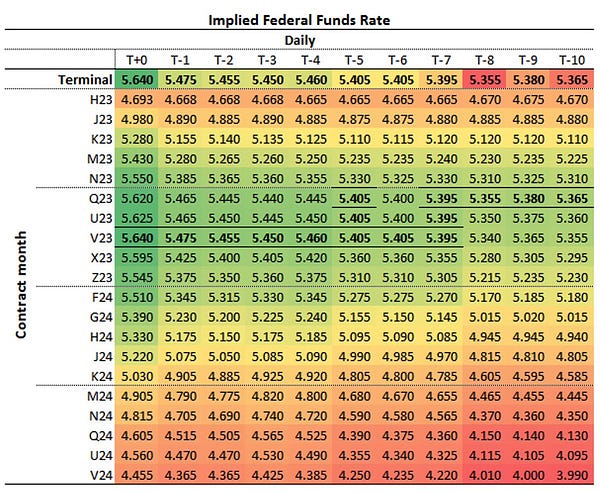

Tuesday’s moves in the dollar and rates were big but not extreme. Everything I see on Wednesday morning tells me that this is a real move and the market is taking it seriously:

So, my expectation going into Wednesday is still long USD but almost every USD pair is at a support or resistance level, so I’m not trying to chase a move because I’d probably be late to the party and in a bad risk-reward situation.

As for AUD, Lowe was mildly dovish during the APAC session, which means I don’t expect any fundamental strength here: if it goes up, I assume it’s technical and I will look for a short.

The key risk event is the Bank of Canada. Expectations are for a policy hold as they’ve previously telegraphed. In a vacuum, my guess would have been either up a bit, down a bit or both but probably flat at the end of the day. Now my thinking is: Powell put 50 bps back on the table the day before, so a no change from the BOC will look weak and the perceived divergence between them and the Fed will become wider.

Again, I’m not going into the event with a position because I have no edge in forecasting what the BOC will do but if I had been forced to make a bet it would have been to the downside, and I certainly wouldn’t fade a move lower now as I might have done otherwise.

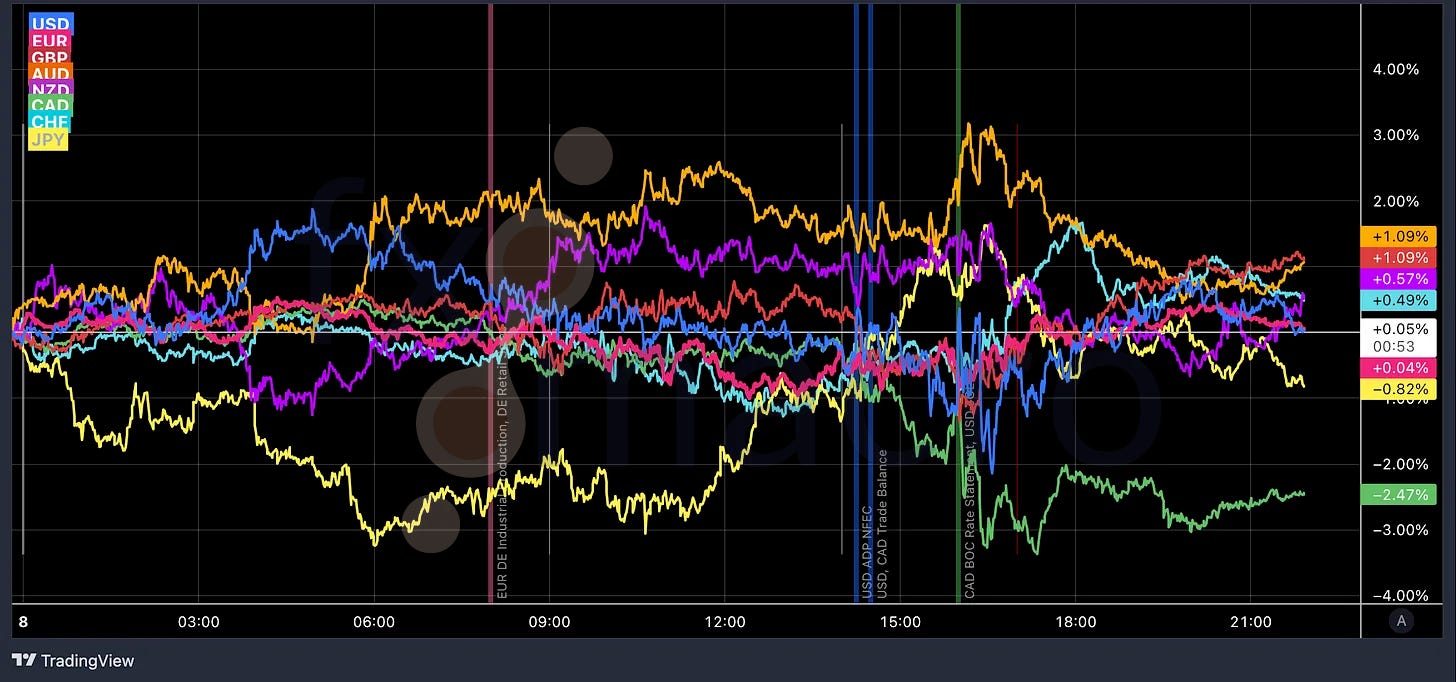

Here’s what happened, CAD is the green line towards the bottom right, and it sold off on the decision but then stabilized:

I wasn’t able to trade the Bank of Canada because when I made my plan for the week on Saturday it looked like it would be a nothing burger, so I didn’t block the time slot in my calendar and it got filled with something else. And even if I had been able to trade it: I have no idea whether I would have made money or not.

Thank god it’s Thursday

It’s been a bit of a wild week so far. This morning we have a long list of headlines to go through but the only thing that’s immediately relevant is the downside surprise in Chinese CPI and PPI:

My initial thought is: could be good for AUD because the PBOC now has more room for economic stimulus but could also be bad for AUD (and everybody else) because it points to weaker Chinese growth. So, I let the market tell me what it thinks, and so far it interpreted it as risk on:

Great, maybe I get a second chance to short AUD!

The chance comes around when the weaker US labour market data pushes AUDUSD into the same level that was tested two times already and it fails to break to the upside twice in a few minutes:

As for risk-on/risk-off, the ES had a pretty rough ride. Not what I would have expected after the labour market data but it is what it is:

Wrapping it up…

I’ll have a very short trading day tomorrow because I’ll be out of any positions before the Nonfarms, and I won’t be trading afterwards, so I’ll wrap it up at this point.

As I wrote above, I’m very happy with how this week turned out - regardless of the result in dollars: I was able to incorporate new information into my macro picture, successfully adapt to an ever-changing market and stay sane in the process. I still remember what I’ve written in my outlook for this week five days ago, and while most of the data remain valid, the conclusions I had drawn were already outdated by Monday morning. But I seriously doubt I would have been able to look at the market and adapt the same way if I hadn’t gone through all the things I go through on the weekend.

I hope you found both the introduction and the practical part of this post instructive and helpful. Since I have written it after the fact, it’s probably influenced by hindsight bias. I’d like to add that other things I’ve been thinking turned out to be wrong and that I did miss a lot of crucial information.2

This post would not have been possible without you, dear reader, so thank you for being here, I appreciate it a lot!

If you like what you’ve read and haven’t checked out my newsletter yet, here you go:

If you think somebody else would like to read this, feel free to share it:

Also, please leave a comment if you like: I’m always curious how others deal with the madness that is the market.

What it most often means is that I will be looking for short-term trades in that direction but sometimes I might be looking for a longer-term trade or just that the fundamentals point in a certain direction. I haven’t forward-tested it in a way you would test a trading system or model because I’m fairly sure it would not work that way.

Just as an example: the strength in JPY on Thursday morning after the Chinese inflation data should have been a warning sign not to bet against the yen ahead of the BOJ and that risk off might be around the corner… I shorted the yen in another trade and it cost me money.

Top Notch Stuff!

Thx

great, thank you!